13 Haze Way Phillipsburg, NJ 08865

Estimated Value: $565,945 - $641,000

--

Bed

--

Bath

2,379

Sq Ft

$254/Sq Ft

Est. Value

About This Home

This home is located at 13 Haze Way, Phillipsburg, NJ 08865 and is currently estimated at $604,736, approximately $254 per square foot. 13 Haze Way is a home located in Warren County with nearby schools including Lopatcong Elementary School, Lopatcong Township Middle School, and Sts. Philip & James School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 12, 2005

Sold by

Caruso Edward F and Caruso Millicent A

Bought by

Bryson Christopher C and Bryson Kathleen C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Outstanding Balance

$171,093

Interest Rate

5.84%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$433,643

Purchase Details

Closed on

Jul 26, 2001

Sold by

Ldlj Associates Lp

Bought by

Caruso Edward F and Caruso Millicent A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,990

Interest Rate

6.71%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bryson Christopher C | $400,000 | -- | |

| Caruso Edward F | $280,990 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bryson Christopher C | $320,000 | |

| Previous Owner | Caruso Edward F | $170,990 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,705 | $358,400 | $89,500 | $268,900 |

| 2024 | $10,247 | $358,400 | $89,500 | $268,900 |

| 2023 | $10,218 | $358,400 | $89,500 | $268,900 |

| 2022 | $10,218 | $358,400 | $89,500 | $268,900 |

| 2021 | $9,478 | $320,000 | $89,500 | $230,500 |

| 2020 | $9,456 | $320,000 | $89,500 | $230,500 |

| 2019 | $9,430 | $320,000 | $89,500 | $230,500 |

| 2018 | $9,430 | $320,000 | $89,500 | $230,500 |

| 2017 | $9,446 | $320,000 | $89,500 | $230,500 |

| 2016 | $9,226 | $320,000 | $89,500 | $230,500 |

| 2015 | $8,920 | $320,000 | $89,500 | $230,500 |

| 2014 | $8,832 | $320,000 | $89,500 | $230,500 |

Source: Public Records

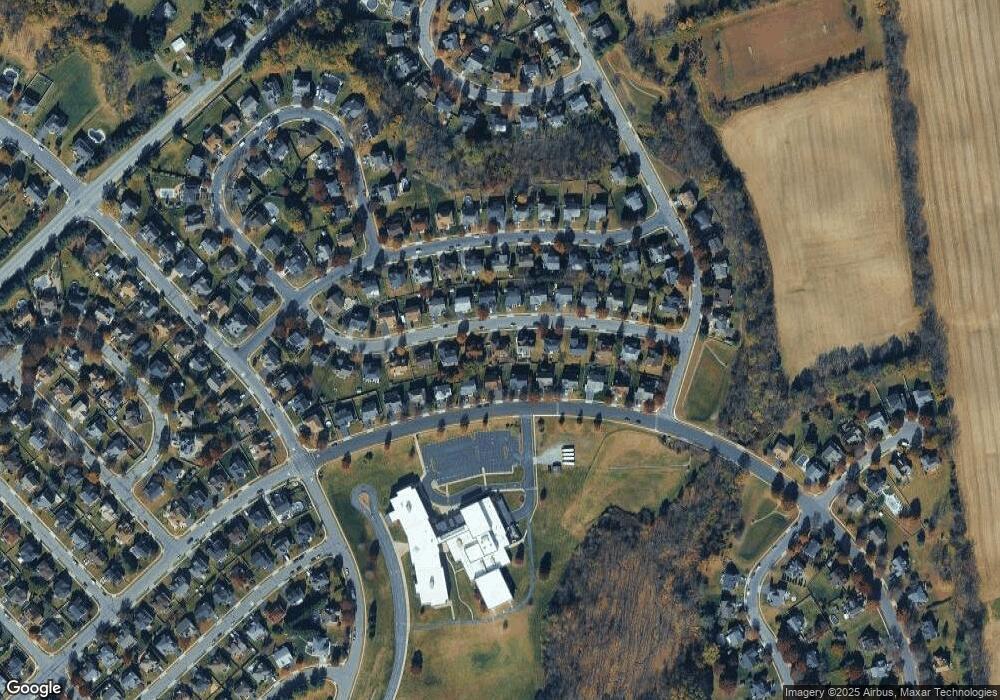

Map

Nearby Homes

- 77 Buckley Hill Dr

- 15 Byron Dr

- 6 Jacob Way

- 4 Spring Ct

- 16 Jacob Way

- 7 Spring Ct

- 105 Canterbury Rd

- 0 Rowe Ln Unit Lot 1 & 2 676101

- 6 Jayne Dr

- 81 Belview Rd

- 4 Plaza Place

- 197 Powderhorn Dr

- 304 Rosehill Ave

- 284 Rainbow Way Unit 284

- 512 Guy Rd Unit 2

- 228 Windmill Ct Unit 228

- 223 Windmill Ct Unit 223

- 221 Windmill Ct Unit 221

- 24 Dinah Dr

- 344 Shannon St