Estimated Value: $545,000 - $689,000

4

Beds

4

Baths

4,621

Sq Ft

$138/Sq Ft

Est. Value

About This Home

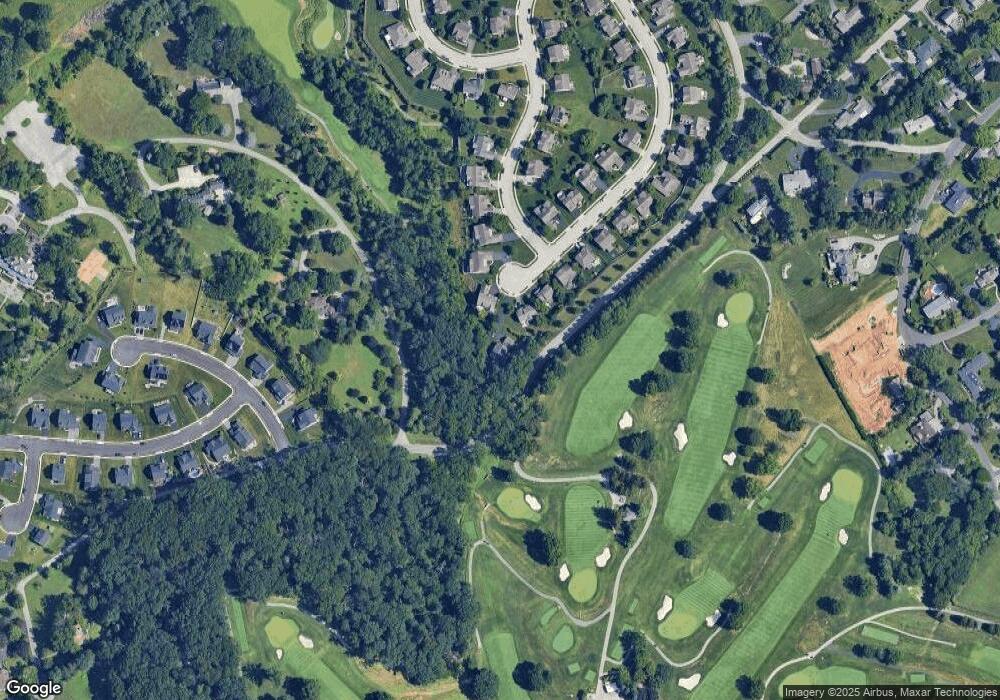

This home is located at 1281 Laurel Oak Ln, York, PA 17403 and is currently estimated at $639,210, approximately $138 per square foot. 1281 Laurel Oak Ln is a home located in York County with nearby schools including York Suburban Middle School, York Suburban Senior High School, and Lincoln Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 18, 2010

Sold by

Lamanteer Michael John and Lamanteer Mary

Bought by

Ekstrom Erik A and Ekstrom Denise L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$282,750

Outstanding Balance

$185,642

Interest Rate

4.95%

Mortgage Type

New Conventional

Estimated Equity

$453,568

Purchase Details

Closed on

Oct 5, 2006

Sold by

Regents Glen Building & Development Llc

Bought by

Lamanteer Michael John and Lamanteer Mary

Purchase Details

Closed on

Apr 21, 2005

Sold by

Regents Glen Building & Development Llc

Bought by

Lamanteer Michael John and Lamanteer Mary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$344,000

Interest Rate

5.95%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ekstrom Erik A | $425,000 | None Available | |

| Lamanteer Michael John | -- | None Available | |

| Lamanteer Michael John | $430,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ekstrom Erik A | $282,750 | |

| Previous Owner | Lamanteer Michael John | $344,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,672 | $308,300 | $81,500 | $226,800 |

| 2024 | $11,369 | $308,300 | $81,500 | $226,800 |

| 2023 | $11,022 | $308,300 | $81,500 | $226,800 |

| 2022 | $10,725 | $308,300 | $81,500 | $226,800 |

| 2021 | $10,304 | $308,300 | $81,500 | $226,800 |

| 2020 | $10,232 | $308,300 | $81,500 | $226,800 |

| 2019 | $9,976 | $308,300 | $81,500 | $226,800 |

| 2018 | $9,766 | $308,300 | $81,500 | $226,800 |

| 2017 | $9,635 | $308,300 | $81,500 | $226,800 |

| 2016 | $0 | $308,300 | $81,500 | $226,800 |

| 2015 | -- | $308,300 | $81,500 | $226,800 |

| 2014 | -- | $308,300 | $81,500 | $226,800 |

Source: Public Records

Map

Nearby Homes

- 1115 Glen View Dr

- 1359 Ben Hogan Way

- 1028 Rosecroft Ln

- 1149 Rosecroft Ln Unit 58

- 1058 Rosecroft Ln Unit 25

- 1133 Rosecroft Ln

- 1138 Rosecroft Ln

- 1016 Rosecroft Ln Unit 8

- 1161 Rosecroft Ln Unit 54

- 1000 Country Club Rd Unit 10

- 1000 Country Club Rd Unit A13

- 1000 Country Club Rd Unit B-2

- 1000 Country Club Rd Unit 8

- 1142 Wyndham Dr

- 1404 Crest Way

- 1110 Turnberry Ln Unit 37

- 1010 Crest Way Unit 403

- 938 Stonehaven Way

- 1265 Stonehaven Way

- 1269 Elderslie Ln Unit 112

- 1277 Laurel Oak Ln

- 1274 Laurel Oak Ln

- 1273 Laurel Oak Ln

- 1270 Laurel Oak Ln

- 1269 Laurel Oak Ln

- 1254 Winding Oak Dr

- 1000 Box Hill Ln

- 1265 Laurel Oak Ln

- 1264 Laurel Oak Ln

- 1261 Laurel Oak Ln

- 1248 Winding Oak Dr

- 1260 Laurel Oak Ln

- 1257 Laurel Oak Ln

- 1244 Winding Oak Dr

- 1040 Box Hill Ln

- 1243 Winding Oak Dr Unit 70

- 1256 Laurel Oak Ln

- 1001 Pin Oak Ln

- 1253 Laurel Oak Ln

- 1841 Buckhill Dr