Estimated Value: $135,906 - $147,000

2

Beds

2

Baths

900

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 12821 S Kenneth Ave Unit B2, Alsip, IL 60803 and is currently estimated at $141,477, approximately $157 per square foot. 12821 S Kenneth Ave Unit B2 is a home located in Cook County with nearby schools including George Washington Elementary School, Nathan Hale Middle School, and A B Shepard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 27, 2005

Sold by

Sarmiento Efrem A and Sarmiento Caroline R

Bought by

Reasnover Alvaro A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,200

Outstanding Balance

$53,357

Interest Rate

7.17%

Mortgage Type

Unknown

Estimated Equity

$88,120

Purchase Details

Closed on

Jan 18, 1996

Sold by

Marino Linnea and Marino Stahl Linnea

Bought by

Sarmiento Efrem A and Sarmiento Caroline R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$49,500

Interest Rate

7.19%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reasnover Alvaro A | $114,000 | Atg Search | |

| Sarmiento Efrem A | $66,000 | Attorneys Natl Title Network |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Reasnover Alvaro A | $91,200 | |

| Previous Owner | Sarmiento Efrem A | $49,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,044 | $9,004 | $809 | $8,195 |

| 2023 | $1,187 | $9,004 | $809 | $8,195 |

| 2022 | $1,187 | $6,151 | $957 | $5,194 |

| 2021 | $1,167 | $6,149 | $956 | $5,193 |

| 2020 | $1,232 | $6,149 | $956 | $5,193 |

| 2019 | $1,210 | $6,332 | $882 | $5,450 |

| 2018 | $1,296 | $6,665 | $882 | $5,783 |

| 2017 | $4,401 | $14,133 | $882 | $13,251 |

| 2016 | $2,337 | $8,110 | $735 | $7,375 |

| 2015 | $2,240 | $8,110 | $735 | $7,375 |

| 2014 | $2,197 | $8,110 | $735 | $7,375 |

| 2013 | $2,369 | $9,152 | $735 | $8,417 |

Source: Public Records

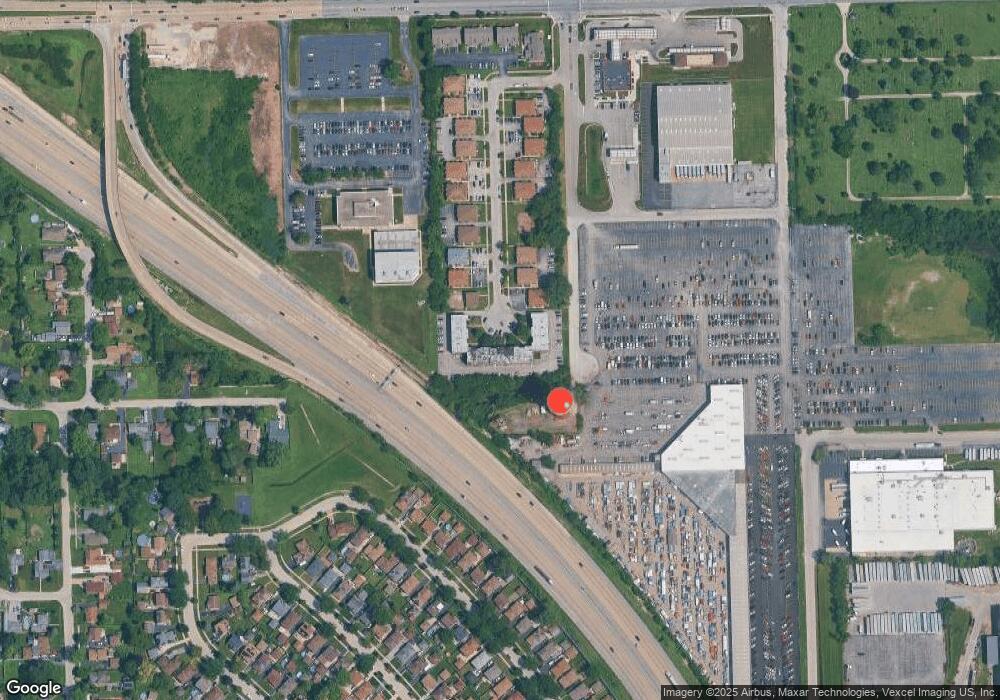

Map

Nearby Homes

- 12824 S Kenneth Ave Unit F1

- 12738 S Kenneth Ave Unit E

- 12736 S Kenneth Ave Unit 1A

- 4406 W 127th Place

- 4343 W Emerald Way St

- 4326 W Emerald Way St

- 4336 W Emerald Way St

- 4309 W Park Lane Dr Unit 2B

- 4654 W 131st St Unit 1S

- 12507 S Tripp Ave

- 14350 S Pulaski Rd

- 3729 W Glen Dr Unit 804

- 3909 W 123rd St Unit 205A

- 4804 W 118th St

- 4808 W 118th St

- 4735 W 122nd St

- 3823 W 123rd St Unit 302

- 3821 W 123rd St Unit 301

- 12147 S Cicero Ave

- 12211 S Harding Ave

- 12821 S Kenneth Ave Unit B3

- 12821 S Kenneth Ave Unit B1

- 12821 S Kenneth Ave Unit B5

- 12821 S Kenneth Ave Unit B6

- 12821 S Kenneth Ave Unit 1B

- 12823 S Kenneth Ave Unit C2

- 12823 S Kenneth Ave Unit C3

- 12823 S Kenneth Ave Unit C6

- 12823 S Kenneth Ave Unit C4

- 12823 S Kenneth Ave Unit C1

- 12819 S Kenneth Ave Unit A1

- 12819 S Kenneth Ave Unit A4

- 12819 S Kenneth Ave Unit A2

- 12819 S Kenneth Ave Unit A3

- 12819 S Kenneth Ave Unit A5

- 12819 S Kenneth Ave Unit A6

- 12825 S Kenneth Ave Unit D3

- 12825 S Kenneth Ave Unit D1

- 12825 S Kenneth Ave Unit D4

- 12825 S Kenneth Ave Unit D6