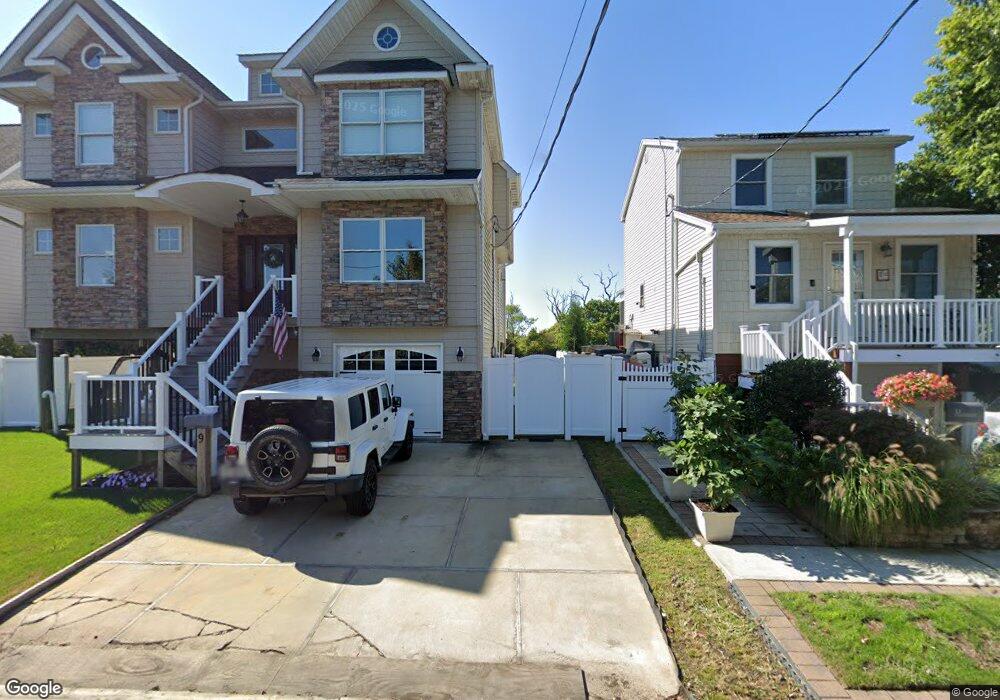

13 E Santa Barbara Rd Lindenhurst, NY 11757

Estimated Value: $470,000 - $540,000

1

Bed

1

Bath

1,008

Sq Ft

$500/Sq Ft

Est. Value

About This Home

This home is located at 13 E Santa Barbara Rd, Lindenhurst, NY 11757 and is currently estimated at $503,818, approximately $499 per square foot. 13 E Santa Barbara Rd is a home located in Suffolk County with nearby schools including Copiague Middle School and Walter G O Connell Copiague High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 2, 2025

Sold by

Garelli Theresa A

Bought by

Theresa Ann Garelli Lt and Garelli

Current Estimated Value

Purchase Details

Closed on

Feb 5, 2020

Sold by

Girasole Equity Corp

Bought by

Garelli Theresa A

Purchase Details

Closed on

Nov 18, 2010

Sold by

Ruggerio David and Garelli Theresa

Bought by

Girasole Equity Corporation

Purchase Details

Closed on

May 28, 2010

Sold by

Tangredi Pamela A and Connolly Carol J

Bought by

Ruggerio David and Garelli Theresa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

5.11%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Theresa Ann Garelli Lt | -- | -- | |

| Garelli Theresa A | -- | None Available | |

| Garelli Theresa A | -- | None Available | |

| Girasole Equity Corporation | $160,000 | -- | |

| Girasole Equity Corporation | $160,000 | -- | |

| Ruggerio David | $218,000 | -- | |

| Ruggerio David | $218,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ruggerio David | $160,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,623 | $3,540 | $580 | $2,960 |

| 2023 | $11,623 | $3,340 | $580 | $2,760 |

| 2022 | $3,829 | $3,070 | $310 | $2,760 |

| 2021 | $3,829 | $3,070 | $310 | $2,760 |

| 2020 | $3,005 | $3,070 | $310 | $2,760 |

| 2019 | $3,005 | $0 | $0 | $0 |

| 2018 | -- | $1,110 | $300 | $810 |

| 2017 | $3,833 | $1,110 | $300 | $810 |

| 2016 | $3,803 | $1,110 | $300 | $810 |

| 2015 | -- | $1,110 | $300 | $810 |

| 2014 | -- | $1,110 | $300 | $810 |

Source: Public Records

Map

Nearby Homes

- 17 E Santa Barbara Rd

- 9 E Santa Barbara Rd

- 21 E Santa Barbara Rd

- 25 E Santa Barbara Rd

- 23 Sands Ln

- 10 E Santa Barbara Rd

- 1 E Santa Barbara Rd

- 31 E Santa Barbara Rd

- 2 E Santa Barbara Rd

- 35 E Santa Barbara Rd

- 10 Sands Ln

- 15 Sands Ln

- 37 E Santa Barbara Rd

- 9 Sands Ln

- 30 E Santa Barbara Rd

- 8 Sands Ln

- 43 E Santa Barbara Rd

- 4 Sands Ln

- 4 Sands Ln Unit house

- 32 E Santa Barbara Rd