1318 Leland Dr Unit 58 Sun City Center, FL 33573

Estimated Value: $232,019 - $273,000

2

Beds

2

Baths

1,544

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 1318 Leland Dr Unit 58, Sun City Center, FL 33573 and is currently estimated at $255,005, approximately $165 per square foot. 1318 Leland Dr Unit 58 is a home located in Hillsborough County with nearby schools including Cypress Creek Elementary School, Shields Middle School, and Lennard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2020

Sold by

Kern Jeanne and Donna M Ward Trust

Bought by

Griffith Mary Colville

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,000

Outstanding Balance

$98,929

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$156,076

Purchase Details

Closed on

Jul 10, 2019

Sold by

Ward Donna M

Bought by

Ward Donna M

Purchase Details

Closed on

Aug 1, 2013

Sold by

Addis Bonnie Jean

Bought by

Ward Donna L

Purchase Details

Closed on

Sep 14, 2005

Sold by

Weeks William C

Bought by

Williams Bonnie Jean

Purchase Details

Closed on

Feb 5, 2005

Sold by

Weeks Jean E and Weeks Jeanne E

Bought by

Weeks Jeanne E

Purchase Details

Closed on

Aug 27, 2004

Sold by

Gutierrez Juan F

Bought by

Weeks Jeanne E

Purchase Details

Closed on

Mar 13, 2001

Sold by

Coplan Ina B

Bought by

Gutierrez Juan F and Gutierrez Juan F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Griffith Mary Colville | $160,000 | South Bay Title Ins Agcy Inc | |

| Ward Donna M | -- | Attorney | |

| Ward Donna L | $95,000 | Florida Title & Guarantee | |

| Williams Bonnie Jean | -- | -- | |

| Weeks Jeanne E | -- | None Available | |

| Weeks Jeanne E | $130,000 | First Fidelity Title Inc | |

| Gutierrez Juan F | $97,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Griffith Mary Colville | $136,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,996 | $204,953 | $100 | $204,853 |

| 2023 | $3,855 | $198,019 | $100 | $197,919 |

| 2022 | $3,601 | $186,406 | $100 | $186,306 |

| 2021 | $2,255 | $149,002 | $100 | $148,902 |

| 2020 | $1,035 | $83,714 | $0 | $0 |

| 2019 | $956 | $81,832 | $0 | $0 |

| 2018 | $937 | $80,306 | $0 | $0 |

| 2017 | $914 | $117,684 | $0 | $0 |

| 2016 | $894 | $77,036 | $0 | $0 |

| 2015 | $902 | $76,500 | $0 | $0 |

| 2014 | $887 | $75,893 | $0 | $0 |

| 2013 | -- | $68,908 | $0 | $0 |

Source: Public Records

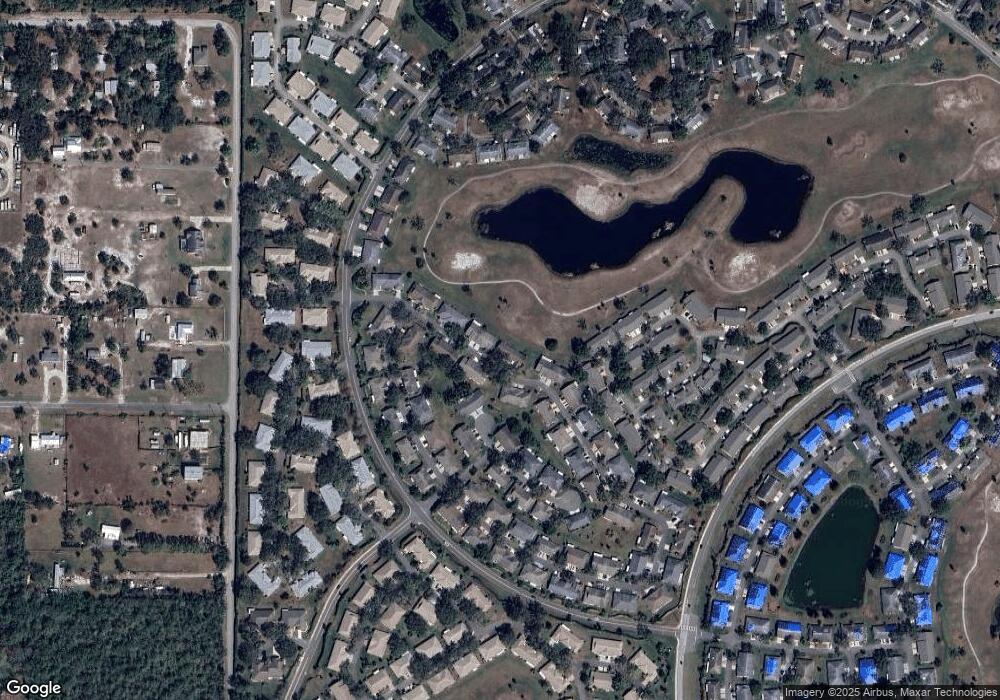

Map

Nearby Homes

- 1318 Leland Dr

- 1508 Ingram Dr Unit 20

- 1514 Ingram Dr Unit 21

- 1604 Leland Dr

- 1609 Laughton Place Unit 54

- 1605 Laughton Place

- 1426 Ingram Dr

- 1530 Ingram Dr Unit 1530

- 1503 Laughton Place Unit 206

- 1506 Laughton Place Unit 307

- 2127 Hailstone Cir

- 2421 Lancaster Dr

- 2410 Lancaster Dr

- 2403 Nantucket Green Ct

- 2501 Lonigan Place

- 2510 Locksley St

- 1417 Langley Dr

- 2329 Lancaster Dr

- 2109 Harleston Place

- 1574 Nantucket Dr Unit 131

- 1318 Leland Dr Unit 1

- 1320 Leland Dr

- 1320 Leland Dr Unit 57

- 1316 Leland Dr Unit 59

- 1314 Leland Dr

- 1315 Leland Dr

- 1315 Leland Dr Unit 103

- 1313 Leland Dr Unit 104

- 1313 Leland Dr

- 1402 Leland Dr

- 1317 Leland Dr

- 1317 Leland Dr Unit 102

- 1319 Leland Dr

- 1311 Leland Dr Unit 105

- 1312 Leland Dr

- 1624 Layton Ct Unit 1624

- 1624 Layton Ct

- 1624 Layton Ct Unit 107

- 1309 Leland Dr