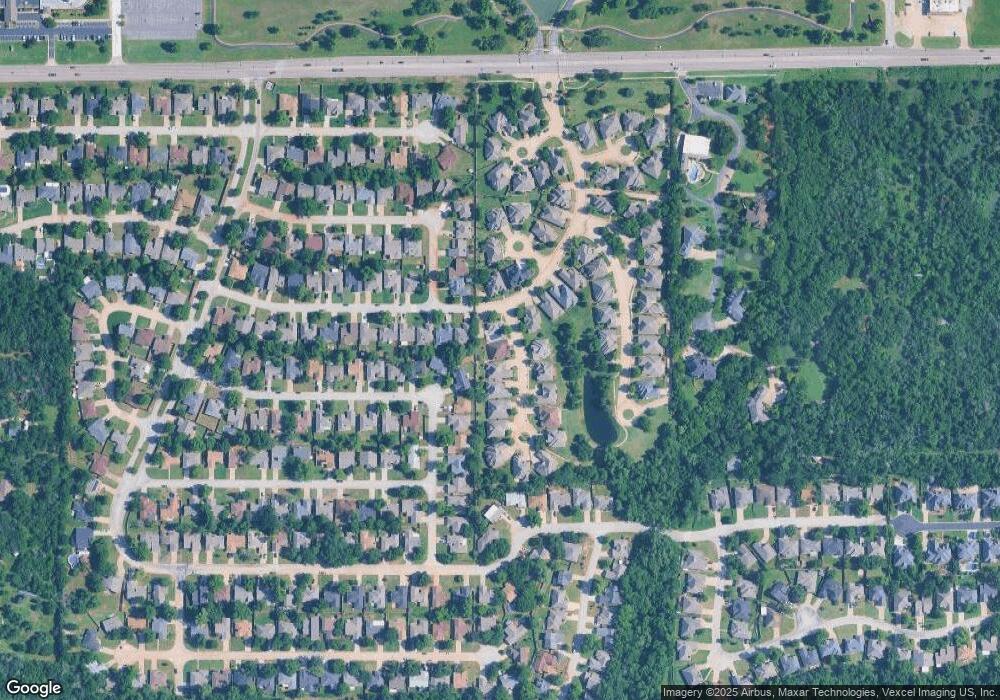

13421 Princeton Ln Edmond, OK 73013

Smiling Hill/Whispering Heights NeighborhoodEstimated Value: $379,000 - $403,000

3

Beds

2

Baths

2,485

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 13421 Princeton Ln, Edmond, OK 73013 and is currently estimated at $389,906, approximately $156 per square foot. 13421 Princeton Ln is a home located in Oklahoma County with nearby schools including Orvis Risner Elementary School, Cimarron Middle School, and Memorial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 20, 2014

Sold by

National Christian Foundation Real Prope

Bought by

Miller Henderson I and Miller Barbara K

Current Estimated Value

Purchase Details

Closed on

Nov 14, 2014

Sold by

Kimmell Family Foundation Inc

Bought by

National Christian Foundation Real Prope

Purchase Details

Closed on

Nov 11, 2014

Sold by

Miller Henderson I and Miller Barbara K

Bought by

The Kimmell Family Foundation Inc

Purchase Details

Closed on

Oct 15, 2013

Sold by

The Kimmell Family Foundation Inc

Bought by

Miller Henderson I and Miller Barbara K

Purchase Details

Closed on

Jul 1, 2011

Sold by

Hill Thomas A and Hill Kay K

Bought by

The Kimmell Family Foundation

Purchase Details

Closed on

Nov 8, 2010

Sold by

University Park Estates Ii Homeowners As

Bought by

Kimmell Garman O and Kimmell Amended Revis Garman O

Purchase Details

Closed on

Mar 7, 2007

Sold by

Kimmell Garman O

Bought by

Kimmell Garman O and Kimmell Amended Revis Garman O

Purchase Details

Closed on

Aug 10, 2006

Sold by

Austin Homes Llc

Bought by

Kimmell Garman O

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Henderson I | $240,000 | None Available | |

| National Christian Foundation Real Prope | -- | None Available | |

| The Kimmell Family Foundation Inc | $240,000 | None Available | |

| Miller Henderson I | $255,000 | None Available | |

| The Kimmell Family Foundation | -- | None Available | |

| Kimmell Garman O | -- | None Available | |

| Kimmell Garman O | -- | None Available | |

| Kimmell Garman O | $257,500 | American Guaranty Title Co |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,786 | $33,798 | $6,011 | $27,787 |

| 2023 | $3,786 | $32,813 | $5,735 | $27,078 |

| 2022 | $3,706 | $31,857 | $6,694 | $25,163 |

| 2021 | $3,558 | $30,930 | $5,609 | $25,321 |

| 2020 | $3,502 | $30,030 | $5,894 | $24,136 |

| 2019 | $3,486 | $29,731 | $5,700 | $24,031 |

| 2018 | $3,401 | $28,865 | $0 | $0 |

| 2017 | $3,278 | $28,023 | $5,655 | $22,368 |

| 2016 | $3,162 | $27,207 | $6,193 | $21,014 |

| 2015 | $3,180 | $27,207 | $6,193 | $21,014 |

| 2014 | $3,259 | $27,926 | $6,193 | $21,733 |

Source: Public Records

Map

Nearby Homes

- 2328 Butternut Place

- 2321 Pinon Place

- 2401 Butternut Place

- 2437 Shady Tree Ln

- 2817 Shady Tree Ln

- 16308 Marsha Dr

- 2912 NE 133rd St

- 13209 Golden Eagle Dr

- 13400 Cedar Pointe Dr

- 13425 Creek Pointe Ln

- 3109 Eagle Crest Rd

- 13917 Briarwyck

- 13500 Fox Creek Dr

- 13504 Fox Creek Dr

- 13509 Silver Eagle Trail

- 1204 Sims Ave

- 13308 Creekside Dr

- 3809 Grandview Terrace

- 13925 Middleberry Rd

- 13500 Green Cedar Ln

- 13417 Princeton Ln

- 2432 Pinon Place

- 13413 Princeton Ln

- 13432 Palm Ave

- 13424 Princeton Ln

- 13500 Princeton Ln

- 2428 Pinon Place

- 2429 Cypress Ct

- 13420 Princeton Ln

- 13409 Princeton Ln

- 13428 Palm Ave

- 13416 Princeton Ln

- 2424 Pinon Place

- 13504 Princeton Ln

- 13500 Pecan Place

- 13405 Princeton Ln

- 2425 Cypress Ct

- 13505 Princeton Ln

- 13424 Palm Ave

- 13412 Princeton Ln