13518 Bedford Chase Cypress, TX 77429

Estimated Value: $883,314 - $969,000

5

Beds

6

Baths

4,981

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 13518 Bedford Chase, Cypress, TX 77429 and is currently estimated at $940,579, approximately $188 per square foot. 13518 Bedford Chase is a home located in Harris County with nearby schools including Sampson Elementary School, Spillane Middle School, and Cypress Woods High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2025

Sold by

Olfers Patrick William and Olfers Wesley Patrick

Bought by

Olfers Sarah Herlin

Current Estimated Value

Purchase Details

Closed on

Jul 22, 2005

Sold by

Smith Shawn and Smith Robbyn

Bought by

Olfers Patrick W and Olfers Sarah H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$359,650

Interest Rate

5.61%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Dec 23, 2002

Sold by

Weekley Homes Lp

Bought by

Smith Shawn and Smith Robbyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$499,356

Interest Rate

7.6%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Olfers Sarah Herlin | -- | None Listed On Document | |

| Olfers Patrick W | -- | Chicago Title Insurance Comp | |

| Smith Shawn | -- | Priority Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Olfers Patrick W | $359,650 | |

| Previous Owner | Smith Shawn | $499,356 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,810 | $964,722 | $214,683 | $750,039 |

| 2024 | $7,810 | $938,478 | $194,942 | $743,536 |

| 2023 | $7,810 | $1,128,304 | $194,942 | $933,362 |

| 2022 | $21,916 | $967,160 | $139,421 | $827,739 |

| 2021 | $21,111 | $830,820 | $139,421 | $691,399 |

| 2020 | $20,246 | $781,710 | $99,939 | $681,771 |

| 2019 | $18,977 | $701,361 | $99,939 | $601,422 |

| 2018 | $4,464 | $701,361 | $99,939 | $601,422 |

| 2017 | $19,051 | $701,361 | $99,939 | $601,422 |

| 2016 | $18,869 | $701,361 | $99,939 | $601,422 |

| 2015 | $9,958 | $701,361 | $99,939 | $601,422 |

| 2014 | $9,958 | $701,361 | $99,939 | $601,422 |

Source: Public Records

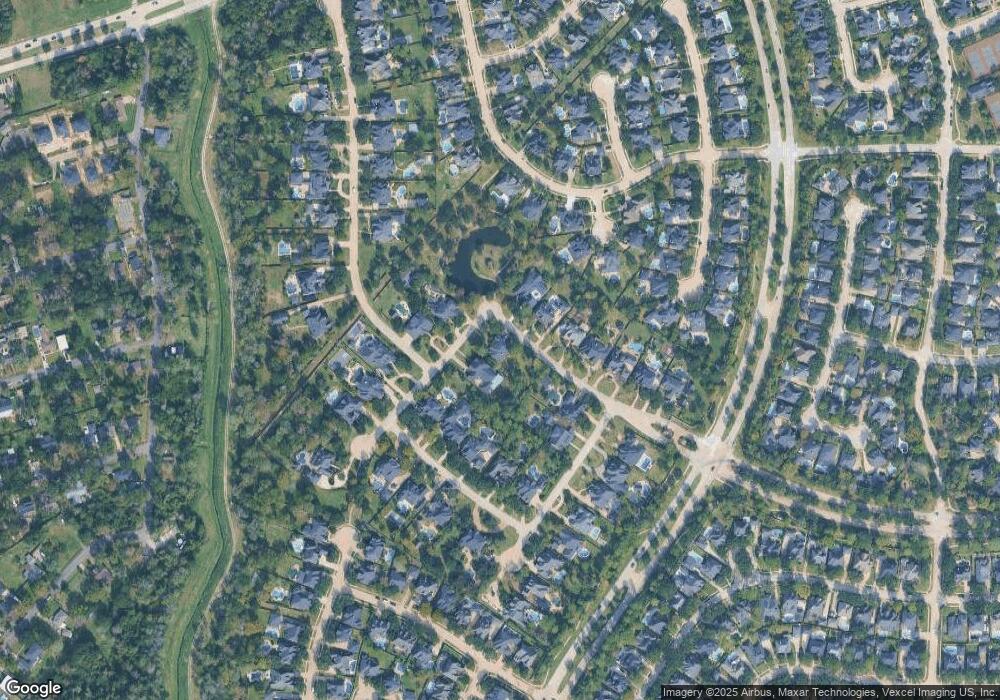

Map

Nearby Homes

- 13506 Key Ridge Ln

- 16606 Darby House St

- 16502 Rawhide Trail

- 16514 Boston Post Rd

- 16518 Boston Post Rd

- 16515 Dunleith Cir

- 16406 Haden Crest Ct

- 16535 Tejas Trail

- 16530 Boston Post Rd

- 14015 Falcon Heights Dr

- 16322 Bontura St

- 13703 Layton Hills Dr

- 14015 Halprin Creek Dr

- 16306 Bontura St

- 13402 Layton Castle Ln

- 13611 Monteigne Ln

- 16219 Haden Crest Ct

- 16211 Halpren Falls Ln

- 16342 Granite Park Ct

- 15902 Mill Canyon Ct

- 13514 Bedford Chase

- 13519 Key Ridge Ln

- 16626 Coles Crossing Dr N

- 16630 Coles Crossing Dr N

- 16622 Coles Crossing Dr N

- 13515 Key Ridge Ln

- 16614 Hamilton Park Dr

- 16618 Hamilton Park Dr

- 16610 Hamilton Park Dr

- 16618 Coles Crossing Dr N

- 13519 Bedford Chase

- 13515 Bedford Chase

- 16606 Hamilton Park Dr

- 16614 Coles Crossing Dr N

- 13707 Eldon Park Ct

- 16602 Hamilton Park Dr

- 13507 Bedford Chase

- 13702 Eldon Park Ct

- 16626 Hamilton Park Dr Unit POOL

- 16610 Coles Crossing Dr N