1349 Azalea Dr Unit 1349 Reynoldsburg, OH 43068

Estimated Value: $241,000 - $291,000

3

Beds

3

Baths

1,520

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 1349 Azalea Dr Unit 1349, Reynoldsburg, OH 43068 and is currently estimated at $259,132, approximately $170 per square foot. 1349 Azalea Dr Unit 1349 is a home located in Franklin County with nearby schools including Hannah J Ashton Middle School, Waggoner Road Junior High School, and Everest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 28, 2012

Sold by

Singer Brewer Linda J

Bought by

Brewer Michael L

Current Estimated Value

Purchase Details

Closed on

Aug 30, 2006

Sold by

Dewitt Donald E and Dewitt Cynthia A

Bought by

Brewer Michael L and Singer Brewer Linda J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,700

Interest Rate

6.88%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 28, 2000

Sold by

Hickey Jack W and Hickey Janice L

Bought by

Dewitt Donald E and Dewitt Cynthia A

Purchase Details

Closed on

Aug 21, 1998

Sold by

Albrecht Richard E

Bought by

Hickey Jack W and Hickey Janice L

Purchase Details

Closed on

Jun 27, 1996

Sold by

Sipes Leroy W

Bought by

Richard E Albrecht

Purchase Details

Closed on

Nov 9, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brewer Michael L | -- | None Available | |

| Brewer Michael L | $182,000 | Talon Group | |

| Dewitt Donald E | $175,000 | Chicago Title | |

| Hickey Jack W | $154,900 | Chicago Title | |

| Richard E Albrecht | $143,000 | -- | |

| -- | $101,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brewer Michael L | $154,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,989 | $87,720 | $11,380 | $76,340 |

| 2023 | $3,838 | $87,710 | $11,375 | $76,335 |

| 2022 | $3,194 | $58,210 | $5,460 | $52,750 |

| 2021 | $3,157 | $57,440 | $5,460 | $51,980 |

| 2020 | $3,221 | $57,440 | $5,460 | $51,980 |

| 2019 | $2,585 | $44,170 | $4,200 | $39,970 |

| 2018 | $2,332 | $44,170 | $4,200 | $39,970 |

| 2017 | $2,584 | $44,170 | $4,200 | $39,970 |

| 2016 | $2,146 | $35,040 | $5,110 | $29,930 |

| 2015 | $2,079 | $35,040 | $5,110 | $29,930 |

| 2014 | $2,089 | $35,040 | $5,110 | $29,930 |

| 2013 | $1,088 | $36,890 | $5,390 | $31,500 |

Source: Public Records

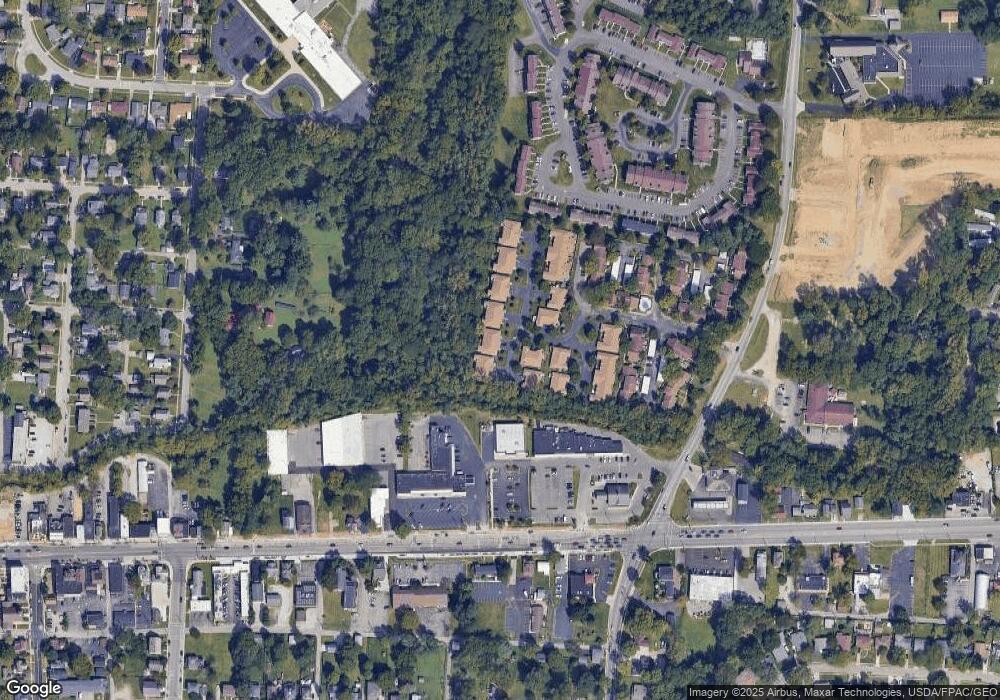

Map

Nearby Homes

- 1350 Azalea Dr Unit 1350

- 7487 E Main St

- Mendelssohn with Finished Lower Level Plan at Wilson Ridge

- Schubert with Finished Lower Level Plan at Wilson Ridge

- 7678 Felder Dr

- 7682 E Main St

- 1545 Alar Ave

- 144 Cambridge Ct

- 210 Estates Ln

- 258 Baron Ct

- 214 Estates Ln

- 7353 Wollam Ave

- 53 Estates Ln

- 60 Estates Ln

- 0 Oak Valley Rd Unit 5148458

- 0 Oak Valley Rd Unit Lot 4, 1.088 ac.

- 7150 E Main St Unit B101

- 99 Hampton Ln

- 1744 Graham Rd

- 7358 Roshon Ave

- 1347 Azalea Dr

- 1357 Azalea Dr Unit 1357

- 1337 Azalea Dr

- 1359 Azalea Dr Unit 1359

- 1360 Azalea Dr

- 1335 Azalea Dr

- 1358 Azalea Dr

- 1362 Azalea Dr Unit 1362

- 1319 Azalea Dr Unit 1319

- 1336 Azalea Dr Unit 1336

- 1317 Azalea Dr

- 1353 Azalea Dr Unit 1353

- 1351 Azalea Dr

- 1361 Azalea Dr Unit 1361

- 1320 Azalea Dr

- 1311 Azalea Dr Unit 1311

- 1318 Azalea Dr

- 1309 Azalea Dr

- 1306 Azalea Dr Unit 1306

- 1304 Azalea Dr