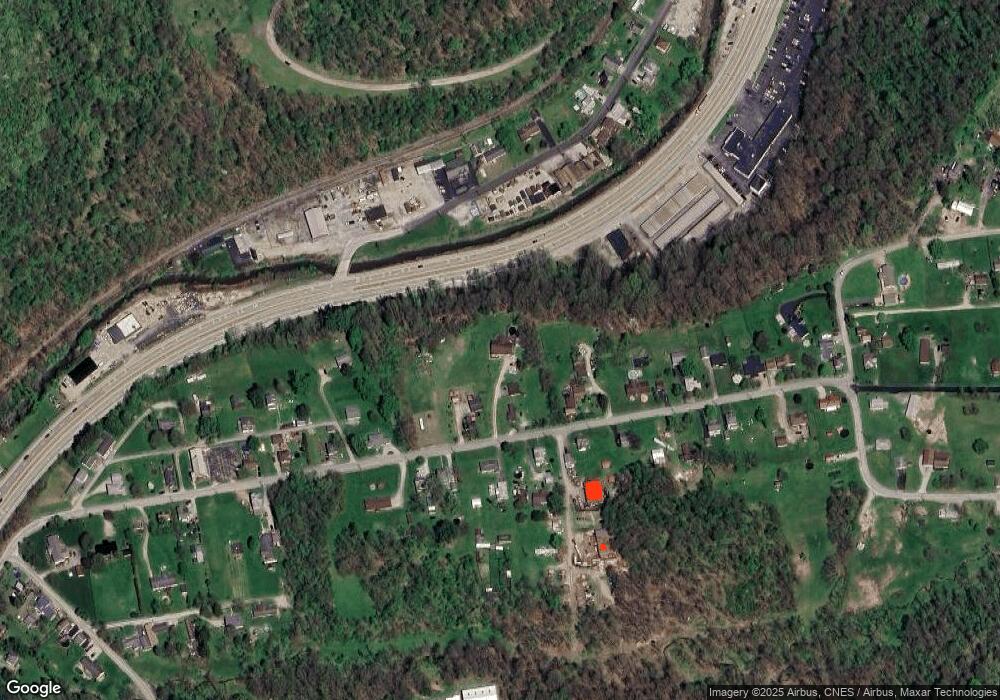

127 E End Rd Connellsville, PA 15425

Estimated Value: $208,000 - $347,000

3

Beds

2

Baths

1,400

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 127 E End Rd, Connellsville, PA 15425 and is currently estimated at $260,872, approximately $186 per square foot. 127 E End Rd is a home located in Fayette County with nearby schools including Connellsville Area Senior High School, Conn Area Catholic School, and Mt Carmel Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2017

Sold by

Gallo Susan L

Bought by

Landman Michael S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$44,000

Outstanding Balance

$36,715

Interest Rate

3.96%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$224,157

Purchase Details

Closed on

Jul 22, 2015

Sold by

Gallo Susan L and Gallo Barry L

Bought by

Landman Michael Scott and Landman Marcia Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

4.01%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 27, 2003

Bought by

Gallo Susan L and Gallo Barry L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Landman Michael S | $55,000 | None Available | |

| Landman Michael Scott | $195,000 | None Available | |

| Gallo Susan L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Landman Michael S | $44,000 | |

| Previous Owner | Landman Michael Scott | $175,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,343 | $57,240 | $15,215 | $42,025 |

| 2024 | $1,277 | $57,240 | $15,215 | $42,025 |

| 2023 | $2,458 | $57,240 | $15,215 | $42,025 |

| 2022 | $2,458 | $57,240 | $15,215 | $42,025 |

| 2021 | $2,458 | $57,240 | $15,215 | $42,025 |

| 2020 | $2,458 | $57,240 | $15,215 | $42,025 |

| 2019 | $2,315 | $57,240 | $15,215 | $42,025 |

| 2018 | $2,315 | $57,240 | $15,215 | $42,025 |

| 2017 | $2,315 | $57,240 | $15,215 | $42,025 |

| 2016 | -- | $57,240 | $15,215 | $42,025 |

| 2015 | -- | $57,240 | $15,215 | $42,025 |

| 2014 | -- | $114,480 | $30,430 | $84,050 |

Source: Public Records

Map

Nearby Homes

- 224 E End Rd

- 722 Connellsville Ave

- 148 Van Dr

- 1204 Memorial Blvd

- 1114 N Jefferson St

- 326 Narrows Rd

- 304 Narrows Rd

- 608 E Crawford Ave

- 3106 Upper Ridgeview Rd

- 1001 Springfield Pike

- 515-517 Pittsburgh St

- 243 E Fairview Ave

- 125 W Peach St

- 535 Broadford Rd

- 214 E Fairview Ave

- 209 E South St

- 118 S Carnegie Ave

- 0 Spruce Hollow Rd Unit 1742476

- 316 W Crawford Ave

- 312 E Washington Ave

Your Personal Tour Guide

Ask me questions while you tour the home.