135 Oakmont Ct Unit 135D Edison, NJ 08820

Estimated Value: $511,000 - $606,000

2

Beds

2

Baths

1,372

Sq Ft

$407/Sq Ft

Est. Value

About This Home

This home is located at 135 Oakmont Ct Unit 135D, Edison, NJ 08820 and is currently estimated at $558,361, approximately $406 per square foot. 135 Oakmont Ct Unit 135D is a home located in Middlesex County with nearby schools including Martin Luther King Elementary School, John Adams Middle School, and J.P. Stevens High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 13, 2025

Sold by

Santangelo Russell and Santangelo Patsy

Bought by

Santangelo Revocable Family Trust and Santangelo

Current Estimated Value

Purchase Details

Closed on

Feb 22, 2018

Sold by

Men Weihsin and Chen Lynda C

Bought by

Sant Angelo Russell and Sant Angelo Patsy

Purchase Details

Closed on

Dec 4, 2009

Sold by

Miller Elizabeth A and Miller Helen S

Bought by

Men Weihsin and Chen Lynda C

Purchase Details

Closed on

Jun 25, 2001

Sold by

Wachsberg Ruth

Bought by

Miller Helen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Interest Rate

6.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Santangelo Revocable Family Trust | -- | Fidelity National Title | |

| Santangelo Revocable Family Trust | -- | Fidelity National Title | |

| Sant Angelo Russell | $375,000 | Fidelity Nat Title Ins Co | |

| Men Weihsin | $270,000 | None Available | |

| Miller Helen | $185,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Miller Helen | $85,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,656 | $145,400 | $55,000 | $90,400 |

| 2024 | $8,609 | $145,400 | $55,000 | $90,400 |

| 2023 | $8,609 | $145,400 | $55,000 | $90,400 |

| 2022 | $8,612 | $145,400 | $55,000 | $90,400 |

| 2021 | $8,263 | $145,400 | $55,000 | $90,400 |

| 2020 | $8,504 | $145,400 | $55,000 | $90,400 |

| 2019 | $7,863 | $145,400 | $55,000 | $90,400 |

| 2018 | $7,985 | $145,400 | $55,000 | $90,400 |

| 2017 | $7,490 | $145,400 | $55,000 | $90,400 |

| 2016 | $7,351 | $145,400 | $55,000 | $90,400 |

| 2015 | $7,072 | $145,400 | $55,000 | $90,400 |

| 2014 | $6,872 | $145,400 | $55,000 | $90,400 |

Source: Public Records

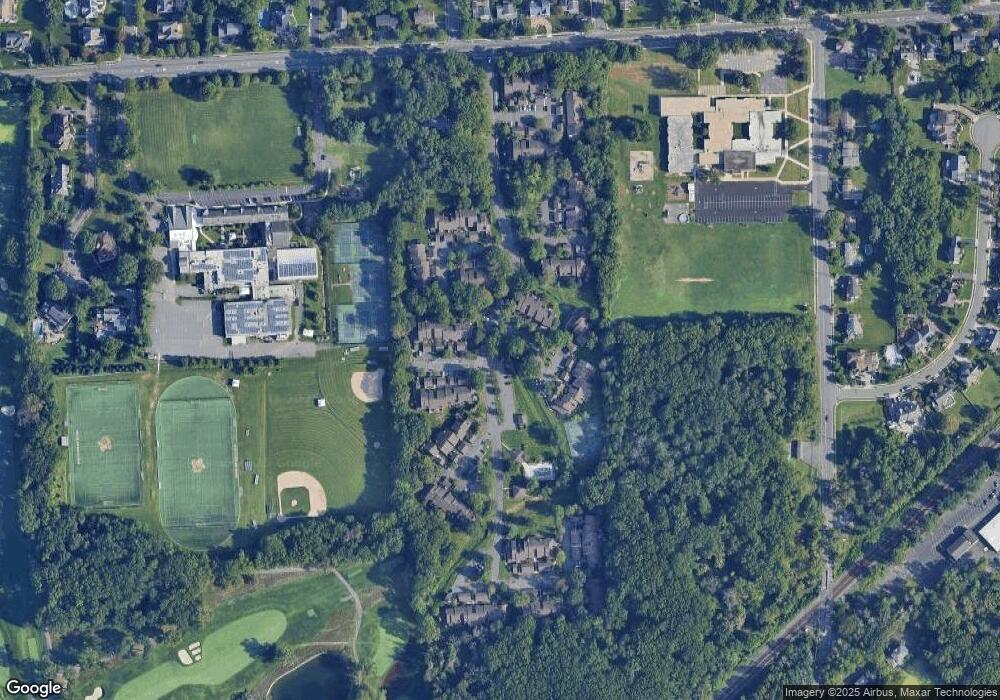

Map

Nearby Homes

- 166 Hidden Hollow Ct

- 31 Hickory Hollow Ct

- 145 Maplewood Ct Unit 145D

- 4 Hemlock Dr

- 3 Old Hickory Ln

- 11 Madaline Dr

- 28 Hawthorn Dr Unit 28

- 28 Hawthorn Dr

- 8 Mary Ellen Dr

- 3801 Cricket Cir

- 302 Westgate Dr

- 404 Westgate Dr

- 338 Westgate Dr Unit 338

- 154 Westgate Dr

- 384 Westgate Dr

- 1681 Woodland Ave

- 18 Westgate Dr

- 5 Old Raritan Rd

- 980 Raritan Rd

- 21 King St

- 81 Laurel Hollow Ct

- 74 Laurel Hollow Ct

- 137 Oakmont Ct

- 155 Maplewood Ct

- 83 Laurel Hollow Ct Unit 83

- 153 Maplewood Ct Unit 153

- 141 Maplewood Ct

- 157 Maplewood Ct

- 52 Holly Ct

- 36 Hickory Hollow Ct

- 75 Laurel Hollow Ct

- 47 Holly Ct

- 34 Hickory Hollow Ct

- 54 Holly Ct

- 136 Oakmont Ct

- 154 Maplewood Ct

- 41 Holly Ct

- 48 Holly Ct

- 33 Hickory Hollow Ct

- 35 Hickory Hollow Ct