127 Fairview Rd Silver Cliff, CO 81252

Estimated Value: $446,445 - $655,000

3

Beds

2

Baths

1,824

Sq Ft

$309/Sq Ft

Est. Value

About This Home

This home is located at 127 Fairview Rd, Silver Cliff, CO 81252 and is currently estimated at $562,861, approximately $308 per square foot. 127 Fairview Rd is a home located in Custer County with nearby schools including Custer County Elementary School, Custer Middle School, and Custer County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 10, 2018

Sold by

Rockenhaus Ted A and Rockenhaus Monica C

Bought by

The Ted A Rockenhaus And Monica C Rocken

Current Estimated Value

Purchase Details

Closed on

Oct 19, 2017

Sold by

Williams Cynthia

Bought by

Rockenhaus Ted A and Rockenhaus Monica C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,550

Outstanding Balance

$215,284

Interest Rate

3.78%

Mortgage Type

New Conventional

Estimated Equity

$347,577

Purchase Details

Closed on

Mar 1, 2013

Sold by

Robinson Thomas A

Bought by

William Cynthia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,417

Interest Rate

3.5%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Ted A Rockenhaus And Monica C Rocken | -- | None Available | |

| Rockenhaus Ted A | -- | Stewart Title | |

| Rockenhaus Ted A | $289,500 | Stewart Title | |

| William Cynthia | $253,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rockenhaus Ted A | $260,550 | |

| Closed | Rockenhaus Ted A | $260,550 | |

| Previous Owner | William Cynthia | $248,417 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,422 | $20,150 | $0 | $0 |

| 2023 | $1,131 | $20,160 | $0 | $0 |

| 2022 | $1,293 | $18,480 | $1,990 | $16,490 |

| 2021 | $1,326 | $18,480 | $1,990 | $16,490 |

| 2020 | $1,215 | $17,120 | $1,990 | $15,130 |

| 2019 | $1,207 | $17,120 | $1,990 | $15,130 |

| 2018 | $1,081 | $15,220 | $2,000 | $13,220 |

| 2017 | $1,050 | $15,220 | $2,003 | $13,217 |

| 2016 | $1,102 | $16,530 | $2,220 | $14,310 |

| 2015 | -- | $207,581 | $27,823 | $179,758 |

| 2012 | $1,108 | $211,517 | $27,823 | $183,694 |

Source: Public Records

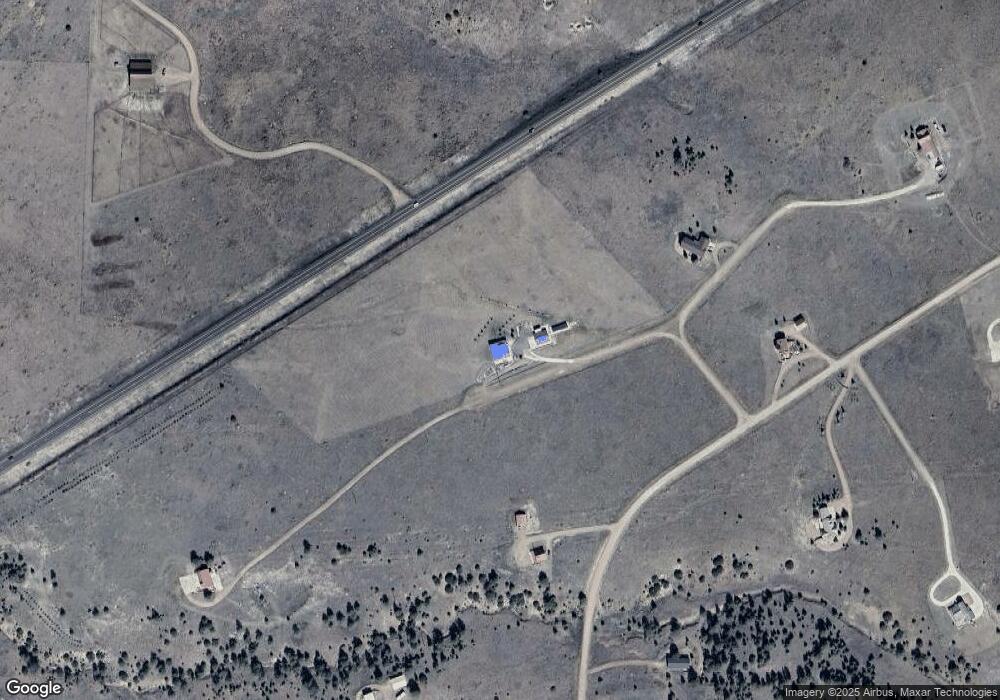

Map

Nearby Homes

- 85 Excelsior Rd

- 5100 Colorado 96

- 207 Bunker Hill Rd

- 1500 Bunker Hill Rd

- 1500 Bunker Hill Cir

- 5151 County Road 160

- 838 County Road 260

- 294 Vista de Agua

- 865 Vista de Aspen Rd

- 881 Vista de Aspen Rd

- 373 Deer Springs Cir

- 680 Ridge Rd

- 1579 County Road 341

- 333 Della Fox Ln

- 0 Deer Springs Cir

- TBD Deer Springs Cir

- 2240 County Road 341

- 2138 County Road 341

- 590 Pine Ln

- 524 Robinson Rd

- 127 Fairview Rd

- 489 Excelsior Rd

- 122 Fairview Rd

- 122 Fairview Rd

- 297 Excelsior Rd

- 297 Excelsior Rd

- 306 Excelsior Rd

- 113 Fairview Rd

- 749 Knickerbocker Rd

- 749 Knickerbocker Rd

- 587 Knickerbocker Rd

- 608 Knickerbocker Rd

- 114 Fairview Rd

- 114 Fairview Rd

- 114 Fairview Rd Unit 56

- TBD Knickerbocker Rd

- 716 Knickerbocker Rd

- 489 Knickerbocker Rd

- TBD L16 Knickerbocker Rd

- 264 Excelsior Rd

Your Personal Tour Guide

Ask me questions while you tour the home.