134 Shonda Leigh Jackson, MO 63755

Estimated Value: $281,922 - $310,000

3

Beds

2

Baths

4

Sq Ft

$73,245/Sq Ft

Est. Value

About This Home

This home is located at 134 Shonda Leigh, Jackson, MO 63755 and is currently estimated at $292,981, approximately $73,245 per square foot. 134 Shonda Leigh is a home located in Cape Girardeau County with nearby schools including Russell Hawkins Junior High School, Jackson Senior High School, and St. Paul Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 9, 2009

Sold by

Dustin Richardson Construction Llc

Bought by

Savat Dereck and Savat Jennifer

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,550

Outstanding Balance

$101,675

Interest Rate

5.1%

Mortgage Type

New Conventional

Estimated Equity

$191,306

Purchase Details

Closed on

Apr 9, 2007

Sold by

Brandon O William Development Llc

Bought by

Dustin Richardson Construction Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,640

Interest Rate

6.19%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Savat Dereck | -- | None Available | |

| Dustin Richardson Construction Llc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Savat Dereck | $155,550 | |

| Previous Owner | Dustin Richardson Construction Llc | $134,640 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $15 | $34,070 | $6,230 | $27,840 |

| 2024 | $15 | $32,450 | $5,930 | $26,520 |

| 2023 | $1,504 | $32,450 | $5,930 | $26,520 |

| 2022 | $1,379 | $29,900 | $5,460 | $24,440 |

| 2021 | $1,380 | $29,900 | $5,460 | $24,440 |

| 2020 | $1,385 | $29,900 | $5,460 | $24,440 |

| 2019 | $1,352 | $29,900 | $0 | $0 |

| 2018 | $1,350 | $29,900 | $0 | $0 |

| 2017 | $1,354 | $29,900 | $0 | $0 |

| 2016 | $1,351 | $29,900 | $0 | $0 |

| 2015 | $1,353 | $29,900 | $0 | $0 |

| 2014 | $1,362 | $29,900 | $0 | $0 |

Source: Public Records

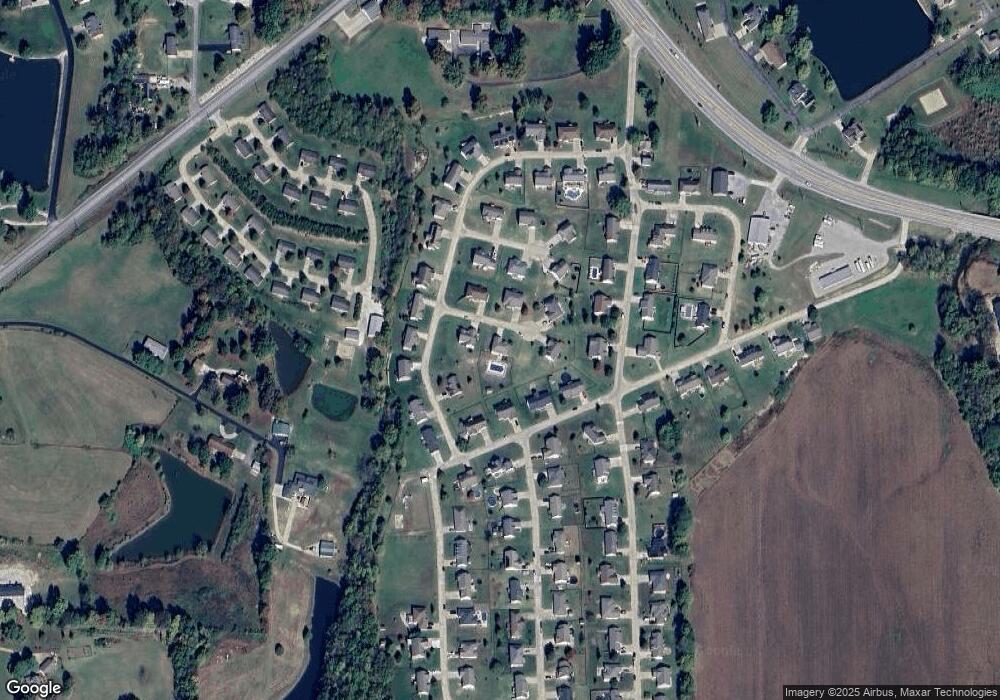

Map

Nearby Homes

- 386 Stonewall Dr

- 454 Meier Lake Dr

- 957 State Highway 34

- 413 Byrd Ct

- 358 Byrd Ct

- 145 Saddlebrooke Ridge

- 0 Highway 72

- 2264 Oak St

- 265 Keystone Dr

- 2342 Alpine Dr

- 862 Aspen Dr

- 157 Highland Hills Dr

- 404 Willow Bend Dr

- 34 Waterhole Trail

- 1512 Briarwood St

- 805 Connie St

- 590 Tumbleweed Pass

- 1670 Jackson Ridge Dr

- 934 Raines Ave

- 1615 Columbia Dr

- 114 Shonda Leigh

- 317 Glen Oak Dr

- 150 Shonda Leigh

- 362 Stonewall Dr

- 135 Shonda Leigh

- 115 Shonda Leigh

- 340 Stonewall Dr

- 149 Shonda Leigh

- 302 Glen Oaks Dr

- 144 Shady Oaks

- 292 Oak Meadow Dr

- 324 Glen Oak Dr

- 122 Shady Oaks

- 302 Glen Oak Dr

- 270 Glen Oak Dr

- 405 Stonewall Dr

- 438 Stonewall Dr

- 152 Shady Oaks

- 264 Oak Meadow Dr

- 246 Glen Oak Dr