130 S Ridge Rd Decatur, TX 76234

Estimated Value: $500,000 - $612,000

4

Beds

3

Baths

2,308

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 130 S Ridge Rd, Decatur, TX 76234 and is currently estimated at $548,151, approximately $237 per square foot. 130 S Ridge Rd is a home located in Wise County with nearby schools including Decatur High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2023

Sold by

Victor Robin W

Bought by

Brewster Tanna and Brewster Dustin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$442,000

Outstanding Balance

$430,181

Interest Rate

6.39%

Mortgage Type

New Conventional

Estimated Equity

$117,970

Purchase Details

Closed on

Nov 25, 2013

Sold by

Stephens Kyle E and Stephens Debbie S

Bought by

Stephens Kyle E and Stephens Heather N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,000

Interest Rate

4.34%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 17, 1999

Sold by

Chenoweth Mark Dwight

Bought by

Stephens Kyle and Stephens Heather

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brewster Tanna | -- | None Listed On Document | |

| Stephens Kyle E | -- | None Available | |

| Stephens Kyle | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brewster Tanna | $442,000 | |

| Previous Owner | Stephens Kyle E | $136,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,807 | $479,862 | $107,586 | $372,276 |

| 2024 | $4,807 | $479,874 | $107,586 | $372,288 |

| 2023 | $5,615 | $464,794 | $0 | $0 |

| 2022 | $6,484 | $422,540 | $88,683 | $333,857 |

| 2021 | $4,536 | $337,330 | $66,680 | $270,650 |

| 2020 | $4,380 | $320,510 | $60,160 | $260,350 |

| 2019 | $3,958 | $291,500 | $59,120 | $232,380 |

| 2018 | $3,717 | $272,710 | $47,090 | $225,620 |

| 2017 | $3,380 | $230,160 | $38,500 | $191,660 |

| 2016 | $3,073 | $219,730 | $38,500 | $181,230 |

| 2015 | -- | $201,860 | $38,500 | $163,360 |

| 2014 | -- | $141,050 | $6,190 | $134,860 |

Source: Public Records

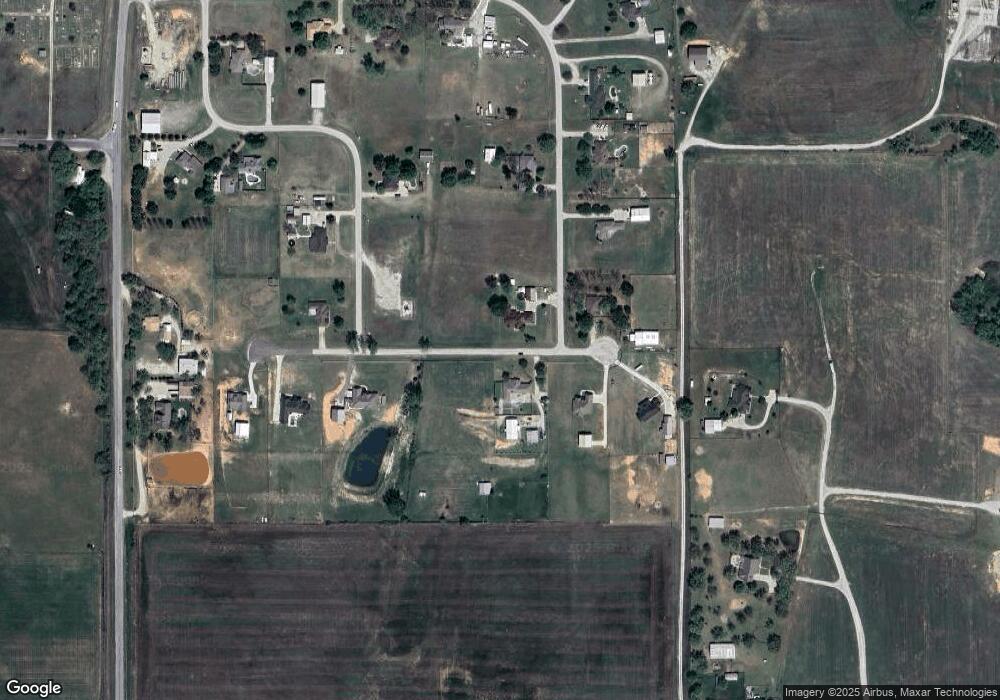

Map

Nearby Homes

- 941 County Road 4270

- 265 County Road 4374

- 5549 S Fm 730

- 4365 S Fm 730

- 459 County Road 4287

- 2150 County Road 4371

- 2160 County Road 4371

- 0 County Road 4371

- 448 County Road 4287

- 177 Private Road 4394

- 00 Lot 11 County Road 4287

- 1521 Old Reunion Rd

- 1231 County Road 4280

- 3198 S Fm 730

- 106 Lajitas Dr

- 289 County Road 4196

- 000 Cr-4227

- 01 Cr-4227

- 3790 S Fm 730

- 333 Private Road 4197

- 900 Timber Trail

- 1001 Timber Trail

- 144 Ridge Rd

- 0014 S Ridge Rd

- 0018 S Ridge Rd

- 803 Timber Trail

- 263 E Ridge St

- 105 S Ridge Rd

- 272 Timber Trail

- 279 S Ridge Rd

- 296 Ridge Rd

- 801 Timber Trail

- 157 Ridge Rd

- 301 Ridge Rd

- 301 Ridge Rd

- 0013 S Ridge Rd

- 0017 S Ridge Rd

- 0019 S Ridge Rd

- 233 Ridge Rd

- 225 Ridge Rd