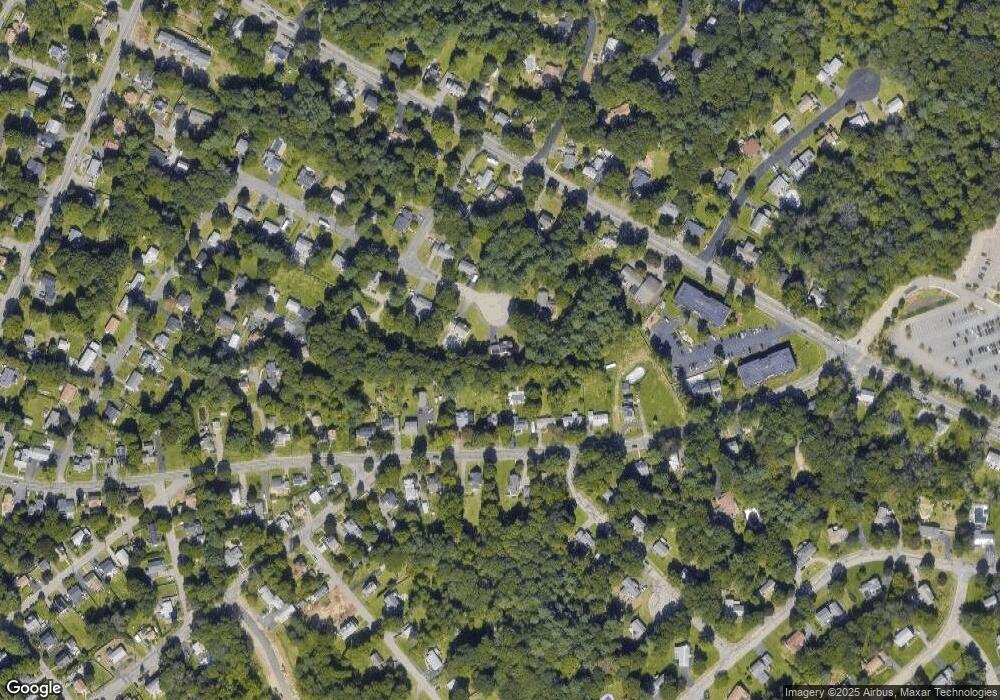

127 Richard Rd Stoughton, MA 02072

Estimated Value: $803,177 - $867,000

4

Beds

3

Baths

2,700

Sq Ft

$312/Sq Ft

Est. Value

About This Home

This home is located at 127 Richard Rd, Stoughton, MA 02072 and is currently estimated at $842,044, approximately $311 per square foot. 127 Richard Rd is a home located in Norfolk County with nearby schools including Joseph R Dawe Jr Elementary School, O'Donnell Middle School, and Stoughton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2008

Sold by

Alaparathi Joshi and Nekkalapudi Padmini

Bought by

Freeman Michael F and Kerr Tracy E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$405,000

Interest Rate

5.76%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 15, 2002

Sold by

Suleski Pattianne

Bought by

Alaparathi Joshi and Alaparathi Padmini

Purchase Details

Closed on

Apr 11, 2002

Sold by

Blount Michael D and Blount Janet A

Bought by

Suleski Pattianne

Purchase Details

Closed on

Jun 29, 2001

Sold by

Stipp William M and Stipp Lisa A

Bought by

Suleski Pattianne

Purchase Details

Closed on

Jun 26, 1998

Sold by

Briarwood Constr Corp

Bought by

Stipp William M and Stipp Lisa A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Freeman Michael F | $450,000 | -- | |

| Freeman Michael F | $450,000 | -- | |

| Alaparathi Joshi | $405,000 | -- | |

| Alaparathi Joshi | $405,000 | -- | |

| Suleski Pattianne | $409,000 | -- | |

| Suleski Pattianne | $409,000 | -- | |

| Suleski Pattianne | $375,000 | -- | |

| Stipp William M | $249,900 | -- | |

| Stipp William M | $249,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stipp William M | $408,093 | |

| Closed | Freeman Michael F | $405,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,678 | $701,000 | $245,000 | $456,000 |

| 2024 | $8,436 | $662,700 | $223,200 | $439,500 |

| 2023 | $8,351 | $616,300 | $207,400 | $408,900 |

| 2022 | $7,973 | $553,300 | $189,600 | $363,700 |

| 2021 | $7,912 | $524,000 | $171,900 | $352,100 |

| 2020 | $7,600 | $510,400 | $165,900 | $344,500 |

| 2019 | $7,388 | $481,600 | $165,900 | $315,700 |

| 2018 | $6,601 | $445,700 | $158,000 | $287,700 |

| 2017 | $6,270 | $432,700 | $150,100 | $282,600 |

| 2016 | $6,043 | $403,700 | $138,300 | $265,400 |

| 2015 | $5,988 | $395,800 | $130,400 | $265,400 |

| 2014 | $5,871 | $373,000 | $118,500 | $254,500 |

Source: Public Records

Map

Nearby Homes

- 578 Central St

- 310 Lincoln St

- 121 Bassick Cir

- 702 Central St

- 40 Hollytree Rd

- 136 Bramblebush Rd

- 139 Clover Ln

- 36 Pleasant Dr Unit 42

- 6 Grove St

- 687 Pleasant St

- 208 Lowe Ave

- 58 Union St Unit 15

- 18 Britton St

- 20 Barnes Rd

- 58 Curtis Ave

- 21 Jones Terrace Unit 2

- 15 Jones Terrace Unit 2

- 17 Jones Terrace Unit 4

- 110 William Kelley Rd

- 11 Monk St