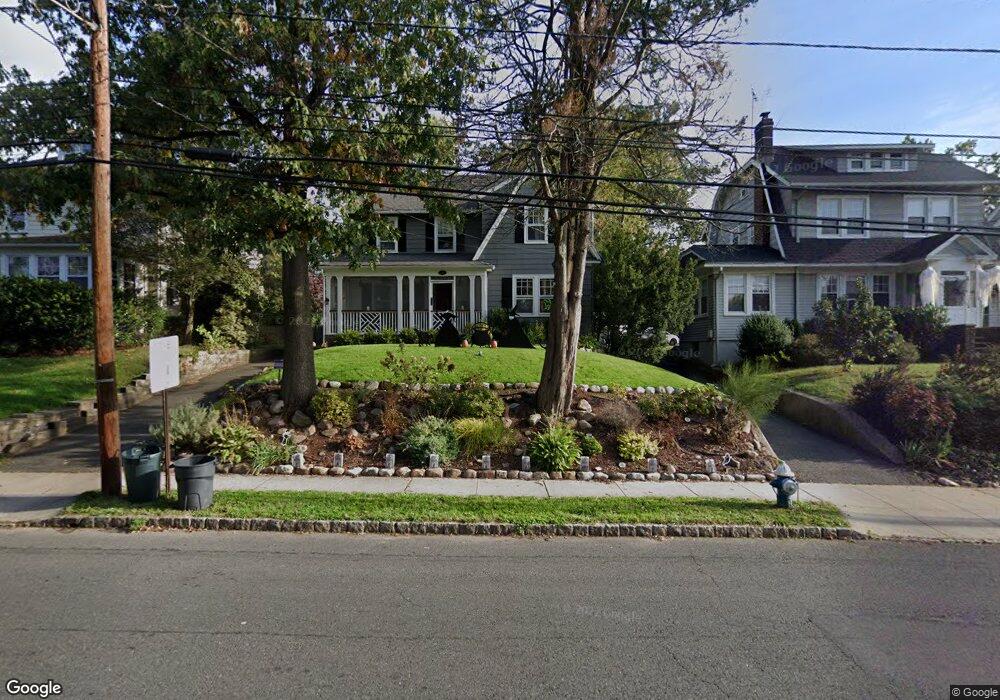

131 Tuscan Rd Maplewood, NJ 07040

Estimated Value: $812,000 - $981,000

--

Bed

--

Bath

1,448

Sq Ft

$595/Sq Ft

Est. Value

About This Home

This home is located at 131 Tuscan Rd, Maplewood, NJ 07040 and is currently estimated at $861,418, approximately $594 per square foot. 131 Tuscan Rd is a home located in Essex County with nearby schools including Tuscan Elementary School, Maplewood Middle School, and Columbia Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 29, 2007

Sold by

Bowden Jay H and Bowden Jaralyn A

Bought by

Oconnor Padraic J and Oconnor Erin K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,500

Outstanding Balance

$55,232

Interest Rate

6.3%

Mortgage Type

Credit Line Revolving

Estimated Equity

$806,186

Purchase Details

Closed on

Jun 11, 2003

Sold by

Adams Adam

Bought by

Bowden Jay and Bowden Jeralyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,500

Interest Rate

5.71%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oconnor Padraic J | $450,000 | Nrt Title Agency Llc | |

| Bowden Jay | $350,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Oconnor Padraic J | $67,500 | |

| Open | Oconnor Padraic J | $360,000 | |

| Previous Owner | Bowden Jay | $297,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $17,021 | $761,400 | $414,600 | $346,800 |

| 2024 | $17,021 | $761,400 | $414,600 | $346,800 |

| 2022 | $16,597 | $470,700 | $292,500 | $178,200 |

| 2021 | $16,093 | $470,700 | $292,500 | $178,200 |

| 2020 | $15,637 | $470,700 | $292,500 | $178,200 |

| 2019 | $15,185 | $470,700 | $292,500 | $178,200 |

| 2018 | $14,794 | $470,700 | $292,500 | $178,200 |

| 2017 | $14,352 | $470,700 | $292,500 | $178,200 |

| 2016 | $13,163 | $357,200 | $227,300 | $129,900 |

| 2015 | $12,859 | $357,200 | $227,300 | $129,900 |

| 2014 | $12,588 | $357,200 | $227,300 | $129,900 |

Source: Public Records

Map

Nearby Homes

- 14 Rutgers St

- 26 Colgate Rd

- 27 Tuscan St

- 44 Oberlin St

- 18 Boyden Pkwy S

- 188 Burnett Ave

- 60 Bowdoin St

- 34 Lancaster Ave

- 74 Hughes St

- 61 Concord Ave

- 72 Concord Ave

- 168 Jacoby St

- 6 Field Rd

- 29 Schaefer Rd

- 37 Menzel Ave

- 551 Prospect St

- 12 44th St

- 2105 Melrose Pkwy

- 11 Oakview Ave

- 74 Meadowbrook Place Unit C0074