13211 SW 42nd St Unit 7103 Miramar, FL 33027

Silver Falls NeighborhoodEstimated Value: $430,000 - $484,538

3

Beds

3

Baths

2,000

Sq Ft

$225/Sq Ft

Est. Value

About This Home

This home is located at 13211 SW 42nd St Unit 7103, Miramar, FL 33027 and is currently estimated at $450,135, approximately $225 per square foot. 13211 SW 42nd St Unit 7103 is a home located in Broward County with nearby schools including Coral Cove Elementary School, New Renaissance Middle School, and Everglades High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2009

Sold by

Gopalan Sholy and Sholy Gayathri

Bought by

Wong Winnie Manlai

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Outstanding Balance

$78,275

Interest Rate

4.98%

Mortgage Type

New Conventional

Estimated Equity

$371,860

Purchase Details

Closed on

Jun 11, 2005

Sold by

Rojas Jesus and Mattey Yllen

Bought by

Gopalan Sholy and Seetharamagupta Gayathri

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,600

Interest Rate

5.28%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Mar 17, 2005

Sold by

Centex Homes

Bought by

Rojas Jesus and Mattey Yllen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,052

Interest Rate

4.87%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wong Winnie Manlai | $160,000 | Florida Title & Guarantee | |

| Gopalan Sholy | $318,000 | South Florida Title Consulta | |

| Rojas Jesus | $226,800 | Metropolitan Title & Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wong Winnie Manlai | $120,000 | |

| Previous Owner | Gopalan Sholy | $63,600 | |

| Previous Owner | Rojas Jesus | $204,052 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,638 | $146,110 | -- | -- |

| 2024 | $2,564 | $142,000 | -- | -- |

| 2023 | $2,564 | $137,870 | $0 | $0 |

| 2022 | $2,351 | $133,860 | $0 | $0 |

| 2021 | $2,295 | $129,970 | $0 | $0 |

| 2020 | $2,266 | $128,180 | $0 | $0 |

| 2019 | $2,233 | $125,300 | $0 | $0 |

| 2018 | $2,137 | $122,970 | $0 | $0 |

| 2017 | $2,050 | $120,450 | $0 | $0 |

| 2016 | $2,035 | $117,980 | $0 | $0 |

| 2015 | $2,013 | $117,160 | $0 | $0 |

| 2014 | $1,965 | $116,240 | $0 | $0 |

| 2013 | -- | $118,470 | $11,850 | $106,620 |

Source: Public Records

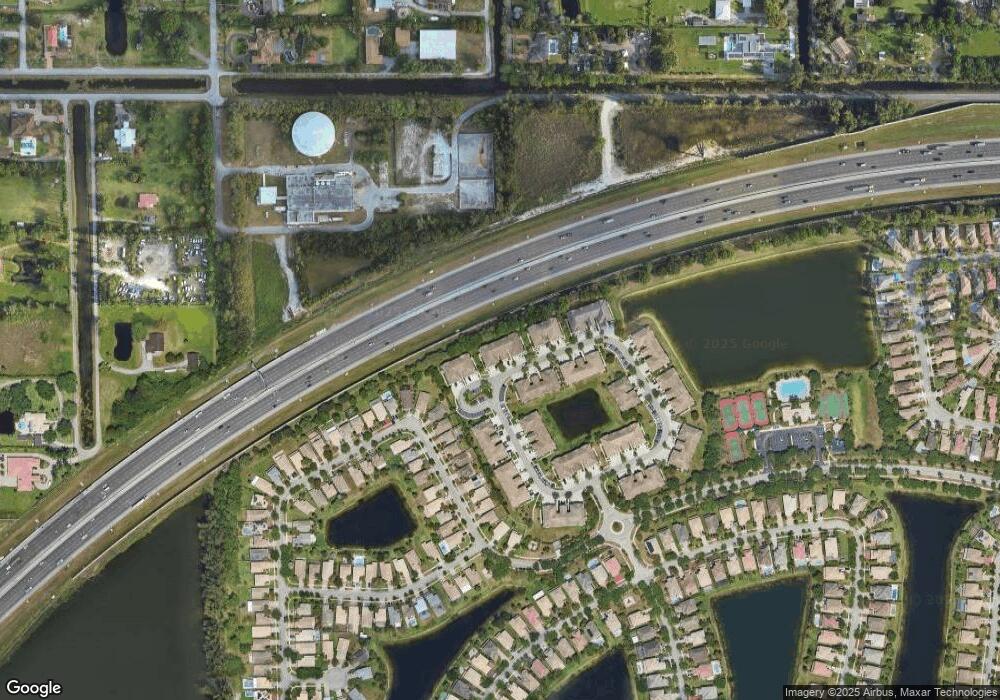

Map

Nearby Homes

- 4230 SW 132nd Way Unit 9106

- 13216 SW 44th St Unit 11204

- 4371 SW 131st Ln

- 13114 SW 44th St Unit 2204

- 13357 SW 46th Ct

- 4604 SW 132nd Ave

- 4591 SW 131st Terrace

- 4527 SW 129th Ave

- 4980 SW 134th Ave

- 13216 SW 49th Ct

- 13249 SW 50th St

- 3801 SW 137th Ave

- 12953 SW 49th Ct

- 13519 SW 50th Ct

- 5000 SW 136th Ave

- 5048 SW 136th Ave

- 12913 SW 49th Ct

- 13680 SW 50th Ct

- 13236 SW 51st St

- 13348 SW 52nd St

- 13213 SW 42nd St Unit 7102

- 13209 SW 42nd St Unit 7104

- 13207 SW 42nd St

- 13215 SW 42nd St Unit 7201

- 13217 SW 42nd St Unit 7101

- 13205 SW 42nd St Unit 7204

- 13203 SW 42nd St Unit 7106

- 13201 SW 42nd St Unit 7203

- 13225 SW 42nd St Unit 8204

- 13221 SW 42nd St Unit 8203

- 13223 SW 42nd St Unit 8104

- 13173 SW 42nd St Unit 6202

- 13165 SW 42nd St Unit 6101

- 13227 SW 42nd St Unit 8103

- 13210 SW 42nd St Unit 15203

- 13157 SW 42nd St Unit 6201

- 13153 SW 42nd St Unit 6102

- 13229 SW 42nd St Unit 8102

- 13231 SW 42nd St Unit 8201