1300 Redbud Ct Moore, OK 73160

Oakridge-Southmoore NeighborhoodEstimated Value: $532,000 - $692,000

4

Beds

4

Baths

3,021

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 1300 Redbud Ct, Moore, OK 73160 and is currently estimated at $579,749, approximately $191 per square foot. 1300 Redbud Ct is a home located in Cleveland County with nearby schools including Plaza Towers Elementary School, Highland West Junior High School, and Southmoore High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 29, 2017

Sold by

Shleton Jayme R and Shleton Sarah M

Bought by

Smith Steve E and Smith Cindy A

Current Estimated Value

Purchase Details

Closed on

Jul 31, 2014

Sold by

Valdez Albert Scott and Valdez Paula L

Bought by

Shelton Jayme R and Shelton Sarah M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$418,500

Interest Rate

4.2%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 7, 2005

Sold by

Cliff Marical Homes Inc

Bought by

Valdez Albert Scott and Valdez Paula L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,650

Interest Rate

6.12%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Mar 1, 2005

Sold by

Phs Development Llc

Bought by

Cliff Marical Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,800

Interest Rate

5.71%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Steve E | $450,000 | First American Title | |

| Shelton Jayme R | $465,000 | Fatco | |

| Valdez Albert Scott | $411,000 | None Available | |

| Cliff Marical Homes Inc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shelton Jayme R | $418,500 | |

| Previous Owner | Valdez Albert Scott | $61,650 | |

| Previous Owner | Cliff Marical Homes Inc | $300,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,921 | $57,053 | $8,588 | $48,465 |

| 2023 | $6,623 | $54,336 | $7,993 | $46,343 |

| 2022 | $6,402 | $51,749 | $8,697 | $43,052 |

| 2021 | $6,220 | $50,051 | $8,697 | $41,354 |

| 2020 | $6,245 | $50,224 | $7,200 | $43,024 |

| 2019 | $6,352 | $50,174 | $7,200 | $42,974 |

| 2018 | $6,637 | $52,415 | $7,200 | $45,215 |

| 2017 | $6,722 | $52,793 | $0 | $0 |

| 2016 | $6,769 | $52,793 | $7,800 | $44,993 |

| 2015 | $6,099 | $52,576 | $6,000 | $46,576 |

| 2014 | $5,204 | $44,826 | $6,000 | $38,826 |

Source: Public Records

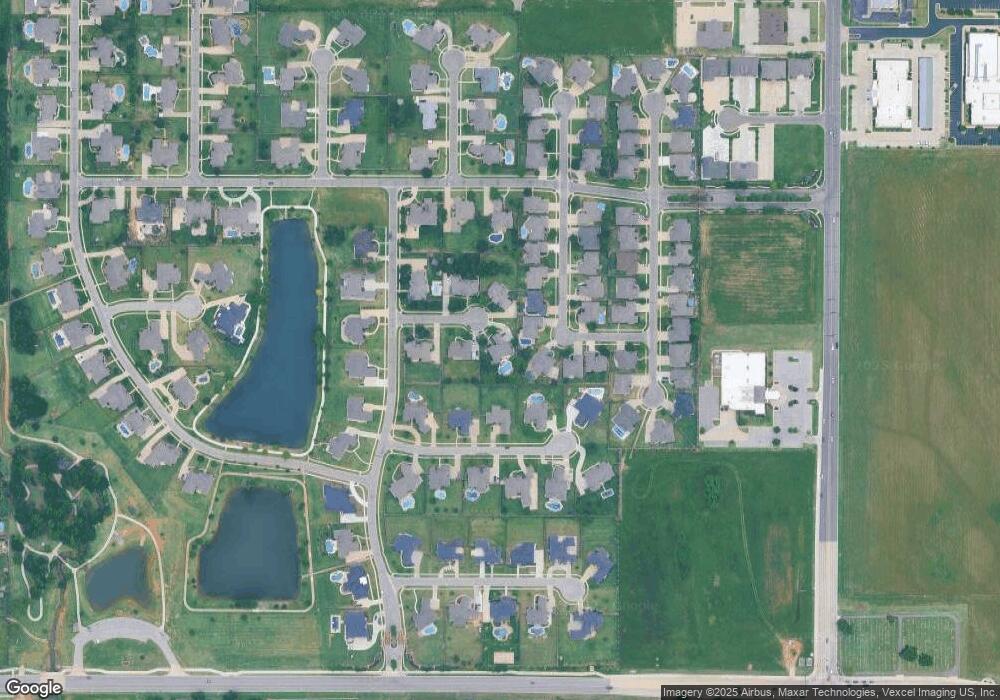

Map

Nearby Homes

- 1304 Redbud Ct

- 3105 White Cedar Dr

- 3101 White Cedar Dr

- 1621 SW 33rd St

- 1745 SW 31st Terrace

- 1741 SW 33rd St

- 809 SW 27th St

- 1913 SW 40th St

- 1925 SW 40th St

- 3901 Sorano Dr

- 620 SW 24th St

- 3909 Sorano Dr

- 2508 Tyler Ln

- 805 Brian Ct

- 813 SW 32nd St

- 3701 Kensington Dr

- 16901 Picasso Dr

- 1011 SW 22nd St

- 816 Lakeview Dr

- 905 SW 41st St

- 3121 White Cedar Dr

- 3125 White Cedar Dr

- 1301 Redbud Ct

- 3117 White Cedar Dr

- 1305 Redbud Ct

- 1205 Sand Plum

- 1208 Red Plum Dr

- 3113 White Cedar Dr

- 1308 Redbud Ct

- 1305 Sand Plum Dr

- 1301 Sand Plum

- 3109 White Cedar Dr

- 3116 White Cedar Dr

- 1204 Red Plum Dr

- 3108 Brush Arbor St

- 1309 Sand Plum

- 1201 Sand Plum Dr

- 3112 White Cedar Dr

- 3201 Sycamore Dr

- 1300 Sand Plum