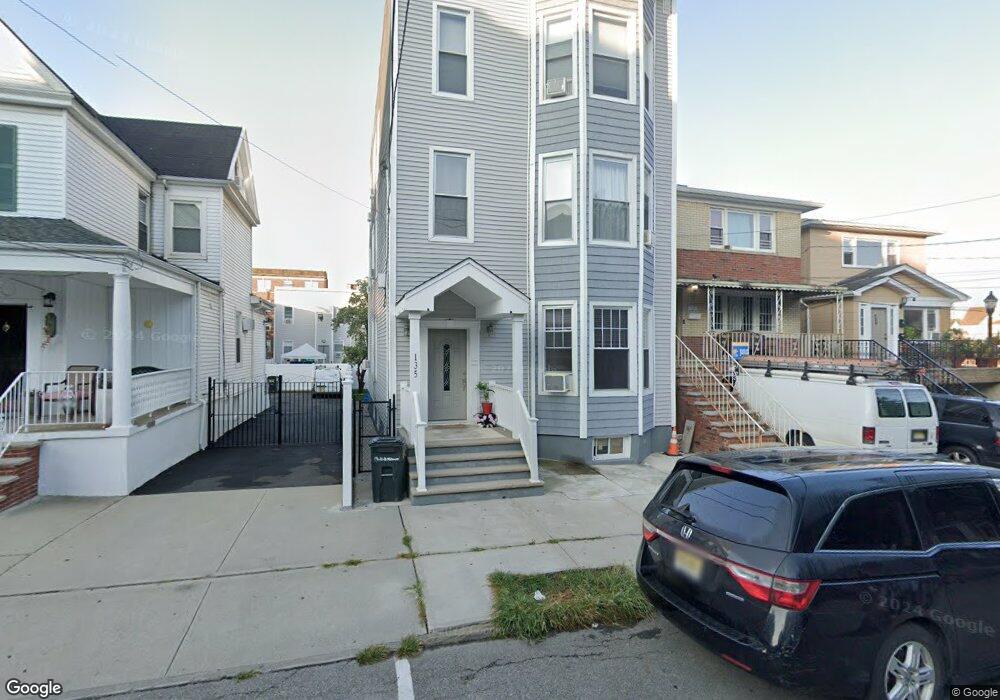

135 74th St North Bergen, NJ 07047

Estimated Value: $872,000 - $1,089,000

8

Beds

4

Baths

2,928

Sq Ft

$352/Sq Ft

Est. Value

About This Home

This home is located at 135 74th St, North Bergen, NJ 07047 and is currently estimated at $1,029,287, approximately $351 per square foot. 135 74th St is a home located in Hudson County with nearby schools including North Bergen High School and St. Joseph of the Palisades Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2019

Sold by

Urgiles Velez Klever

Bought by

Urgiles Velez Klever and Sanmartin Carpio Nelly Veronica

Current Estimated Value

Purchase Details

Closed on

Jan 20, 2015

Sold by

Garcia Asucena

Bought by

Urgiles Velez Klever

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$299,475

Outstanding Balance

$229,638

Interest Rate

3.87%

Mortgage Type

FHA

Estimated Equity

$799,649

Purchase Details

Closed on

May 12, 2005

Sold by

Mavrianos Michael

Bought by

Garcia Asucena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$424,000

Interest Rate

5.75%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Urgiles Velez Klever | -- | Old Republic Title | |

| Urgiles Velez Klever | $305,000 | Alta | |

| Garcia Asucena | $530,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Urgiles Velez Klever | $299,475 | |

| Previous Owner | Garcia Asucena | $424,000 | |

| Previous Owner | Garcia Asucena | $553,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,885 | $966,500 | $365,000 | $601,500 |

| 2024 | $15,735 | $966,500 | $365,000 | $601,500 |

| 2023 | $15,735 | $966,500 | $365,000 | $601,500 |

| 2022 | $15,261 | $966,500 | $365,000 | $601,500 |

| 2021 | $10,770 | $184,000 | $60,000 | $124,000 |

| 2020 | $10,547 | $184,000 | $60,000 | $124,000 |

| 2019 | $10,209 | $178,300 | $60,000 | $118,300 |

| 2018 | $10,049 | $178,300 | $60,000 | $118,300 |

| 2017 | $9,862 | $178,300 | $60,000 | $118,300 |

| 2016 | $9,748 | $178,300 | $60,000 | $118,300 |

| 2015 | $9,434 | $178,300 | $60,000 | $118,300 |

| 2014 | $9,343 | $178,300 | $60,000 | $118,300 |

Source: Public Records

Map

Nearby Homes

- 133 73rd St Unit 13

- 124 71st St

- 7403 Broadway

- 39 74th St Unit A6

- 137 76th St

- 7108 Hudson Ave

- 20 75th St

- 124 68th St Unit 204

- 55 71st St

- 7100 Jfk Blvd E Unit 5E

- 7100 Jfk Blvd E Unit 2N

- 138C 68th St

- 62 69th St Unit 503

- 7100 Blvd E Unit 10P

- 7100 Blvd E Unit 2N

- 7100 Blvd E Unit 5E

- 7100 Blvd E Unit 14 D

- 218 68th St

- 5 77th St

- 7100 Boulevard E Unit 14 M