13235 12th Ave SW Unit 1232 Burien, WA 98146

Seahurst NeighborhoodEstimated Value: $259,000 - $568,000

2

Beds

2

Baths

1,150

Sq Ft

$358/Sq Ft

Est. Value

About This Home

This home is located at 13235 12th Ave SW Unit 1232, Burien, WA 98146 and is currently estimated at $411,159, approximately $357 per square foot. 13235 12th Ave SW Unit 1232 is a home located in King County with nearby schools including Hazel Valley Elementary School, Cascade Middle School, and Highline High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 12, 2016

Sold by

Rowan J Ashley and Rowan Lydia M

Bought by

Flowers Julianne Frances

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,850

Outstanding Balance

$123,272

Interest Rate

3.41%

Estimated Equity

$287,887

Purchase Details

Closed on

Jan 30, 2006

Sold by

Kim Sam K

Bought by

Rowan J Ashley and Rowan Lydia M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,920

Interest Rate

6.16%

Purchase Details

Closed on

Oct 13, 2000

Sold by

Lawrence Michael W and Lawrence Eileen A

Bought by

Kim Sam K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,500

Interest Rate

7.89%

Purchase Details

Closed on

Apr 8, 1993

Sold by

Sound Vista Incorporated

Bought by

Lawrence Michael W and Eileen A+

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Flowers Julianne Frances | $163,000 | Chicago Title | |

| Rowan J Ashley | $154,900 | Ticor National | |

| Kim Sam K | $110,000 | Fidelity National Title | |

| Lawrence Michael W | $76,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Flowers Julianne Frances | $154,850 | |

| Previous Owner | Rowan J Ashley | $123,920 | |

| Previous Owner | Kim Sam K | $104,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,397 | $304,000 | $27,300 | $276,700 |

| 2023 | $3,164 | $327,000 | $26,900 | $300,100 |

| 2022 | $2,992 | $289,000 | $25,100 | $263,900 |

| 2021 | $3,008 | $241,000 | $22,400 | $218,600 |

| 2020 | $2,600 | $234,000 | $21,500 | $212,500 |

| 2018 | $2,200 | $175,000 | $14,300 | $160,700 |

| 2017 | $1,955 | $153,000 | $13,400 | $139,600 |

| 2016 | $1,678 | $137,000 | $13,400 | $123,600 |

| 2015 | $1,556 | $121,000 | $16,100 | $104,900 |

| 2014 | -- | $107,000 | $16,100 | $90,900 |

| 2013 | -- | $80,000 | $16,100 | $63,900 |

Source: Public Records

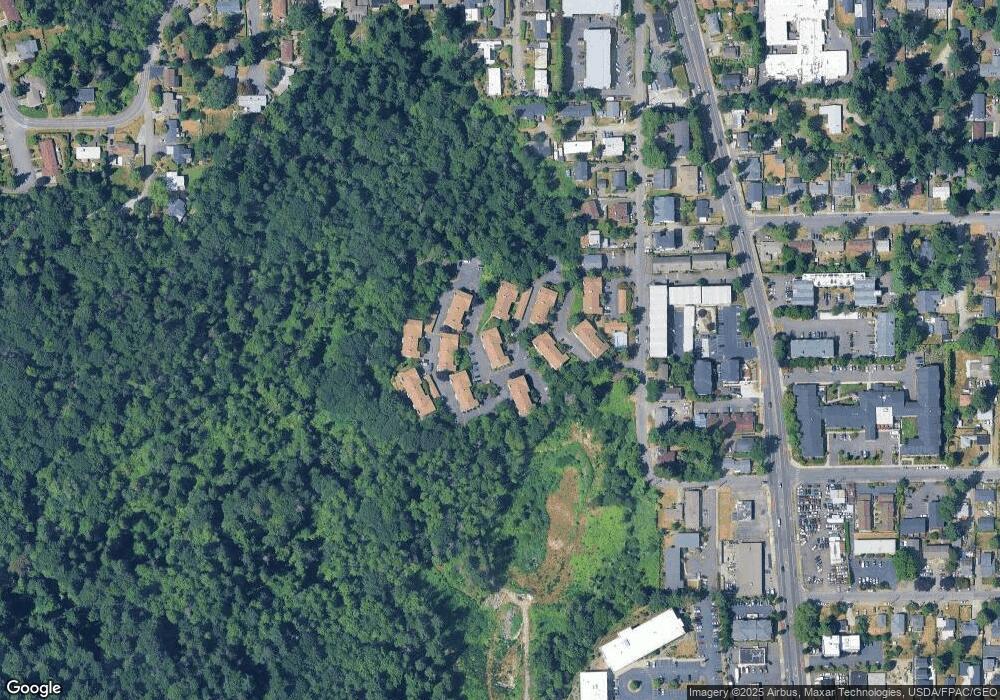

Map

Nearby Homes

- 13235 12th Ave SW Unit 733

- 13235 12th Ave SW Unit 522

- 1220 SW 132nd Ln Unit 523

- 1239 SW 132nd Ln Unit 822

- 13016 8th Place SW

- 11544 17th Ave SW

- 1438 SW 129th St

- 12434 Ambaum Blvd SW Unit C114

- 12342 13th Place SW Unit A

- 12332 13th Place SW Unit A

- 226 SW 131st St

- 1832 SW Shoreview Ln

- 420 SW 127th St

- 12330 13th Place SW

- 1517 SW 124th St

- 615 SW 124th St

- 1415 SW 122nd St Unit A

- 1229 SW 146th St

- 818 SW 120th St

- 13055 2nd Ave S Unit A

- 13235 12th Ave SW Unit 711

- 13235 12th Ave SW Unit 121

- 13235 12th Ave SW Unit 612

- 13235 12th Ave SW Unit 422

- 13235 12th Ave SW Unit 213

- 13235 12th Ave SW Unit 1123

- 13235 12th Ave SW Unit 832

- 13235 12th Ave SW Unit 931

- 13235 12th Ave SW Unit 1121

- 13235 12th Ave SW Unit 731

- 13235 12th Ave SW Unit 332

- 13235 12th Ave SW Unit 933

- 13235 12th Ave SW Unit 511

- 13235 12th Ave SW Unit 721

- 13235 12th Ave SW Unit 433

- 13235 12th Ave SW Unit 1013

- 13235 12th Ave SW Unit 723

- 13235 12th Ave SW Unit 1113

- 13235 12th Ave SW Unit 613

- 13235 12th Ave SW Unit 311