1302 Tall Oaks Ln Unit C Wheaton, IL 60187

Jewell Road NeighborhoodEstimated Value: $436,000 - $492,243

2

Beds

4

Baths

1,759

Sq Ft

$264/Sq Ft

Est. Value

About This Home

This home is located at 1302 Tall Oaks Ln Unit C, Wheaton, IL 60187 and is currently estimated at $464,061, approximately $263 per square foot. 1302 Tall Oaks Ln Unit C is a home located in DuPage County with nearby schools including Carl Sandburg Elementary School, Monroe Middle School, and Wheaton North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 3, 2021

Sold by

Wall Gary L and Wall Charlyene M

Bought by

Forsyth Paul and Forsyth Liita

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$299,920

Interest Rate

2.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 15, 2002

Sold by

Miglio Edward J

Bought by

Wall Gary L and Wall Charlyene M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,500

Interest Rate

6.64%

Purchase Details

Closed on

May 20, 2000

Sold by

Miglio Edward J and Miglio Joann

Bought by

Miglio Edward J

Purchase Details

Closed on

Mar 3, 2000

Sold by

Brown James H and Brown Joyce

Bought by

Miglio Edward J and Miglio Joann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,000

Interest Rate

8.26%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Forsyth Paul | $375,000 | Old Republic Title | |

| Wall Gary L | $251,500 | -- | |

| Miglio Edward J | -- | -- | |

| Miglio Edward J | $180,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Forsyth Paul | $299,920 | |

| Previous Owner | Wall Gary L | $150,000 | |

| Previous Owner | Wall Gary L | $193,900 | |

| Previous Owner | Wall Gary L | $167,000 | |

| Previous Owner | Wall Gary L | $161,500 | |

| Previous Owner | Miglio Edward J | $372,500 | |

| Previous Owner | Miglio Edward J | $119,500 | |

| Previous Owner | Miglio Edward J | $120,000 | |

| Previous Owner | Miglio Edward J | $171,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,633 | $134,431 | $19,273 | $115,158 |

| 2023 | $7,281 | $123,740 | $17,740 | $106,000 |

| 2022 | $6,136 | $94,600 | $16,770 | $77,830 |

| 2021 | $5,758 | $92,350 | $16,370 | $75,980 |

| 2020 | $5,735 | $91,490 | $16,220 | $75,270 |

| 2019 | $5,589 | $89,070 | $15,790 | $73,280 |

| 2018 | $4,914 | $78,850 | $14,880 | $63,970 |

| 2017 | $4,820 | $75,940 | $14,330 | $61,610 |

| 2016 | $4,732 | $72,910 | $13,760 | $59,150 |

| 2015 | $4,667 | $69,560 | $13,130 | $56,430 |

| 2014 | $5,711 | $81,430 | $15,370 | $66,060 |

| 2013 | $5,566 | $81,680 | $15,420 | $66,260 |

Source: Public Records

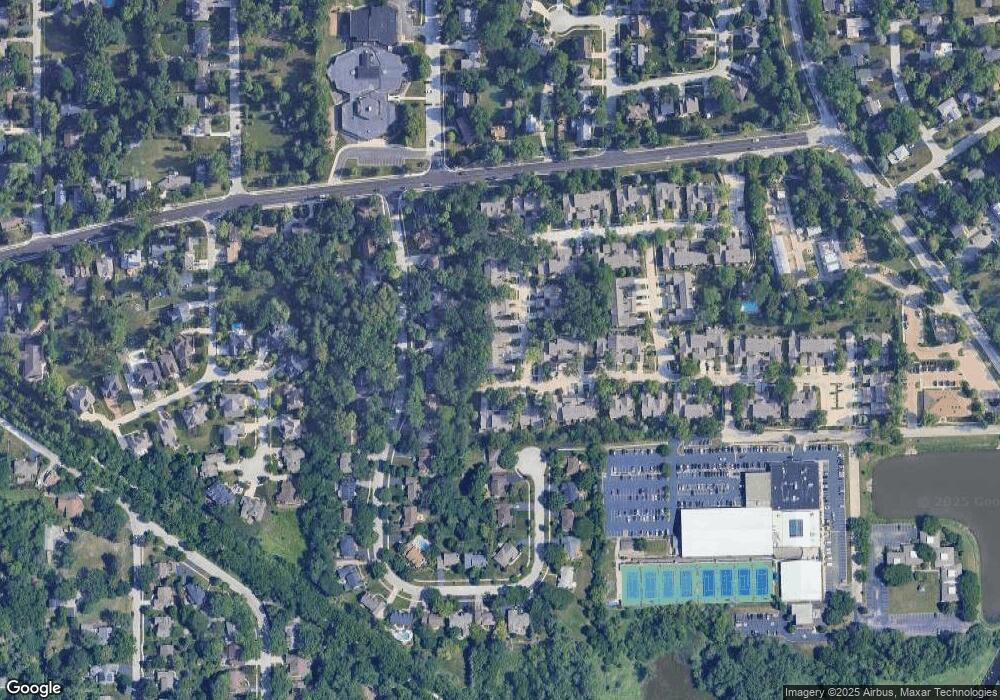

Map

Nearby Homes

- 1231 Champion Forest Ct

- 1022 Oakview Dr Unit D

- 25W633 Jewell Rd

- 0N337 Herrick Dr

- 0N301 Herrick Dr

- 25W704 Jewell Rd

- 0N510 Gary Ave

- 26W035 Hazel Ln

- 0N632 Gables Blvd

- N631 Knollwood Dr

- 0N 634 Knollwood Dr

- 26W241 Jewell Rd

- 26W181 Grand Ave

- 425 W Madison Ave

- 325 W Prairie Ave

- 234 N Knollwood Dr

- 26W278 Harrison Ave

- 2018 N West St

- 100 W Park Circle Dr Unit 1C

- 0 Ellis Ave

- 1302 Tall Oaks Ln Unit C

- 1302 Tall Oaks Ln

- 1296 Tall Oaks Ln

- 1296 Tall Oaks Ln Unit B

- 1306 Tall Oaks Ln

- 1290 Tall Oaks Ln

- 1318 Tall Oaks Ln

- 1322 Tall Oaks Ln

- 1322 Tall Oaks Ln Unit B

- 1149 Wheaton Oaks Dr

- 1326 Tall Oaks Ln

- 1145 Wheaton Oaks Dr

- 1319 Tall Oaks Ln

- 1319 Tall Oaks Ln Unit 1319

- 1401 Champion Forest Ct

- 1210 Wheaton Oaks Dr Unit C

- 1141 Wheaton Oaks Dr Unit 1

- 1346 Tall Oaks Ln

- 1206 Wheaton Oaks Dr Unit D

- 1214 Wheaton Oaks Dr Unit B