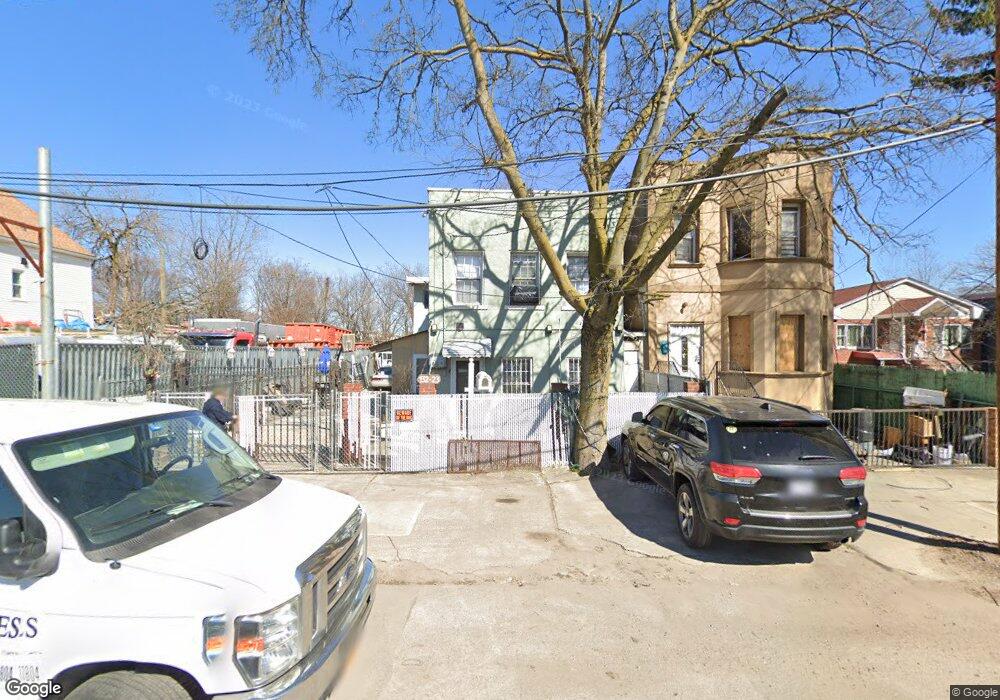

13223 Ruby St Howard Beach, NY 11414

Howard Beach NeighborhoodEstimated Value: $551,000 - $860,000

Studio

--

Bath

1,512

Sq Ft

$456/Sq Ft

Est. Value

About This Home

This home is located at 13223 Ruby St, Howard Beach, NY 11414 and is currently estimated at $688,947, approximately $455 per square foot. 13223 Ruby St is a home located in Queens County with nearby schools including P.S. 232 - Lindenwood, Robert H. Goddard High School, and Our World Neighborhood Charter School 2.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2015

Sold by

Hernandez Manuela and Rivera Adolfo

Bought by

Hernandez Manuela

Current Estimated Value

Purchase Details

Closed on

Feb 8, 2002

Sold by

Mcdermott Terance

Bought by

Medrano William D and Vargas Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$243,092

Interest Rate

7.18%

Purchase Details

Closed on

Jan 14, 1998

Sold by

Yorgo Development Inc

Bought by

David Uri Ben

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,000

Interest Rate

6.74%

Purchase Details

Closed on

Aug 18, 1994

Sold by

Raisis Lillian

Bought by

James Vita

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hernandez Manuela | -- | -- | |

| Medrano William D | -- | -- | |

| David Uri Ben | $190,000 | -- | |

| Yorgo Development Inc | $70,000 | -- | |

| James Vita | -- | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Medrano William D | $243,092 | |

| Previous Owner | Yorgo Development Inc | $133,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,900 | $14,618 | $2,158 | $12,460 |

| 2024 | $2,900 | $14,437 | $2,003 | $12,434 |

| 2023 | $2,741 | $13,648 | $2,082 | $11,566 |

| 2022 | $2,574 | $44,880 | $6,900 | $37,980 |

| 2021 | $2,564 | $37,200 | $6,900 | $30,300 |

| 2020 | $2,579 | $38,040 | $6,900 | $31,140 |

| 2019 | $2,517 | $38,040 | $6,900 | $31,140 |

| 2018 | $2,318 | $11,373 | $2,409 | $8,964 |

| 2017 | $2,191 | $10,747 | $2,564 | $8,183 |

| 2016 | $2,029 | $10,747 | $2,564 | $8,183 |

| 2015 | $1,223 | $10,152 | $4,351 | $5,801 |

| 2014 | $1,223 | $10,026 | $4,297 | $5,729 |

Source: Public Records

Map

Nearby Homes

- 13225 Ruby St

- 7602 Blake Ave

- 1474 Blake Ave

- 365 Forbell St

- 1472 Blake Ave

- 133- 38 Amber St

- 705 Eldert Ln Unit 709

- 133-24 78th St

- 1460 Sutter Ave

- 107-53 77th St

- 132-30 80th St

- 568 Drew St

- 557 Drew St

- 1386 Sutter Ave

- 13236 82nd St

- 699 N Conduit Blvd

- 13225 82nd St

- 1128 Belmont Ave

- 1394 Dumont Ave

- 778 Lincoln Ave