1250 Warbler Ridge Unit 43 Springfield, OH 45503

Estimated Value: $175,000 - $222,000

2

Beds

2

Baths

1,365

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 1250 Warbler Ridge Unit 43, Springfield, OH 45503 and is currently estimated at $205,940, approximately $150 per square foot. 1250 Warbler Ridge Unit 43 is a home located in Clark County with nearby schools including Rolling Hills Elementary School, Northridge Middle School, and Kenton Ridge Middle & High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2014

Sold by

Antoniadis Roxandra Vladimirovna

Bought by

Mahan Linda L

Current Estimated Value

Purchase Details

Closed on

Apr 1, 2008

Sold by

Lawrence David M

Bought by

Antoniadis Roxandra Vladimirovna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,920

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 7, 1999

Sold by

Wiley Steven L and Wiley Nina A

Bought by

Lawrence David M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,200

Interest Rate

8.02%

Purchase Details

Closed on

May 27, 1997

Sold by

Wrenwood Dev Corp

Bought by

Wiley Steven L and Wiley Nina A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,750

Interest Rate

8.24%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mahan Linda L | $94,000 | Attorney | |

| Antoniadis Roxandra Vladimirovna | $119,900 | Attorney | |

| Lawrence David M | $104,000 | -- | |

| Wiley Steven L | $92,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Antoniadis Roxandra Vladimirovna | $95,920 | |

| Previous Owner | Lawrence David M | $83,200 | |

| Previous Owner | Wiley Steven L | $87,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,381 | $42,880 | $6,780 | $36,100 |

| 2023 | $1,381 | $42,880 | $6,780 | $36,100 |

| 2022 | $1,404 | $42,880 | $6,780 | $36,100 |

| 2021 | $1,405 | $38,010 | $5,600 | $32,410 |

| 2020 | $1,407 | $38,010 | $5,600 | $32,410 |

| 2019 | $1,435 | $38,010 | $5,600 | $32,410 |

| 2018 | $1,149 | $31,450 | $7,000 | $24,450 |

| 2017 | $977 | $34,584 | $7,000 | $27,584 |

| 2016 | $969 | $34,584 | $7,000 | $27,584 |

| 2015 | $1,379 | $34,584 | $7,000 | $27,584 |

| 2014 | $993 | $34,584 | $7,000 | $27,584 |

| 2013 | $990 | $34,584 | $7,000 | $27,584 |

Source: Public Records

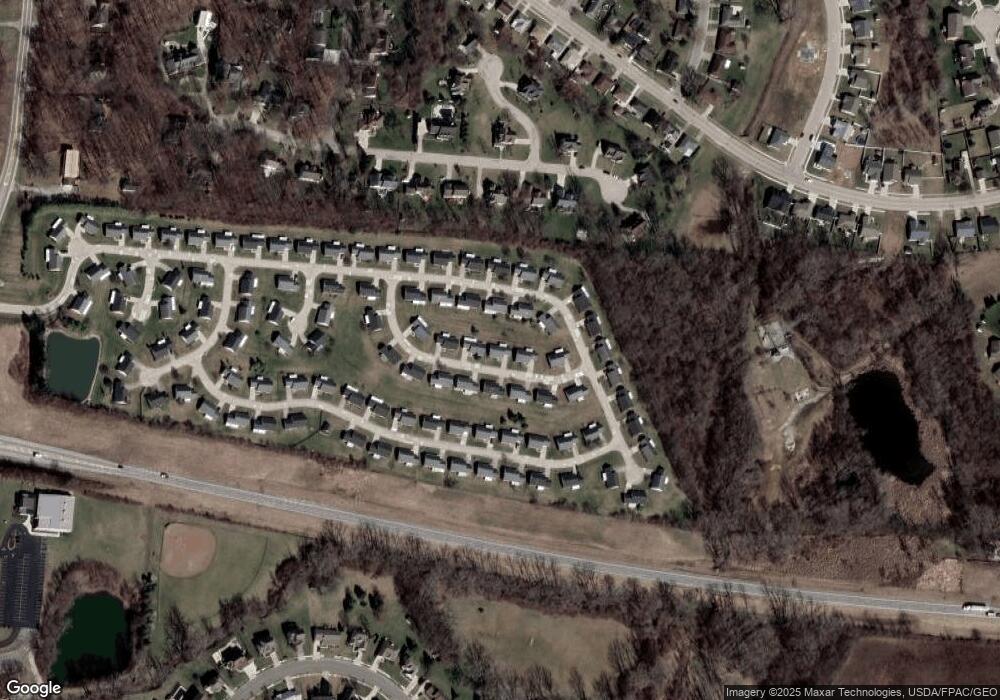

Map

Nearby Homes

- 1139 Greenoak Ct

- 1162 Kingsgate Rd

- 4133 Willowbrook Dr

- 4109 Derr Rd

- 4050 Tacoma St

- 1509 Kingsgate Rd

- 3631 Kingsgate Ln

- 1501 Kingsgate Rd

- 1640 Montego Dr

- 4315 Carona St

- 1503 Kingsgate Rd

- 1243 Student Ave

- 1505 Kingsgate Rd

- 1507 Kingsgate Rd

- 1148 Foxboro Rd

- 1781 Pinehurst Dr

- 4438 Tacoma St

- 4249 Reno Rd

- 970 Forest Edge Ave

- 1250 Warbler Ridge Unit XX

- 1240 Warbler Ridge

- 1260 Warbler Ridge Unit 44

- 1247 Warbler Ridge Unit 47

- 1237 Warbler Ridge Unit 48

- 1257 Old Farm Ln Unit 35

- 1245 Old Farm Ln Unit 36

- 1245 Old Farm Ln

- 1257 Warbler Ridge Unit 46

- 1230 Warbler Ridge Unit 41

- 1281 Old Farm Ln Unit 34

- 1235 Old Farm Ln Unit 37

- 1235 Old Farm Ln

- 1229 Warbler Ridge Unit 49

- 1229 Warbler Ridge Unit 1229

- 1229 Warbler Ridge

- 1225 Old Farm Ln

- 1220 Warbler Ridge Unit 40

- 1220 Warbler Ridge

- 1246 Old Farm Ln Unit 18