12840 W Cooper Morgan Trail Unit 185 Prescott, AZ 86305

Williamson Valley Road NeighborhoodEstimated Value: $150,000 - $382,000

--

Bed

--

Bath

--

Sq Ft

0.87

Acres

About This Home

This home is located at 12840 W Cooper Morgan Trail Unit 185, Prescott, AZ 86305 and is currently estimated at $235,333. 12840 W Cooper Morgan Trail Unit 185 is a home located in Yavapai County with nearby schools including Granite Mountain Middle School, Abia Judd Elementary School, and Prescott Mile High Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 17, 2009

Sold by

M & I Marshall & Ilsley Bank

Bought by

Ventures Hs Llc

Current Estimated Value

Purchase Details

Closed on

Sep 17, 2008

Sold by

Cruz Albaro Antonio and Barbie Julia

Bought by

M & I Marshall & Ilsley Bank

Purchase Details

Closed on

Oct 2, 2006

Sold by

Cross Alexander and Cruz Albaro A

Bought by

Barbic Julia

Purchase Details

Closed on

Oct 26, 2005

Sold by

Talking Rock Land Llc

Bought by

Cruz Albaro Antonio and Barbic Julia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,749

Interest Rate

5.74%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 10, 2005

Sold by

First American Title Insurance Agency In

Bought by

Talking Rock Land Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,749

Interest Rate

5.74%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ventures Hs Llc | $463,500 | Security Title Agency | |

| M & I Marshall & Ilsley Bank | $140,508 | First American Title Ins | |

| Barbic Julia | $224,000 | None Available | |

| Cruz Albaro Antonio | $261,250 | First American Title Ins | |

| Talking Rock Land Llc | -- | First American Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cruz Albaro Antonio | $195,749 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $397 | -- | -- | -- |

| 2024 | $390 | -- | -- | -- |

| 2023 | $390 | $12,788 | $12,788 | $0 |

| 2022 | $362 | $8,619 | $8,619 | $0 |

| 2021 | $364 | $8,727 | $8,727 | $0 |

| 2020 | $367 | $0 | $0 | $0 |

| 2019 | $354 | $0 | $0 | $0 |

| 2018 | $354 | $0 | $0 | $0 |

| 2017 | $319 | $0 | $0 | $0 |

| 2016 | $317 | $0 | $0 | $0 |

| 2015 | -- | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

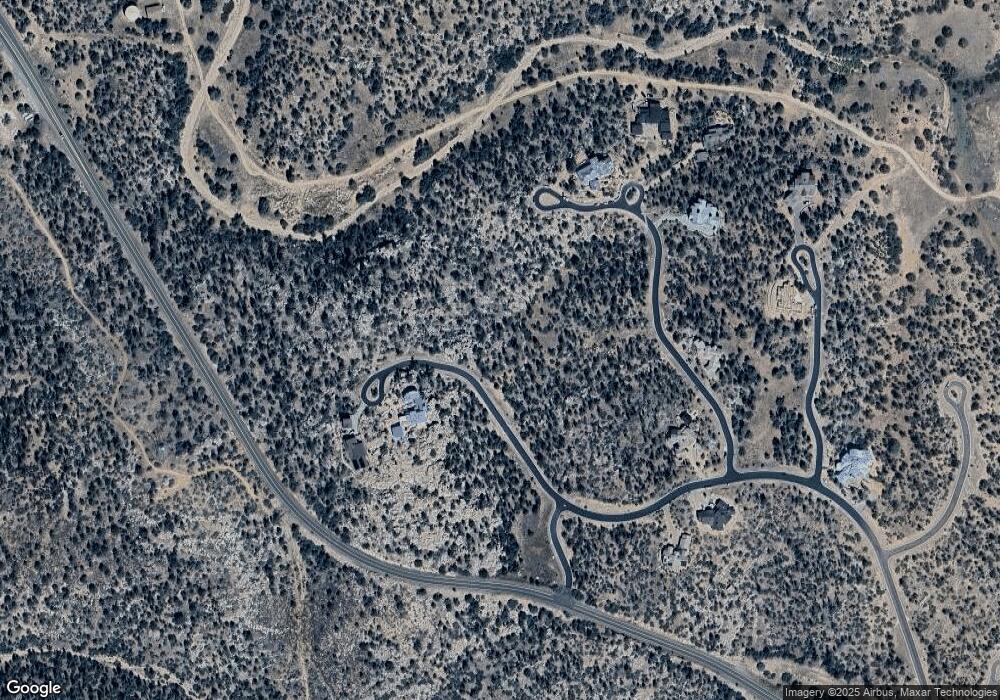

Map

Nearby Homes

- 12780 W Cooper Morgan Trail

- 15400 N High Lonesome Way

- 12825 W Cooper Morgan Trail

- 12900 W Cooper Morgan Trail

- 15405 N High Lonesome Way

- 15300 N Long View Ln

- 15270 N Long View Ln

- 15225 N Little Diamond Way

- 15320 N Escalante Way

- 12415 W Hermitage Way

- 15175 N Third Mesa Ln

- 12300 W El Capitan Dr Unit 125

- 12300 El Capitan Way

- 15495 N Angels Gate Rd

- 12285 W El Capitan Dr

- 7250 W Corn Squeezing Ln

- 0 Tbd Ln Unit PAR1076636

- 12145 W Cooper Morgan Trail

- 15210 Four Mile Creek Ln

- 14800 N Deer View Trail

- 12840 W Cooper Morgan Trail

- 12870 W Cooper Morgan Trail

- 12780 W Cooper Morgan Trail Unit 183

- 12780 W Cooper Morgan Trail

- 12935 W Cooper Morgan Trail

- 12825 W Cooper Morgan Trail Unit 191

- 15360 N High Lonesome Way

- 15420 N High Lonesome Way

- 12750 W Cooper Morgan Trail

- 15320 N High Lonesome Way

- 12785 W Cooper Morgan Trail

- 12955 Cooper Morgan Trail

- 12955 W Cooper Morgan Trail Unit 189

- 12955 W Cooper Morgan Trail

- 12720 W Cooper Morgan Trail

- 12720 W Cooper Morgan Trail Unit 181

- 15405 N High Lonesome Way Unit 174

- 15300 N High Lonesome Way Unit 180

- 15300 N High Lonesome Way

- 12680 W Cooper Morgan Trail