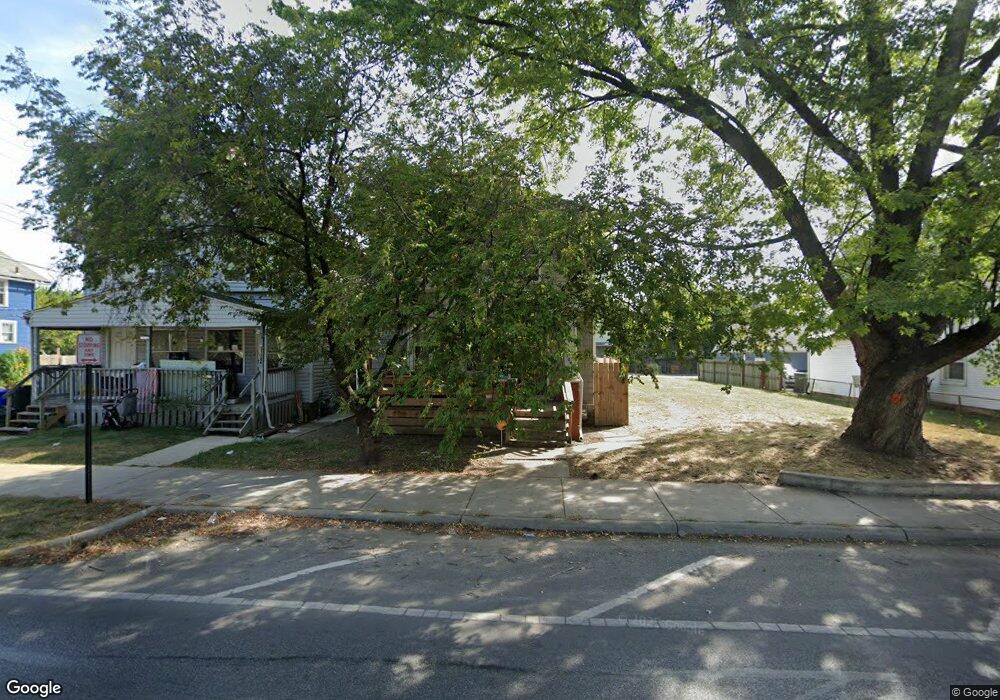

126 S Hague Ave Columbus, OH 43204

Central Hilltop NeighborhoodEstimated Value: $135,000 - $187,000

3

Beds

1

Bath

1,506

Sq Ft

$103/Sq Ft

Est. Value

About This Home

This home is located at 126 S Hague Ave, Columbus, OH 43204 and is currently estimated at $155,776, approximately $103 per square foot. 126 S Hague Ave is a home located in Franklin County with nearby schools including Highland Elementary School, Westmoor Middle School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 3, 2020

Sold by

Coleman Tabitha

Bought by

Mbtc Properties Llc

Current Estimated Value

Purchase Details

Closed on

Nov 15, 2019

Sold by

Bradshaw Michael Keith

Bought by

Coleman Tabitha

Purchase Details

Closed on

Nov 18, 2018

Sold by

Coleman Tabitha

Bought by

Bradshaw Michael Keith

Purchase Details

Closed on

Nov 10, 2011

Sold by

Linde Pamela M

Bought by

Coleman Tabitha

Purchase Details

Closed on

May 28, 2009

Sold by

Mohawk Diversified Llc

Bought by

Linde Pamela M

Purchase Details

Closed on

May 14, 2009

Sold by

Go Invest Wisely Llc

Bought by

Mohawk Diversified Llc

Purchase Details

Closed on

Aug 29, 2008

Sold by

Blue Spruce Entities Llc

Bought by

Go Invest Wisely Llc

Purchase Details

Closed on

Jun 30, 2008

Sold by

Endicott Dwight D and Case #06Cve01 853

Bought by

Wells Fargo Bank Na and Citigroup Mortgage Loan Trust Series 200

Purchase Details

Closed on

Jun 23, 1995

Sold by

Palka Anthony M

Bought by

Endicott Dwight D and Endicott Barbara S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Interest Rate

7.9%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mbtc Properties Llc | -- | None Available | |

| Coleman Tabitha | $34,100 | None Available | |

| Bradshaw Michael Keith | $34,100 | None Available | |

| Coleman Tabitha | $5,000 | Attorney | |

| Linde Pamela M | $17,500 | Attorney | |

| Mohawk Diversified Llc | $11,000 | Attorney | |

| Go Invest Wisely Llc | $4,500 | None Available | |

| Blue Spruce Entities Llc | $3,200 | None Available | |

| Wells Fargo Bank Na | $32,000 | None Available | |

| Endicott Dwight D | $51,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Endicott Dwight D | $52,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,791 | $39,070 | $5,430 | $33,640 |

| 2023 | $1,918 | $39,060 | $5,425 | $33,635 |

| 2022 | $1,117 | $14,460 | $1,720 | $12,740 |

| 2021 | $1,114 | $14,460 | $1,720 | $12,740 |

| 2020 | $985 | $14,460 | $1,720 | $12,740 |

| 2019 | $863 | $11,940 | $1,440 | $10,500 |

| 2018 | $1,439 | $11,940 | $1,440 | $10,500 |

| 2017 | $1,282 | $11,940 | $1,440 | $10,500 |

| 2016 | $1,246 | $13,650 | $3,850 | $9,800 |

| 2015 | $1,256 | $13,650 | $3,850 | $9,800 |

| 2014 | $846 | $13,650 | $3,850 | $9,800 |

| 2013 | $721 | $16,030 | $4,515 | $11,515 |

Source: Public Records

Map

Nearby Homes

- 85 S Warren Ave

- 2710 Palmetto St

- 65 S Hague Ave

- 235 S Harris Ave

- 227 S Hague Ave

- 219 S Ogden Ave

- 262 S Harris Ave

- 66 N Burgess Ave

- 232 S Burgess Ave

- 261 S Chase Ave

- 126 S Richardson Ave

- 310 S Ogden Ave

- 2845 Fremont St

- 334 S Warren Ave

- 121 N Terrace Ave

- 238 S Richardson Ave

- 339 S Powell Ave

- 87 N Warren Ave

- 350 S Ogden Ave

- 274 S Richardson Ave

- 130 S Hague Ave

- 122 S Hague Ave Unit 124

- 134 S Hague Ave

- 110-112 S Hague Ave

- 142 S Hague Ave

- 129 S Harris Ave

- 121-123 S Harris Ave

- 121 S Harris Ave Unit 123

- 125 S Hague Ave

- 106 S Hague Ave

- 121 S Hague Ave

- 129 S Hague Ave

- 129 N Hague Ave

- 137 S Harris Ave

- 125 S Harris Ave

- 146 S Hague Ave

- 121 N Harris Ave

- 133 S Hague Ave

- 137 N Hague Ave

- 137 N Hague Ave Unit 139