12715 County Road 1113 Athens, TX 75751

Estimated Value: $270,413 - $494,000

--

Bed

1

Bath

1,816

Sq Ft

$193/Sq Ft

Est. Value

About This Home

This home is located at 12715 County Road 1113, Athens, TX 75751 and is currently estimated at $351,103, approximately $193 per square foot. 12715 County Road 1113 is a home located in Henderson County with nearby schools including Cross Roads J High School and Cross Roads High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 15, 2012

Sold by

Easley Sorsby Tori

Bought by

Sorsby Mitchell Allen

Current Estimated Value

Purchase Details

Closed on

Jul 25, 2007

Sold by

Parsons Family Living Trust

Bought by

Sorsby Mitchell A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$63,121

Interest Rate

6.69%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$287,982

Purchase Details

Closed on

Jul 9, 2002

Sold by

Hopkins Billy Shawn and Hopkins Misty M

Bought by

Sorsby Mitchell A

Purchase Details

Closed on

Aug 7, 2000

Sold by

Bane Tim and Bane Amie

Bought by

Sorsby Mitchell A

Purchase Details

Closed on

Sep 15, 1999

Sold by

Reeves Clovis

Bought by

Sorsby Mitchell A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sorsby Mitchell Allen | -- | None Available | |

| Sorsby Mitchell A | -- | None Available | |

| Sorsby Mitchell A | -- | -- | |

| Sorsby Mitchell A | -- | -- | |

| Sorsby Mitchell A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sorsby Mitchell A | $100,000 | |

| Closed | Sorsby Mitchell Allen | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $876 | $147,399 | -- | -- |

| 2024 | $876 | $133,999 | $0 | $0 |

| 2023 | $1,718 | $121,817 | $43,123 | $160,103 |

| 2022 | $2,928 | $184,160 | $43,120 | $141,040 |

| 2021 | $1,828 | $121,310 | $23,090 | $98,220 |

| 2020 | $1,285 | $111,980 | $23,090 | $88,890 |

| 2019 | $1,597 | $85,630 | $16,480 | $69,150 |

| 2018 | $2,308 | $123,130 | $13,410 | $109,720 |

| 2017 | $2,267 | $120,980 | $13,410 | $107,570 |

| 2016 | $2,267 | $120,980 | $13,410 | $107,570 |

| 2015 | $1,755 | $120,980 | $13,410 | $107,570 |

| 2014 | $1,875 | $120,980 | $13,410 | $107,570 |

Source: Public Records

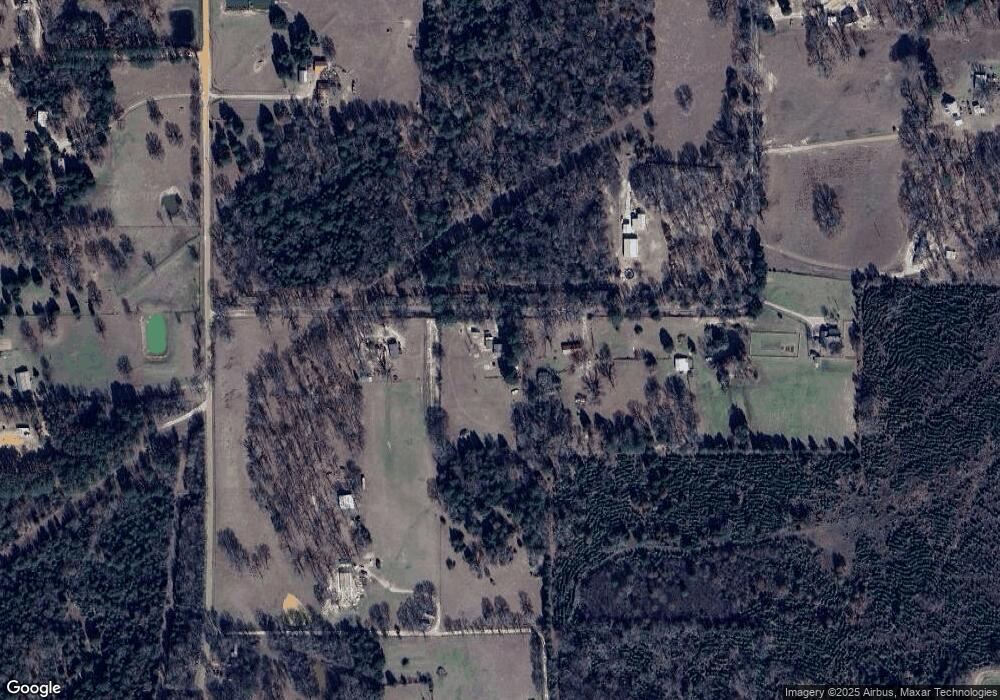

Map

Nearby Homes

- 12469 County Road 1114

- 12401 County Road 1113

- 12646 Private Road 5104

- 11567 Fm 59

- 12126 Fm 59

- 11250 Fm 59

- TBD Cr-1200

- 8419 County Road 1213

- 0 Private Road 5204

- 000 Private Road 5204

- Lot #9 Private Road 5210

- 13660 Fm 59

- 13660 Fm 59

- 10530 Private Road 5207

- 910 Sycamore St

- 908 Sycamore St

- 11786 County Road 1200

- 12751 County Road 1200

- 12663 County Road 1113

- 12402 County Road 1113

- 12603 County Road 1113

- 00 Off Cr 1114

- 00 Off Cr 1114

- 02 County Road 1114

- 01 County Road 1114

- 0 County Road 1114

- 00 County Road 1114

- 12803 County Road 1114

- 12855 County Road 1114

- 00 Private Road 5104

- 12351 Cr 1113

- 12351 County Road 1113

- 12384 County Road 1114

- 12947 County Road 1114

- 12947 Cr 1114

- 12310 County Road 1114

- 12195 County Road 1114

- 12276 County Road 1114