13425 Castilian Dr Unit 1 Houston, TX 77015

Cloverleaf NeighborhoodEstimated Value: $113,018 - $127,000

3

Beds

2

Baths

1,360

Sq Ft

$89/Sq Ft

Est. Value

About This Home

This home is located at 13425 Castilian Dr Unit 1, Houston, TX 77015 and is currently estimated at $121,505, approximately $89 per square foot. 13425 Castilian Dr Unit 1 is a home located in Harris County with nearby schools including Green Valley Elementary School, Cobb 6th Grade Campus, and Cunningham Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2019

Sold by

Fallin Carol J and Fallin Steve Fallin

Bought by

Sfallin Series Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

3.6%

Purchase Details

Closed on

Apr 26, 2005

Sold by

Shamoon Michael W

Bought by

Fallin Steve

Purchase Details

Closed on

Mar 11, 2002

Sold by

Shamoon Michael W

Bought by

Shamoon Michael W

Purchase Details

Closed on

Sep 5, 1995

Sold by

Rebeiz Elie and Rebeiz Teresa

Bought by

Shamoon Michael W and Shamoon Rhonda K

Purchase Details

Closed on

Mar 29, 1994

Sold by

Shamoon Rhonda K and Shamoon Michael W

Bought by

Rebeiz Elie and Rebeiz Teresa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$34,750

Interest Rate

7.05%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 21, 1993

Sold by

Currie Mavis

Bought by

Shamoon Michael W and Shamoon Rhonda K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sfallin Series Llc | -- | -- | |

| Fallin Steve | -- | Texas American Title Company | |

| Shamoon Michael W | -- | -- | |

| Shamoon Michael W | $28,500 | -- | |

| Rebeiz Elie | -- | -- | |

| Shamoon Michael W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Sfallin Series Llc | -- | |

| Previous Owner | Rebeiz Elie | $34,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,433 | $118,571 | $23,040 | $95,531 |

| 2024 | $2,433 | $113,415 | $23,040 | $90,375 |

| 2023 | $2,433 | $109,780 | $23,040 | $86,740 |

| 2022 | $2,139 | $92,000 | $23,040 | $68,960 |

| 2021 | $2,271 | $89,776 | $17,280 | $72,496 |

| 2020 | $1,716 | $66,516 | $17,280 | $49,236 |

| 2019 | $1,640 | $63,540 | $15,120 | $48,420 |

| 2018 | $1,371 | $51,000 | $12,672 | $38,328 |

| 2017 | $1,375 | $53,641 | $12,672 | $40,969 |

| 2016 | $971 | $40,237 | $9,187 | $31,050 |

| 2015 | $486 | $26,778 | $9,187 | $17,591 |

| 2014 | $486 | $29,758 | $9,187 | $20,571 |

Source: Public Records

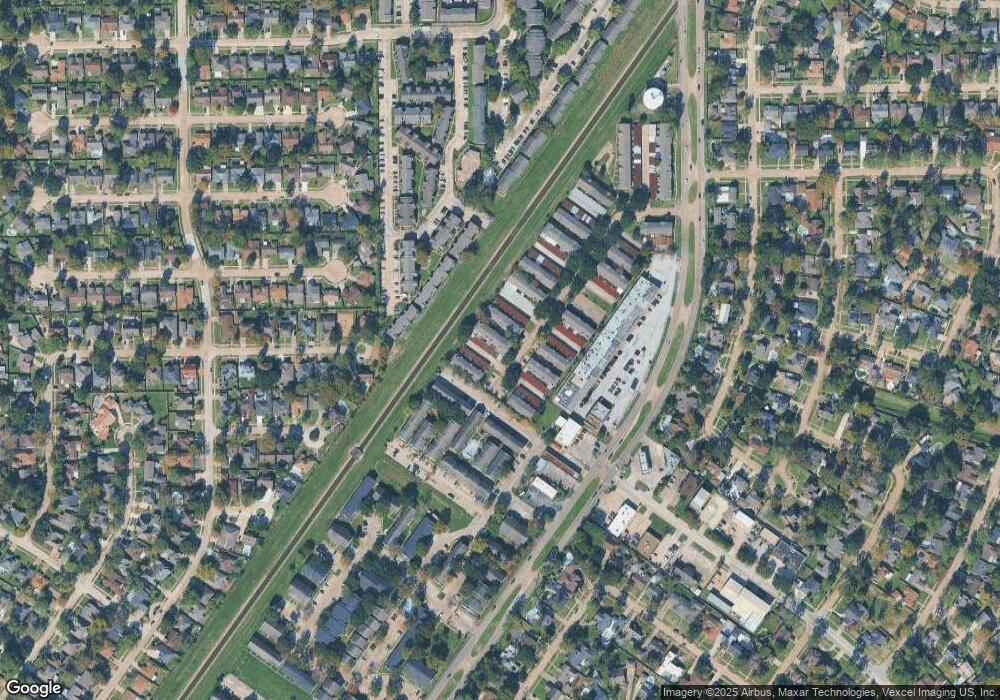

Map

Nearby Homes

- 13415 Castilian Dr Unit 1

- 13527 Castilian Dr Unit 1

- 13480 S Thorntree Dr Unit 1004

- 13480 S Thorntree Dr Unit 1206

- 13480 S Thorntree Dr Unit 910

- 13480 S Thorntree Dr Unit 508

- 13410 S Thorntree Dr

- 13338 Rampchester Ln

- 314 Shady Rock Ln

- 13311 Redgate Dr

- 167 White Cedar St

- 338 Evanston St

- 13630 Oleoke Ln

- 122 White Cedar St

- 13307 N Thorntree Dr

- 13835 Waterville Way

- 13211 Whitchurch Way

- 126 Oryan Ct

- 230 Shekel Ln

- 271 Shekel Ln

- 13427 Castilian Dr Unit 1

- 13423 Castilian Dr Unit 1

- 13421 Castilian Dr Unit 1

- 13419 Castilian Dr Unit 1

- 13417 Castilian Dr Unit 1

- 13403 Castilian Dr Unit 1

- 13429 Castilian Dr Unit 1

- 13431 Castilian Dr Unit 1

- 13405 Castilian Dr Unit 1

- 13433 Castilian Dr Unit 1

- 13407 Castilian Dr Unit 1

- 13435 Castilian Dr Unit 1

- 13424 Castilian Dr Unit 2

- 13424 Castilian Dr Unit 2/113

- 13409 Castilian Dr Unit 1

- 13437 Castilian Dr Unit 1

- 13411 Castilian Dr Unit 1

- 13439 Castilian Dr Unit 1

- 13422 Castilian Dr Unit 2

- 13422 Castilian Dr Unit 2114