1290 Lidstrom Rd E Port Orchard, WA 98366

Parkwood NeighborhoodEstimated Value: $556,000 - $761,000

3

Beds

3

Baths

2,964

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 1290 Lidstrom Rd E, Port Orchard, WA 98366 and is currently estimated at $676,455, approximately $228 per square foot. 1290 Lidstrom Rd E is a home located in Kitsap County with nearby schools including Orchard Heights Elementary School, Marcus Whitman Middle School, and South Kitsap High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2022

Sold by

Slagle Darlene P

Bought by

Darlene P Slagle Trust

Current Estimated Value

Purchase Details

Closed on

Mar 9, 2005

Sold by

Slagle Darlene P

Bought by

Slagle Darlene P

Purchase Details

Closed on

Nov 9, 2004

Sold by

Slagle Darlene P

Bought by

Slagle Darlene P

Purchase Details

Closed on

Nov 25, 2002

Sold by

Slagle Brian Ernest and Slagle Darlene Plahs

Bought by

Plahs Frank and Plahs Sekva Jean

Purchase Details

Closed on

Mar 22, 2002

Sold by

Ness Ronald D and Ness Kathy A

Bought by

Slagle Brian Ernest

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Darlene P Slagle Trust | -- | -- | |

| Slagle Darlene P | -- | -- | |

| Slagle Darlene P | -- | -- | |

| Plahs Frank | -- | -- | |

| Slagle Brian Ernest | $19,000 | Land Title Co |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $5,570 | $695,150 | $96,200 | $598,950 |

| 2025 | $5,570 | $640,020 | $79,960 | $560,060 |

| 2024 | $5,401 | $640,020 | $79,960 | $560,060 |

| 2023 | $5,366 | $640,020 | $79,960 | $560,060 |

| 2022 | $5,237 | $523,240 | $74,670 | $448,570 |

| 2021 | $5,069 | $479,050 | $69,380 | $409,670 |

| 2020 | $4,984 | $457,600 | $66,080 | $391,520 |

| 2019 | $4,257 | $428,950 | $65,100 | $363,850 |

| 2018 | $4,425 | $343,210 | $65,100 | $278,110 |

| 2017 | $3,758 | $343,210 | $65,100 | $278,110 |

| 2016 | $3,634 | $303,480 | $65,100 | $238,380 |

| 2015 | $3,513 | $297,210 | $65,100 | $232,110 |

| 2014 | -- | $290,940 | $65,100 | $225,840 |

| 2013 | -- | $278,100 | $68,520 | $209,580 |

Source: Public Records

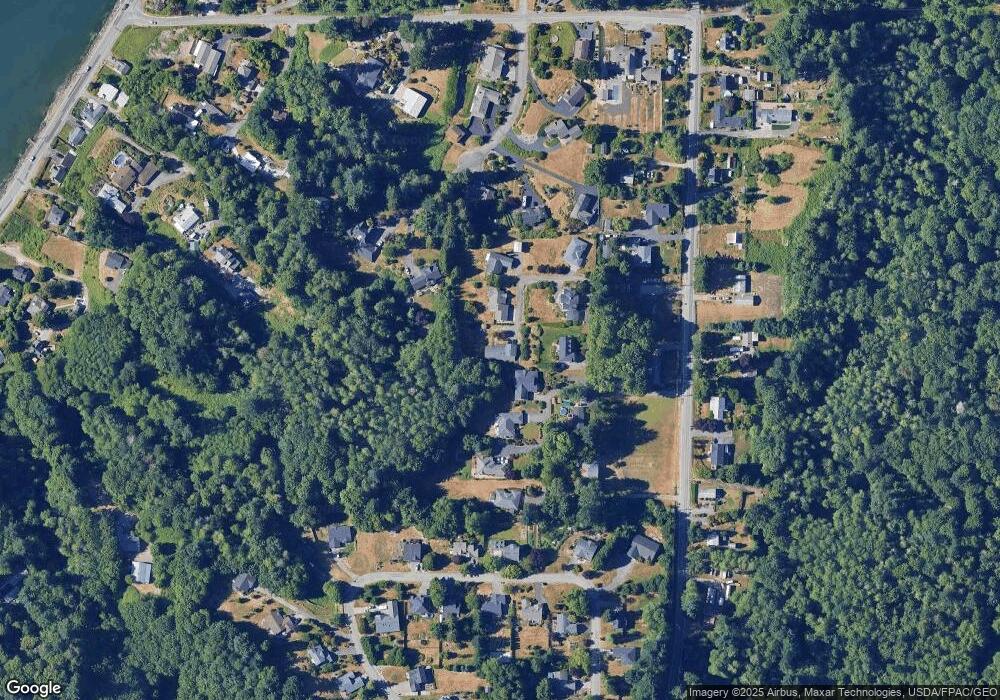

Map

Nearby Homes

- 1341 Salt Point Place E

- 3140 E Washington St

- 0 E Washington St Unit NWM2337936

- 22 Lots E Washington St

- 0 Beach Dr E Unit NWM2448019

- 0 Beach Dr E Unit NWM2139946

- 3817 SE Horstman Rd

- 4233 SE Horsehead Way

- 4798 E Stable Ln

- 1200 Baby Doll Rd E

- 0 Wendell Ave SE

- 123 E 4th St

- 4305 SE Elijah Ct

- 4010 SE Lovell St

- 1811 Bay St

- 3900 SE Mile Hill Dr

- 3930 SE Mile Hill Dr

- 1663 Harrison Ave SE

- 1703 Harrison Ave SE

- 2949 SE Mile Hill Dr Unit C-2

- 1294 Lidstrom Rd E

- 1286 Lidstrom Rd E

- 1288 Lidstrom Rd E

- 1282 Lidstrom Rd E

- 1306 Lidstrom Rd E

- 1505 Lidstrom Place E

- 1329 Salt Point Place E

- 1298 Lidstrom Rd E

- 1278 Lidstrom Rd E

- 1302 Lidstrom Rd E

- 1515 Lidstrom Place E

- 1274 Lidstrom Rd E

- 1272 Lidstrom Rd E

- 1525 Lidstrom Place E

- 2102 E Nautical Cove Way

- 1420 Lidstrom Rd E

- 1506 Lidstrom Place E

- 1535 Lidstrom Place E

- 1310 Lidstrom Rd E

- 1410 Lidstrom Rd E