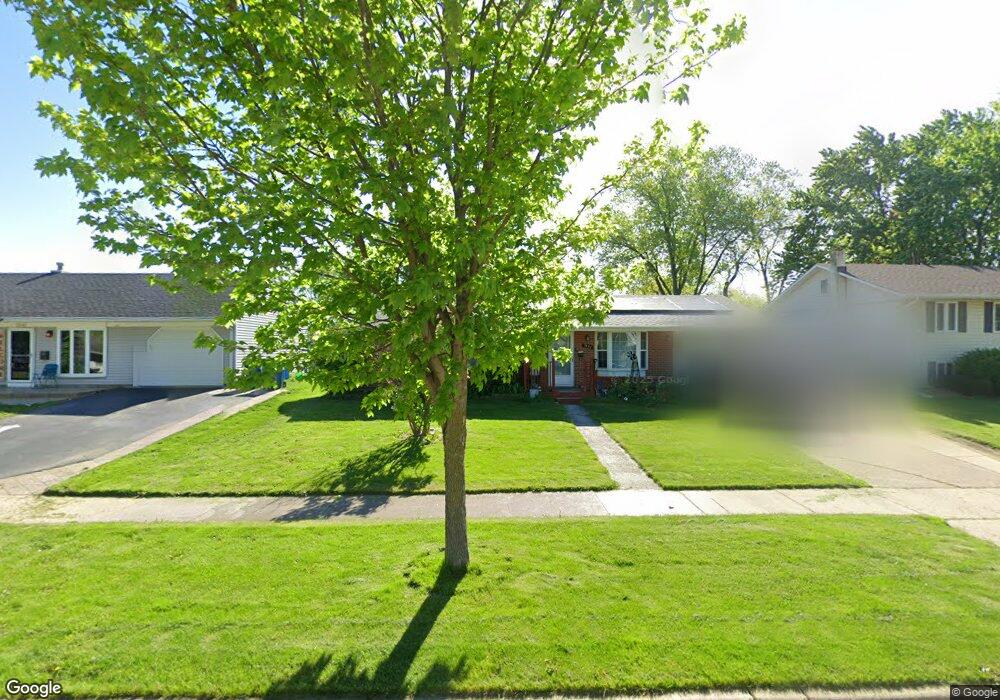

1331 Post Rd Aurora, IL 60506

North River NeighborhoodEstimated Value: $273,000 - $347,000

Studio

--

Bath

1,651

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 1331 Post Rd, Aurora, IL 60506 and is currently estimated at $304,828, approximately $184 per square foot. 1331 Post Rd is a home located in Kane County with nearby schools including Smith Elementary School, Jewel Middle School, and West Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2021

Sold by

Debolt Christopher Scott and Debolt Sue Ellen

Bought by

Debolt Christopher S and Debolt Sue E

Current Estimated Value

Purchase Details

Closed on

Feb 22, 2021

Sold by

Debolt Christopher Scott and Debolt Sue Ellen

Bought by

Debolt Christopher Scott and Debolt Sue Ellen

Purchase Details

Closed on

Mar 17, 2017

Sold by

Debolt Christopher Scott and Debolt Sue Ellen

Bought by

Debolt Christopher S and Debolt Sue E

Purchase Details

Closed on

Nov 21, 2001

Sold by

Tesch Sue Ellen and Debolt Sue Ellen

Bought by

Debolt Christopher Scott and Debolt Sue Ellen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,000

Interest Rate

6.64%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Debolt Christopher S | -- | Attorney | |

| Debolt Christopher Scott | -- | None Available | |

| Debolt Christopher S | -- | None Available | |

| Debolt Christopher Scott | -- | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Debolt Christopher Scott | $91,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,735 | $80,426 | $15,912 | $64,514 |

| 2023 | $5,470 | $71,860 | $14,217 | $57,643 |

| 2022 | $5,273 | $65,566 | $12,972 | $52,594 |

| 2021 | $5,029 | $61,043 | $12,077 | $48,966 |

| 2020 | $5,338 | $63,016 | $11,218 | $51,798 |

| 2019 | $5,123 | $58,386 | $10,394 | $47,992 |

| 2018 | $4,801 | $54,087 | $9,614 | $44,473 |

| 2017 | $4,394 | $48,695 | $8,858 | $39,837 |

| 2016 | $4,247 | $45,980 | $7,593 | $38,387 |

| 2015 | -- | $39,970 | $6,529 | $33,441 |

| 2014 | -- | $38,441 | $6,279 | $32,162 |

| 2013 | -- | $39,069 | $6,190 | $32,879 |

Source: Public Records

Map

Nearby Homes

- 910 Southbridge Dr

- 1229 Yellowpine Dr

- 461 Sullivan Rd

- 795 N Elmwood Dr

- 833 Sheldon Ave

- 781 N Elmwood Dr

- 740 N Elmwood Dr

- 500 California Ave

- 1104 New Haven Ave

- 388 Manor Place

- 1351 Monomoy St Unit D

- 1389 Monomoy St Unit B2

- 833 N Randall Rd Unit C4

- 811 N Randall Rd Unit B

- 616 Morton Ave

- 1358 Monomoy St Unit A

- 1421 Heather Dr

- 742 N Glenwood Place

- 1039 S Pleasure Ct

- 418 W Illinois Ave

- 1321 Post Rd

- 1341 Post Rd

- 1330 Durham Dr Unit 1

- 1305 Post Rd

- 1340 Durham Dr

- 1320 Durham Dr Unit 1

- 880 Upper Brandon Dr

- 1330 Post Rd

- 1285 Post Rd

- 1340 Post Rd

- 1320 Post Rd Unit 1

- 1310 Durham Dr

- 1350 Post Rd

- 1310 Post Rd

- 1275 Post Rd

- 1290 Post Rd

- 1300 Durham Dr

- 934 Upper Brandon Dr Unit 2

- 1321 Foran Ln

- 1331 Foran Ln