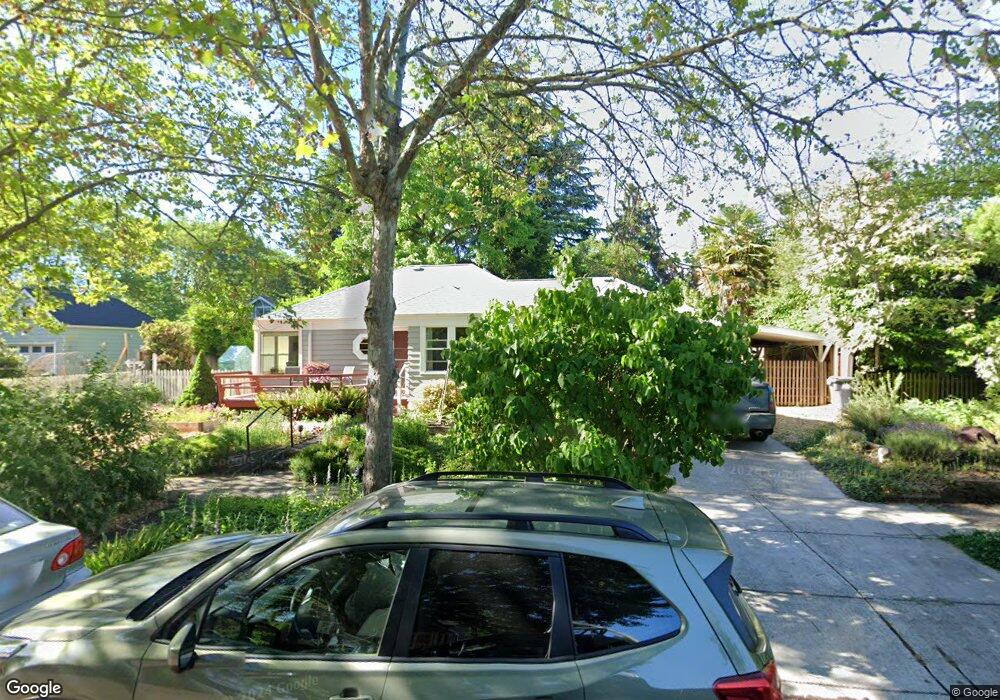

1336 W 10th Ave Eugene, OR 97402

Jefferson Westside NeighborhoodEstimated Value: $355,506 - $390,000

2

Beds

1

Bath

1,006

Sq Ft

$370/Sq Ft

Est. Value

About This Home

This home is located at 1336 W 10th Ave, Eugene, OR 97402 and is currently estimated at $372,627, approximately $370 per square foot. 1336 W 10th Ave is a home located in Lane County with nearby schools including Cesar Chavez Elementary School, Arts And Technology Academy At Jefferson, and Churchill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 13, 2024

Sold by

Fenech Joseph and Joseph Fenech 1994 Revocable Trust

Bought by

Fenech Sandra

Current Estimated Value

Purchase Details

Closed on

Sep 10, 2007

Sold by

Fenech Joseph

Bought by

Fenech Joseph and Joseph Fenech 1994 Revocable Trust

Purchase Details

Closed on

Sep 13, 2005

Sold by

Fenech Joseph

Bought by

Fenech Joseph and Joseph Fenech 1994 Revocable Trust

Purchase Details

Closed on

Oct 22, 2004

Sold by

Fenech Joseph

Bought by

Fenech Joseph and The Joseph Fenech 1994 Revocable Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fenech Sandra | $345,000 | Cascade Title | |

| Fenech Joseph | -- | None Available | |

| Fenech Joseph | -- | -- | |

| Fenech Joseph | -- | Cascade Title Co |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,161 | $162,219 | -- | -- |

| 2024 | $3,121 | $157,495 | -- | -- |

| 2023 | $3,121 | $152,908 | $0 | $0 |

| 2022 | $2,924 | $148,455 | $0 | $0 |

| 2021 | $2,747 | $144,132 | $0 | $0 |

| 2020 | $2,756 | $139,934 | $0 | $0 |

| 2019 | $2,662 | $135,859 | $0 | $0 |

| 2018 | $2,506 | $128,060 | $0 | $0 |

| 2017 | $2,393 | $128,060 | $0 | $0 |

| 2016 | $2,320 | $124,330 | $0 | $0 |

| 2015 | $2,249 | $120,709 | $0 | $0 |

| 2014 | $2,212 | $117,193 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1445 W 11th Ave

- 1130 Polk Aly

- 1195 Almaden St

- 1230 W 7th Ave

- 780 Van Buren St

- 5716 Bainbridge Rd

- 5725 Bainbridge Rd

- 5719 Bainbridge Rd

- 5726 Bainbridge Rd

- 1740 W Broadway

- 990 W 7th Ave

- 960 W 7th Ave

- 1074 Legacy St

- 1092 Legacy St

- 1391 W 5th Ave

- 1890 W 12th Ave

- 5778 Durst St

- 1030 W 5th Ave

- 1612 Polk St

- 461 Blair Blvd