Estimated Value: $115,000 - $174,081

3

Beds

2

Baths

1,688

Sq Ft

$82/Sq Ft

Est. Value

About This Home

This home is located at 1306 Glenn Ave, Lima, OH 45804 and is currently estimated at $138,770, approximately $82 per square foot. 1306 Glenn Ave is a home located in Allen County with nearby schools including Perry Elementary School, Perry High School, and Auglaize County Educational Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 10, 2016

Sold by

Mabry Tracy

Bought by

Eberle Timothy J

Current Estimated Value

Purchase Details

Closed on

Jul 16, 2006

Sold by

Scott Hutchison Properties Inc

Bought by

Watters John

Purchase Details

Closed on

Jun 9, 2006

Sold by

Secretary Of Hud

Bought by

Scott Hutchison Properties Inc

Purchase Details

Closed on

Jun 26, 2004

Sold by

Golden Gerald L and Golden Gerald Lee

Bought by

The Secretary Of Hud

Purchase Details

Closed on

Sep 30, 1998

Sold by

Merick Lloyd

Bought by

Golden Gerald and Golden Julie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,641

Interest Rate

6.98%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 1, 1982

Bought by

Merick Lloyd C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eberle Timothy J | $4,200 | None Available | |

| Watters John | $29,000 | None Available | |

| Scott Hutchison Properties Inc | $6,400 | Lakeside Title And Escrow Ag | |

| The Secretary Of Hud | $60,476 | None Available | |

| Golden Gerald | $63,000 | -- | |

| Merick Lloyd C | $41,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Golden Gerald | $62,641 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,060 | $26,360 | $7,910 | $18,450 |

| 2023 | $1,106 | $25,100 | $7,530 | $17,570 |

| 2022 | $1,119 | $25,100 | $7,530 | $17,570 |

| 2021 | $1,341 | $25,100 | $7,530 | $17,570 |

| 2020 | $1,213 | $26,920 | $7,180 | $19,740 |

| 2019 | $1,213 | $25,940 | $7,180 | $18,760 |

| 2018 | $1,193 | $25,940 | $7,180 | $18,760 |

| 2017 | $1,510 | $25,940 | $7,180 | $18,760 |

| 2016 | $1,417 | $25,940 | $7,180 | $18,760 |

| 2015 | $1,331 | $25,940 | $7,180 | $18,760 |

| 2014 | $1,331 | $23,490 | $7,180 | $16,310 |

| 2013 | $1,505 | $23,490 | $7,180 | $16,310 |

Source: Public Records

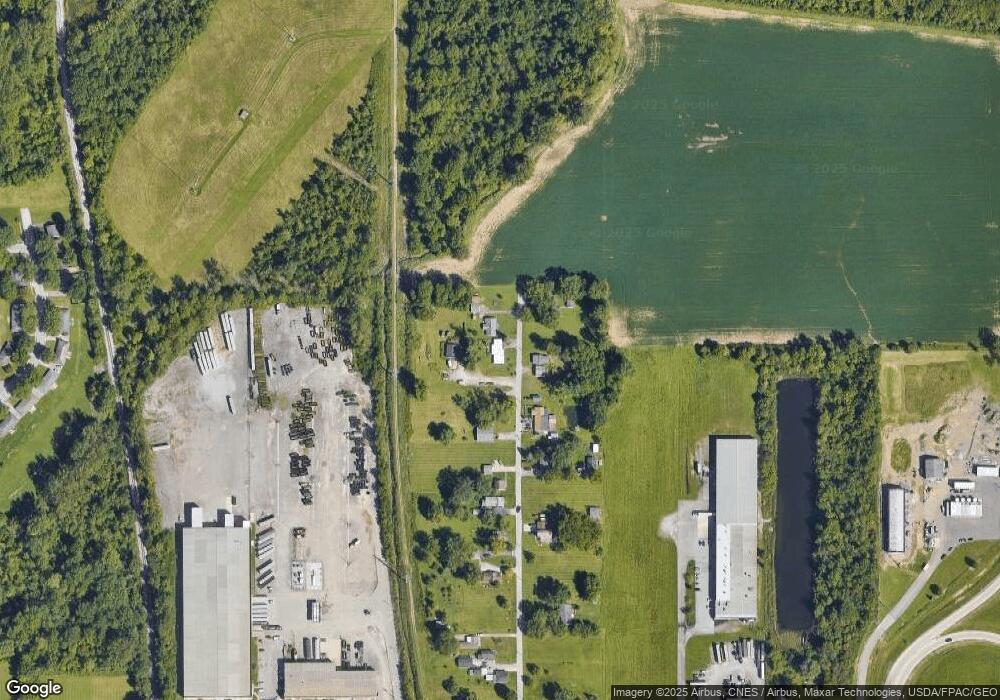

Map

Nearby Homes

- 1330 Essex Dr

- 1125 S Sugar St

- 865 E 4th St

- 815 Catalpa Ave

- 915 Michael Ave

- 1803 Saint Johns Rd

- 812 E Vine St

- 801 E Vine St

- 639 E 4th St

- 640 E 4th St

- 725 E Vine St

- 1212 Bellefontaine Ave

- 6 Oakwood Place

- 650 S Dewey Ave

- 2223 Makin Dr

- 717 E Albert St

- 0 E Vine St

- 621 Prospect Ave

- 00 Bellefontaine Ave

- 818 Madison Ave

Your Personal Tour Guide

Ask me questions while you tour the home.