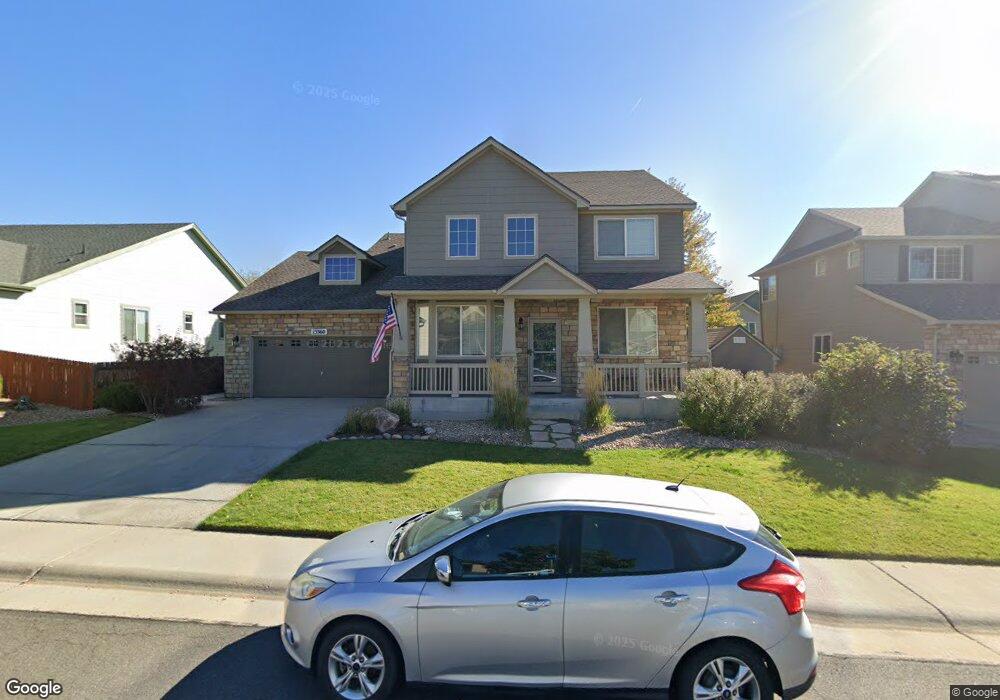

13360 Jasmine St Thornton, CO 80602

Estimated Value: $713,917 - $740,000

6

Beds

4

Baths

3,763

Sq Ft

$193/Sq Ft

Est. Value

About This Home

This home is located at 13360 Jasmine St, Thornton, CO 80602 and is currently estimated at $727,979, approximately $193 per square foot. 13360 Jasmine St is a home located in Adams County with nearby schools including West Ridge Elementary School, Shore Acres Elementary School, and Elderberry Elementary.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 19, 2018

Sold by

Heddings Jason A and Heddings Erica E

Bought by

Gallegos Adam and Gallegos Stefanie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$460,927

Outstanding Balance

$390,742

Interest Rate

4.12%

Mortgage Type

FHA

Estimated Equity

$337,237

Purchase Details

Closed on

Jan 20, 2012

Sold by

Heddings Jason A

Bought by

Heddings Jaason A and Heddings Erica E

Purchase Details

Closed on

Feb 25, 2010

Sold by

Melody Homes Inc

Bought by

Heddings Jason A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$319,113

Interest Rate

4.75%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gallegos Adam | $500,000 | Homestead Title & Escrow | |

| Heddings Jaason A | -- | None Available | |

| Heddings Jason A | $325,000 | Heritage Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gallegos Adam | $460,927 | |

| Previous Owner | Heddings Jason A | $319,113 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,591 | $43,070 | $8,440 | $34,630 |

| 2023 | $4,569 | $50,810 | $8,660 | $42,150 |

| 2022 | $3,561 | $36,310 | $8,900 | $27,410 |

| 2021 | $3,430 | $36,310 | $8,900 | $27,410 |

| 2020 | $3,281 | $36,240 | $9,150 | $27,090 |

| 2019 | $4,298 | $36,240 | $9,150 | $27,090 |

| 2018 | $4,451 | $32,810 | $6,840 | $25,970 |

| 2017 | $4,173 | $30,790 | $6,840 | $23,950 |

| 2016 | $3,606 | $26,540 | $5,730 | $20,810 |

| 2015 | $3,600 | $26,540 | $5,730 | $20,810 |

| 2014 | -- | $23,800 | $5,090 | $18,710 |

Source: Public Records

Map

Nearby Homes

- 13385 Jasmine St

- 13349 Krameria St

- 13234 Krameria St

- 13391 Locust Ct

- 13275 Holly St Unit F

- 13271 Holly St Unit B

- 6345 E 135th Ave

- 13305 Monaco Ct

- 13068 Kearney St

- 13243 Holly St Unit F

- 5575 E 130th Dr

- 13028 Grape Ct

- 6078 E 137th Ave

- 13696 Lilac St

- 15372 Jersey Ct

- 6893 E 132nd Place

- 12845 Jasmine Way

- 5628 Hudson Cir

- 5341 E 129th Way

- 13830 Ivy St

- 13350 Jasmine St

- 13370 Jasmine St

- 13365 Jasmine St

- 13367 Kearney St

- 13375 Jasmine St

- 13380 Jasmine St

- 13377 Kearney St

- 13355 Jasmine St

- 13357 Kearney St

- 13340 Jasmine St

- 13345 Jasmine St

- 13347 Kearney St

- 13390 Jasmine St

- 13330 Jasmine St

- 13387 Kearney St

- 13395 Jasmine St

- 13335 Jasmine St

- 13374 Jersey St

- 13354 Jersey St

- 13337 Kearney St