1282 Fenwick Garth Arnold, MD 21012

Estimated Value: $1,113,000 - $3,060,000

Studio

3

Baths

2,462

Sq Ft

$915/Sq Ft

Est. Value

About This Home

This home is located at 1282 Fenwick Garth, Arnold, MD 21012 and is currently estimated at $2,253,623, approximately $915 per square foot. 1282 Fenwick Garth is a home located in Anne Arundel County with nearby schools including Jones Elementary School, Severna Park Middle School, and Severna Park High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2024

Sold by

Elling Robert K and Elling Kim B

Bought by

Robert K Elling Trust and Kim B Elling Trust

Current Estimated Value

Purchase Details

Closed on

Jan 18, 2017

Bought by

Elling Kim

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$348,154

Interest Rate

4.12%

Purchase Details

Closed on

Jun 4, 1993

Sold by

Callari Giulio

Bought by

Elling Robert K and Elling Kim B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$675,000

Interest Rate

7.47%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Robert K Elling Trust | -- | None Listed On Document | |

| Elling Kim | -- | -- | |

| Elling Robert K | $900,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Elling Kim | $548,250 | |

| Previous Owner | Elling Kim | $348,154 | |

| Previous Owner | Elling Kim | -- | |

| Previous Owner | Elling Robert K | $675,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $18,091 | $2,685,033 | -- | -- |

| 2024 | $18,091 | $2,628,200 | $2,156,000 | $472,200 |

Source: Public Records

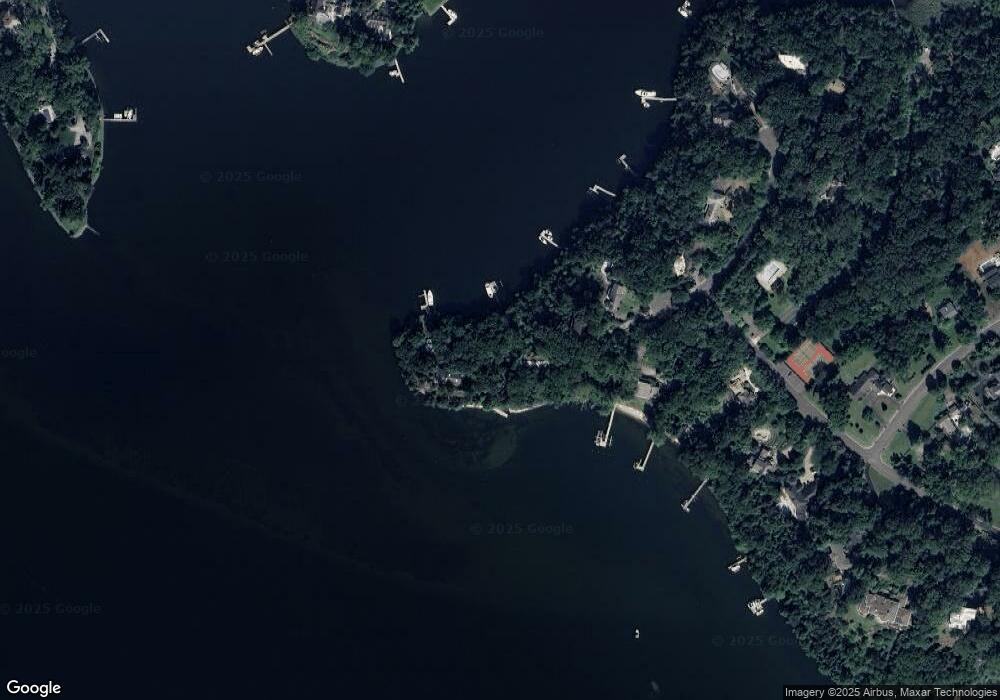

Map

Nearby Homes

- 769 Robinhood Rd

- 100 Asquithoaks Ln

- 812 Coachway

- 1199 Asquithpines Place

- 1277 Ritchie Hwy Unit 195

- 856 St Edmonds Place

- 1350 Ritchie Hwy

- 1232 Taylor Ave

- 1486 Downham Market

- 1428 Ravine Way

- 357 Overlook Trail

- 1426 Silver Oak Ln

- 0000 Mazie

- 00 Mazie

- 981 Ritchie Hwy

- 208 Admirals Ct

- 1753 Ebling Trail

- 1446 Ridgeway

- 939 Kinhart Ct

- 1241 Tamarack Trail

- 1276 Fenwick Garth

- 1270 Fenwick Garth

- 1288 Fenwick Garth

- 1264 Fenwick Garth

- 1294 Kinloch Cir

- 1258 Fenwick Garth

- 1300 Kinloch Cir

- 1222 Fenwick Garth

- 1135 Asquith Dr

- 1306 Kinloch Cir

- 1137 Asquith Dr

- 1133 Asquith Dr

- 1246 Fenwick Garth

- 230 Glen Oban Dr

- 1312 Kinloch Cir

- 318 Rugby Cove

- 1228 Fenwick Garth

- 1128 Asquith Dr

- 1131 Asquith Dr

- 1240 Fenwick Garth