131 Golf Dr Fairmont, WV 26554

Estimated Value: $320,000 - $354,000

3

Beds

2

Baths

2,396

Sq Ft

$138/Sq Ft

Est. Value

About This Home

This home is located at 131 Golf Dr, Fairmont, WV 26554 and is currently estimated at $331,623, approximately $138 per square foot. 131 Golf Dr is a home located in Marion County with nearby schools including Watson Elementary School, West Fairmont Middle School, and Fairmont Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 3, 2023

Sold by

Turner Steven A

Bought by

Singleton Renee E

Current Estimated Value

Purchase Details

Closed on

Aug 18, 2017

Sold by

Gray Kayla D and Gray Jessica R

Bought by

Turner Steven A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,052

Interest Rate

3.92%

Mortgage Type

VA

Purchase Details

Closed on

Dec 30, 2015

Sold by

Yoho Charles E and Yoho Paulette A

Bought by

Gray Kayla D and Gray Jessica R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,075

Interest Rate

3.98%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Singleton Renee E | -- | None Listed On Document | |

| Turner Steven A | $244,000 | None Available | |

| Gray Kayla D | $228,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Turner Steven A | $252,052 | |

| Previous Owner | Gray Kayla D | $217,075 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,472 | $161,940 | $39,780 | $122,160 |

| 2023 | $2,396 | $156,780 | $39,780 | $117,000 |

| 2022 | $2,275 | $152,880 | $39,780 | $113,100 |

| 2021 | $2,113 | $143,520 | $36,180 | $107,340 |

| 2020 | $2,105 | $142,320 | $39,060 | $103,260 |

| 2019 | $2,101 | $140,040 | $42,660 | $97,380 |

| 2018 | $1,768 | $118,560 | $29,760 | $88,800 |

| 2017 | $1,691 | $114,360 | $27,120 | $87,240 |

| 2016 | $3,332 | $113,040 | $28,020 | $85,020 |

| 2015 | $3,265 | $110,940 | $29,760 | $81,180 |

| 2014 | $3,265 | $109,860 | $29,760 | $80,100 |

Source: Public Records

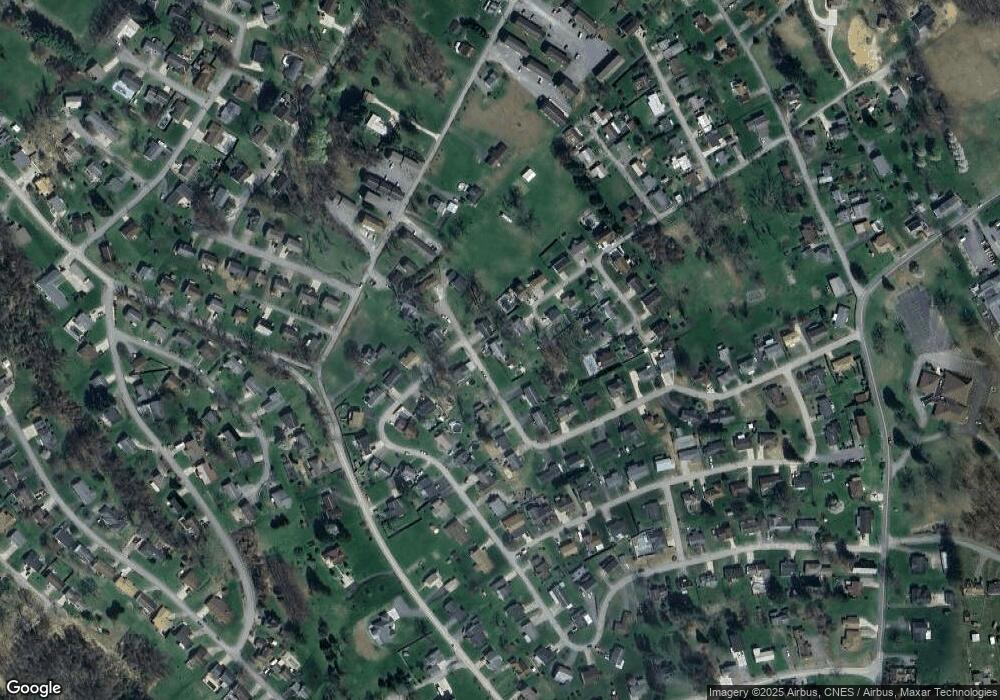

Map

Nearby Homes

- 111 Golf Dr

- 130 Gilbob St

- 1804 Vernon Dr

- 162 Fox Hill Ln

- TBD Sherb's Plat St

- 106 Warren Rd

- 101 Kennywood Dr

- 2320 Locust Dr

- 1603 Big Tree Dr

- TBD Old Monongah Rd

- 0 Fairmont Ave

- 1298 Rivershore Dr

- 1643 Simmons Ln

- 1448 Hite Ave

- 1630 Fairfield Rd

- 205 Braddock St

- 1617 Crestmont Cir

- 1567 Mary Lou Retton Dr

- 917 Mudlick Run Rd

- 17 Timothy Ln