1271 Joshua Way Medina, OH 44256

Estimated Value: $302,928 - $330,000

2

Beds

2

Baths

1,427

Sq Ft

$223/Sq Ft

Est. Value

About This Home

This home is located at 1271 Joshua Way, Medina, OH 44256 and is currently estimated at $318,732, approximately $223 per square foot. 1271 Joshua Way is a home located in Medina County with nearby schools including Garfield Elementary School, Claggett Middle School, and Medina High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 7, 2016

Sold by

Saunders Lori L and Saunders Biran R

Bought by

Saunders Lori L and Saunders Brian R

Current Estimated Value

Purchase Details

Closed on

Aug 30, 2004

Sold by

Sweet Briar Homes Inc

Bought by

Hein Lori L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,800

Outstanding Balance

$73,697

Interest Rate

6.08%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$245,035

Purchase Details

Closed on

Apr 22, 2004

Sold by

Sweetbriar Homes Inc

Bought by

Kapolka Kari

Purchase Details

Closed on

Jan 29, 2004

Sold by

Kapolka Kari

Bought by

Sweet Briar Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,500

Interest Rate

5.88%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Saunders Lori L | -- | None Available | |

| Hein Lori L | $183,500 | -- | |

| Sweet Briar Homes Inc | -- | -- | |

| Kapolka Kari | -- | -- | |

| Sweet Briar Homes Inc | $35,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hein Lori L | $146,800 | |

| Previous Owner | Sweet Briar Homes Inc | $127,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,879 | $78,000 | $22,230 | $55,770 |

| 2023 | $3,879 | $78,000 | $22,230 | $55,770 |

| 2022 | $3,329 | $78,000 | $22,230 | $55,770 |

| 2021 | $3,110 | $61,410 | $17,500 | $43,910 |

| 2020 | $3,136 | $61,410 | $17,500 | $43,910 |

| 2019 | $3,080 | $61,410 | $17,500 | $43,910 |

| 2018 | $2,966 | $55,090 | $13,380 | $41,710 |

| 2017 | $3,008 | $55,090 | $13,380 | $41,710 |

| 2016 | $3,097 | $55,090 | $13,380 | $41,710 |

| 2015 | $3,004 | $51,010 | $12,390 | $38,620 |

| 2014 | $3,160 | $51,010 | $12,390 | $38,620 |

| 2013 | $3,087 | $51,010 | $12,390 | $38,620 |

Source: Public Records

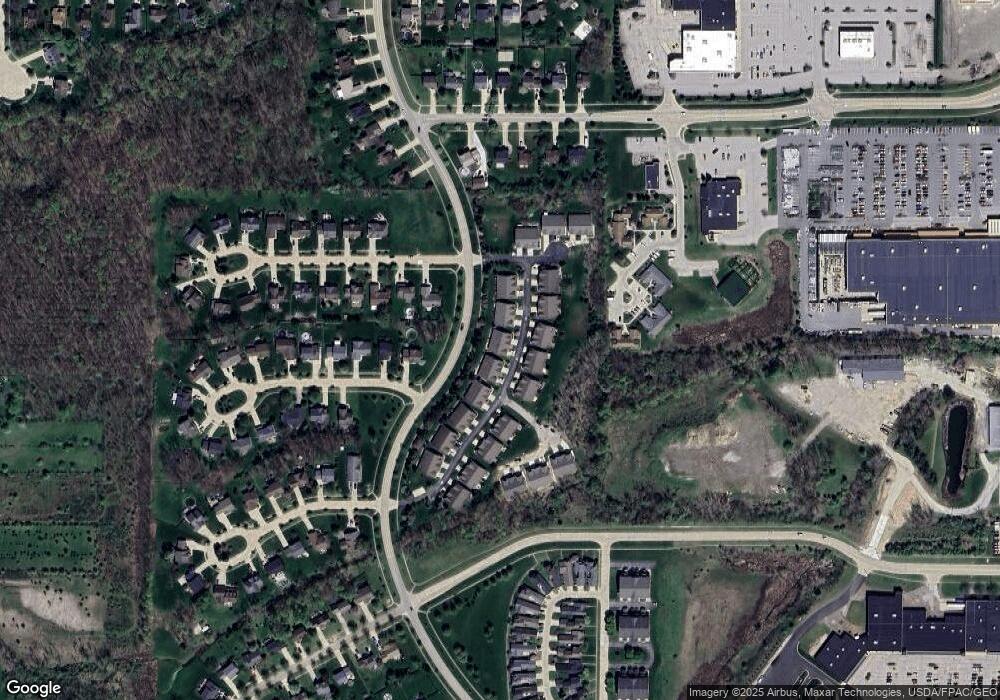

Map

Nearby Homes

- S/L 27 Devon Path

- S/L 26 Devon Path

- 1199 Hillview Way

- 5035 Red Maple Ct

- 4015 Marks Rd Unit 2A

- 4015 Marks Rd Unit 2D

- 5315 Genny Dr

- 1168 N Jefferson St Unit U18

- 1073 N Jefferson St Unit B

- 4051 Irvine Oval

- 5443 Daintree Ln

- 3722 Watkins Rd

- 5233 Eagles Nest Ln

- 4575 Rocky Mountain Dr

- 5501 Arapaho Way

- 3997 Stonegate Dr

- 754 N Huntington St

- 585 Birch Hill Dr

- 799 Savannah Trail

- 1054 Cedarwood Ln

- 1265 Joshua Way

- 1273 Joshua Way

- 1263 Joshua Way

- 1279 Joshua Way

- 1270 Joshua Way

- 1268 Joshua Way

- 1257 Joshua Way

- 1274 Joshua Way

- 1276 Joshua Way

- 1260 Joshua Way

- 1287 Joshua Way

- 1282 Joshua Way

- 240 Devon Path

- 242 Devon Path

- 1284 Joshua Way

- 1249 Joshua Way

- 1289 Joshua Way

- 1254 Joshua Way

- 1288 Joshua Way

- 1252 Joshua Way