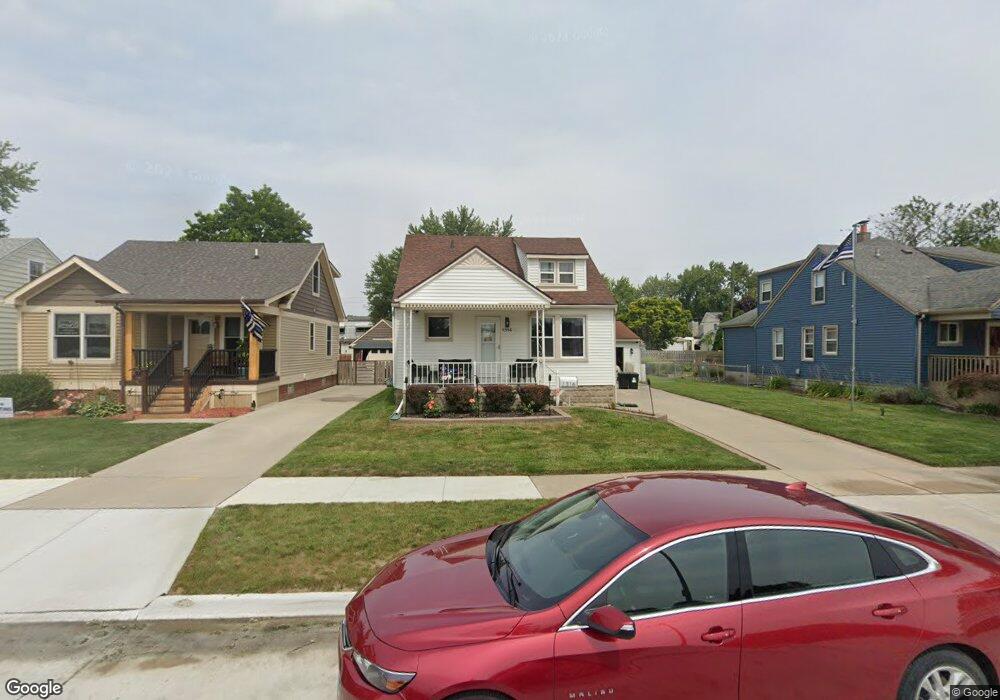

1316 Oxford Ct Unit Bldg-Unit Wyandotte, MI 48192

Estimated Value: $184,083 - $226,000

--

Bed

1

Bath

930

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 1316 Oxford Ct Unit Bldg-Unit, Wyandotte, MI 48192 and is currently estimated at $202,771, approximately $218 per square foot. 1316 Oxford Ct Unit Bldg-Unit is a home located in Wayne County with nearby schools including Washington Elementary School, Woodrow Wilson School, and Roosevelt High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 13, 2018

Sold by

Jims Pravda Llc

Bought by

Jones Brent

Current Estimated Value

Purchase Details

Closed on

Feb 26, 2015

Sold by

Copley Theodore and Kerr Darcy

Bought by

Conejo Capital Partners 2 Llc

Purchase Details

Closed on

Apr 5, 2009

Sold by

Kerr Darcy L and Copley Darcy L

Bought by

Copley Theodore L

Purchase Details

Closed on

Jun 29, 2004

Sold by

Garant Curtis A and Garant Cheryl L

Bought by

Copley Theodore L

Purchase Details

Closed on

Jul 27, 1999

Sold by

Esther Hemswor David R and Esther Hemswor

Bought by

Garant Cheryl L and Garant Curtis A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Brent | $125,000 | None Available | |

| Conejo Capital Partners 2 Llc | $40,544 | None Available | |

| Jims Pravda Llc | $1,700 | None Available | |

| Copley Theodore L | -- | None Available | |

| Copley Theodore L | $138,500 | First American Title Southea | |

| Garant Cheryl L | $110,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,611 | $82,200 | $0 | $0 |

| 2024 | $2,611 | $77,700 | $0 | $0 |

| 2023 | $2,490 | $72,400 | $0 | $0 |

| 2022 | $2,884 | $66,400 | $0 | $0 |

| 2021 | $2,826 | $61,800 | $0 | $0 |

| 2020 | $2,787 | $56,000 | $0 | $0 |

| 2019 | $2,749 | $50,100 | $0 | $0 |

| 2018 | $1,640 | $43,600 | $0 | $0 |

| 2017 | $1,370 | $43,600 | $0 | $0 |

| 2016 | $1,984 | $40,400 | $0 | $0 |

| 2015 | $3,541 | $37,500 | $0 | $0 |

| 2013 | $3,430 | $34,300 | $0 | $0 |

| 2012 | $1,593 | $35,900 | $11,100 | $24,800 |

Source: Public Records

Map

Nearby Homes