12815 Wishing Well Way Bristow, VA 20136

Braemar NeighborhoodEstimated Value: $489,000 - $572,000

3

Beds

4

Baths

1,628

Sq Ft

$334/Sq Ft

Est. Value

About This Home

This home is located at 12815 Wishing Well Way, Bristow, VA 20136 and is currently estimated at $544,097, approximately $334 per square foot. 12815 Wishing Well Way is a home located in Prince William County with nearby schools including Patriot High School, T. Clay Wood Elementary School, and E.H. Marsteller Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2008

Sold by

Bank Of Ny Tr

Bought by

Pack Daniel R

Current Estimated Value

Purchase Details

Closed on

Dec 30, 2005

Sold by

Cappiccille Robert M

Bought by

Palma Ricardo and Palma Alfaro,Jose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,000

Interest Rate

6.28%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 10, 2002

Sold by

Nvr Inc

Bought by

Cappiccille Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,400

Interest Rate

7.18%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 11, 2002

Sold by

Brookfield Washington Inc

Bought by

N V R Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pack Daniel R | $180,000 | -- | |

| Palma Ricardo | $415,000 | -- | |

| Cappiccille Robert | $224,940 | -- | |

| N V R Inc | $240,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Palma Ricardo | $332,000 | |

| Previous Owner | Cappiccille Robert | $202,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,665 | $504,400 | $131,300 | $373,100 |

| 2024 | $4,665 | $469,100 | $125,000 | $344,100 |

| 2023 | $4,735 | $455,100 | $115,000 | $340,100 |

| 2022 | $4,659 | $420,700 | $107,900 | $312,800 |

| 2021 | $4,649 | $380,500 | $88,000 | $292,500 |

| 2020 | $5,490 | $354,200 | $81,900 | $272,300 |

| 2019 | $5,427 | $350,100 | $81,900 | $268,200 |

| 2018 | $3,779 | $313,000 | $78,000 | $235,000 |

| 2017 | $3,827 | $309,500 | $78,000 | $231,500 |

| 2016 | $3,687 | $300,800 | $73,100 | $227,700 |

| 2015 | $3,435 | $297,100 | $73,100 | $224,000 |

| 2014 | $3,435 | $273,800 | $69,000 | $204,800 |

Source: Public Records

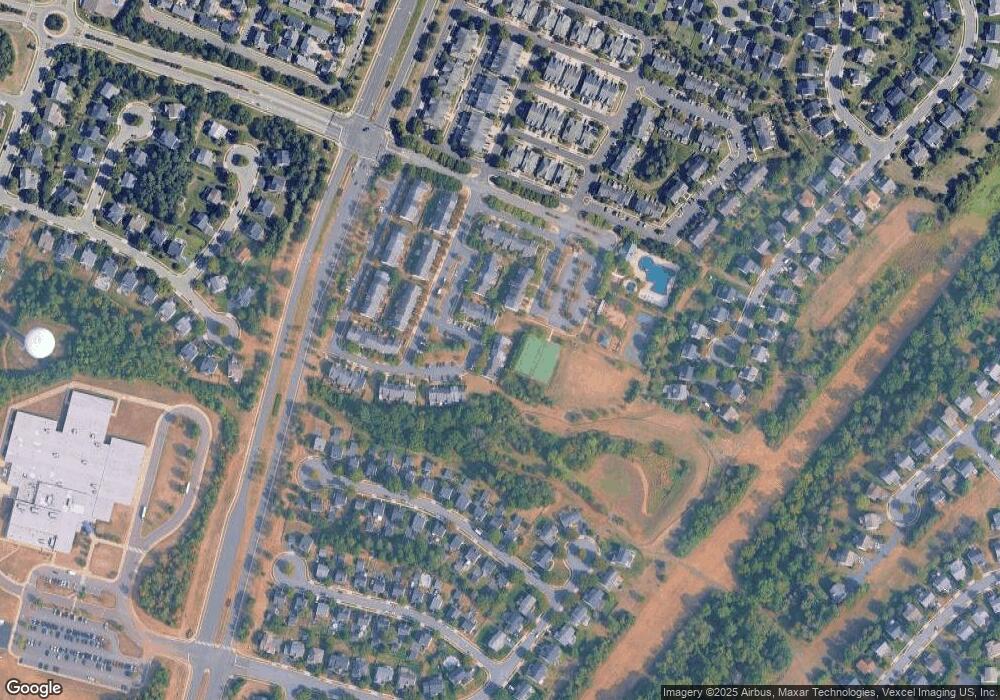

Map

Nearby Homes

- 9994 Shortbread Way

- 12750 Brewland Way

- 9817 Maitland Loop

- 10028 Boreland Ct

- Hampton II Plan at Parkgate Estates

- 10119 Orland Stone Dr

- 10045 Pentland Hills Way

- 10024 Darnaway Ct

- 13610 Newtonmore Place

- 12410 Iona Sound Dr

- 12127 & 12131 Vint Hill Rd

- 10240 Inchberry Ct

- 9516 Tarvie Cir

- 12360 Corncrib Ct

- 9758 Tombreck Ct

- 12916 Ness Hollow Ct

- 9505 Dunblane Ct

- 9381 Crestview Ridge Dr

- 9923 Bagpipe Ct

- 9348 Crestview Ridge Dr

- 12817 Wishing Well Way

- 12813 Wishing Well Way

- 12819 Wishing Well Way

- 12821 Wishing Well Way

- 12809 Wishing Well Way

- 12823 Wishing Well Way

- 12807 Wishing Well Way

- 12805 Wishing Well Way

- 10128 Sir Reynard Ln

- 12803 Wishing Well Way

- 10126 Sir Reynard Ln

- 12801 Wishing Well Way

- 10124 Sir Reynard Ln

- 9981 Shortbread Way

- 12827 Wishing Well Way

- 9979 Shortbread Way

- 12829 Wishing Well Way

- 12831 Wishing Well Way

- 9977 Shortbread Way

- 10120 Sir Reynard Ln