12700 SW 58th St Mustang, OK 73064

Estimated Value: $344,000 - $550,000

3

Beds

3

Baths

2,305

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 12700 SW 58th St, Mustang, OK 73064 and is currently estimated at $471,048, approximately $204 per square foot. 12700 SW 58th St is a home located in Canadian County with nearby schools including Mustang Lakehoma Elementary School, Mustang Horizon Intermediate School, and Mustang Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 13, 2024

Sold by

Creed Willam R and Creed Debra Alyeen

Bought by

William R Creed And Debra Alyeen Creed Revoca

Current Estimated Value

Purchase Details

Closed on

Jun 22, 2012

Sold by

Wilson Darrell L

Bought by

Creed William and Creed Debra

Purchase Details

Closed on

Apr 12, 2007

Sold by

Bunch Jerry Lee and Bunch Kimmy V

Bought by

Wilson Darrell L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$355,000

Interest Rate

6.19%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 31, 2002

Sold by

Bunting Larry A and Bunting Barbara~L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,000

Interest Rate

6.62%

Purchase Details

Closed on

Jul 24, 1998

Sold by

Broady Lawrence A and Broady Jean E

Purchase Details

Closed on

Mar 13, 1995

Sold by

Owens Gary and Owens Terri

Purchase Details

Closed on

Oct 20, 1994

Sold by

Thoroughbred Development Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| William R Creed And Debra Alyeen Creed Revoca | -- | None Listed On Document | |

| Creed William | $330,000 | American Eagle Title Group | |

| Wilson Darrell L | $266,250 | None Available | |

| -- | $245,000 | -- | |

| -- | $212,000 | -- | |

| -- | $149,000 | -- | |

| -- | $148,500 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilson Darrell L | $355,000 | |

| Previous Owner | -- | $245,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,487 | $41,604 | $12,286 | $29,318 |

| 2023 | $4,487 | $39,623 | $10,955 | $28,668 |

| 2022 | $4,337 | $37,736 | $10,955 | $26,781 |

| 2021 | $4,356 | $38,039 | $10,955 | $27,084 |

| 2020 | $4,435 | $38,342 | $10,955 | $27,387 |

| 2019 | $4,493 | $38,880 | $10,947 | $27,933 |

| 2018 | $4,359 | $37,028 | $10,740 | $26,288 |

| 2017 | $4,098 | $35,266 | $9,603 | $25,663 |

| 2016 | $3,892 | $35,265 | $10,092 | $25,173 |

| 2015 | $4,322 | $31,987 | $7,466 | $24,521 |

| 2014 | $4,322 | $37,009 | $7,466 | $29,543 |

Source: Public Records

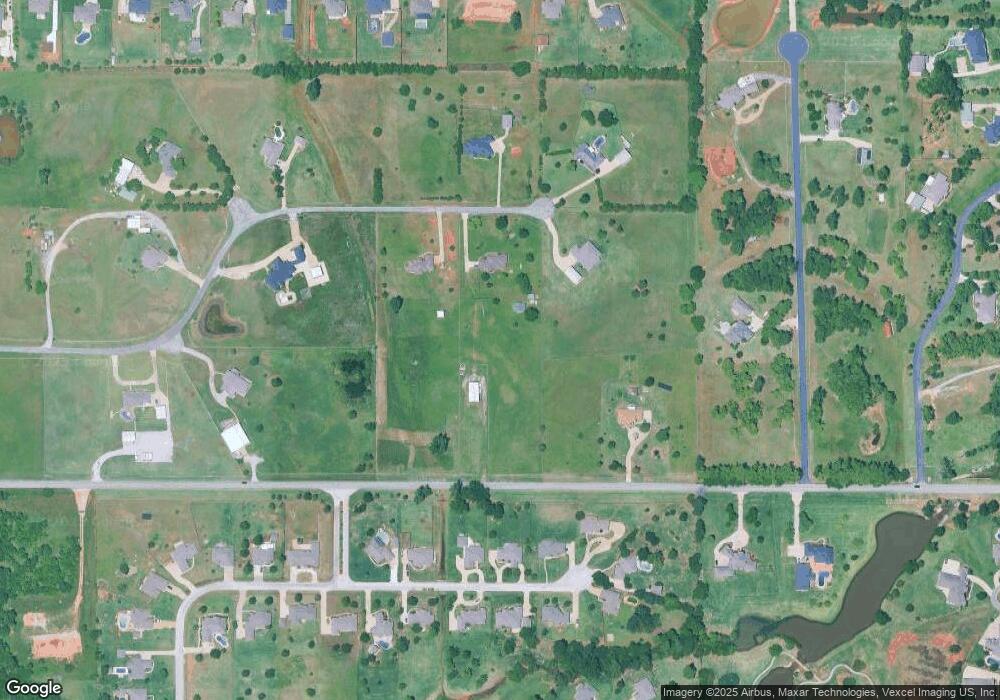

Map

Nearby Homes

- 1400 Quail Lake Way

- 1012 N Scouts Court Way

- 5108 Mccann Ct

- 1305 N Hunters Bridge Way

- 0 SW 59th St

- 5409 Heidelberg Dr

- 1401 W Harvard Way

- 1425 W Harvard Way

- 1208 W Flowering Peach Way

- 1250 N Tea Olive Way

- 1316 W Harvard Way

- 1408 N Golden Bell Way

- 1308 W Harvard Way

- 913 N Centennial Way

- 1005 W Ridgehaven Way

- 1721 W Antler Way

- 900 W Nandina Way

- 821 N Clear Springs Way

- 609 N Centennial Way

- 513 N Shannon Way

- 12720 SW 58th St

- 12600 SW 58th St

- 12701 SW 58th St

- 12601 SW 58th St

- 12601 SW 59th St

- 12800 SW 58th St

- 12608 SW 54th St

- 12801 SW 58th St

- 5901 Stonegate Ln

- 12700 SW 54th St

- 12600 SW 54th St

- 1305 Quail Lake Way

- 12708 SW 54th St

- 12820 SW 58th St

- 1309 Quail Lake Way

- 1311 Quail Lake Way

- 5701 Stonegate Ln

- 1401 Quail Lake Way

- 12716 SW 54th St

- 1405 Quail Lake Way