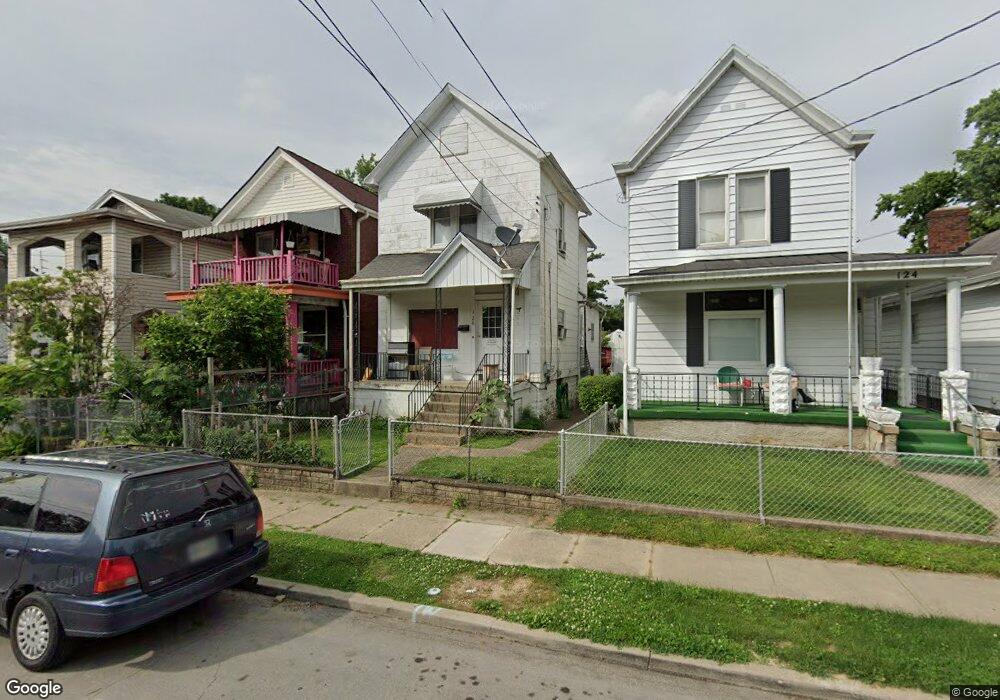

126 W 69th St Cincinnati, OH 45216

Carthage NeighborhoodEstimated Value: $112,000 - $367,000

3

Beds

3

Baths

1,300

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 126 W 69th St, Cincinnati, OH 45216 and is currently estimated at $211,058, approximately $162 per square foot. 126 W 69th St is a home located in Hamilton County with nearby schools including Rising Stars at Carthage, Hartwell School, and Shroder High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 18, 2011

Sold by

Pnc Mortgage

Bought by

He Qiming

Current Estimated Value

Purchase Details

Closed on

Jun 15, 2010

Sold by

Wesley Molita M

Bought by

Pnc Mortgage

Purchase Details

Closed on

Dec 14, 2001

Sold by

Jpl Properties

Bought by

Wesley Molita M

Purchase Details

Closed on

Aug 1, 2001

Sold by

Ann Ingold Mary and Ann Glenn

Bought by

Jpl Properties

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.23%

Purchase Details

Closed on

Dec 2, 1998

Sold by

Mercer Mable Hughes and Hughes Mable M

Bought by

Ingold Mary Ann

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| He Qiming | $14,000 | Attorney | |

| Pnc Mortgage | $38,000 | Attorney | |

| Wesley Molita M | $59,900 | -- | |

| Jpl Properties | $50,000 | -- | |

| Ingold Mary Ann | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jpl Properties | $50,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,209 | $18,862 | $5,859 | $13,003 |

| 2023 | $1,210 | $18,862 | $5,859 | $13,003 |

| 2022 | $853 | $11,897 | $3,140 | $8,757 |

| 2021 | $834 | $11,897 | $3,140 | $8,757 |

| 2020 | $837 | $11,897 | $3,140 | $8,757 |

| 2019 | $793 | $10,256 | $2,706 | $7,550 |

| 2018 | $794 | $10,256 | $2,706 | $7,550 |

| 2017 | $764 | $10,256 | $2,706 | $7,550 |

| 2016 | $380 | $4,900 | $3,605 | $1,295 |

| 2015 | $340 | $4,900 | $3,605 | $1,295 |

| 2014 | $342 | $4,900 | $3,605 | $1,295 |

| 2013 | $347 | $4,900 | $3,605 | $1,295 |

Source: Public Records

Map

Nearby Homes

- 206 W 69th St

- 120 W Seventy Second St

- 107 W Sixty Fifth St

- 6605 Hasler Ln

- 121 64th St

- 3 W 73rd St

- 6310 Vine St

- 524 Maple St

- 118 W North Bend Rd

- 1 Spruce St

- 412 Walnut St

- 302 Walnut St

- 215 Walnut St

- 1139 Towanda Terrace

- 5914 Elmwood Ave

- 14 Township Ave

- 0 Township Road 111

- 1117 W Seymour Ave

- 8081 Woodbine Ave

- 1522 Kenova Ave

Your Personal Tour Guide

Ask me questions while you tour the home.