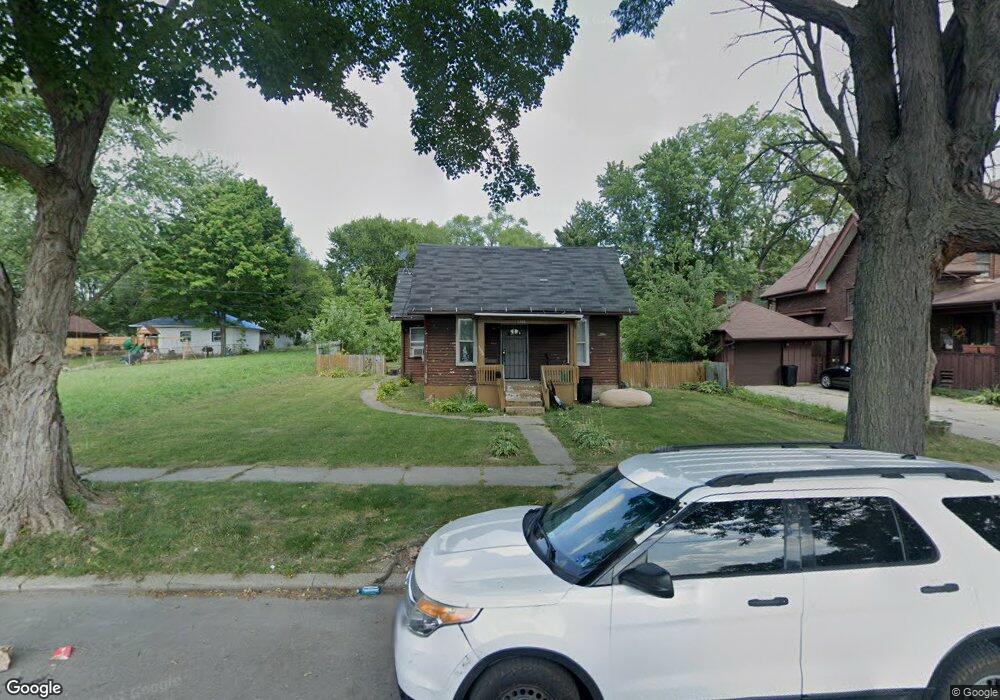

1352 6th Ave Rockford, IL 61104

Midtown District NeighborhoodEstimated Value: $90,897 - $117,000

--

Bed

--

Bath

1,380

Sq Ft

$72/Sq Ft

Est. Value

About This Home

This home is located at 1352 6th Ave, Rockford, IL 61104 and is currently estimated at $99,474, approximately $72 per square foot. 1352 6th Ave is a home located in Winnebago County with nearby schools including Constance Lane Elementary School, Abraham Lincoln Middle School, and Rockford East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2021

Sold by

Timothy Jensen

Bought by

Trammell Willie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$27,400

Outstanding Balance

$2,742

Interest Rate

0.03%

Mortgage Type

Seller Take Back

Estimated Equity

$96,732

Purchase Details

Closed on

Dec 9, 2020

Sold by

Winnebago County

Bought by

Jensen Timothy

Purchase Details

Closed on

Oct 23, 2020

Sold by

Cnty Clerk/The Cnty/Winnebago

Bought by

Winnebago County

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trammell Willie | $27,500 | None Listed On Document | |

| Trammell Willie | $27,500 | None Listed On Document | |

| Jensen Timothy | -- | Denzin Soltanzadeh Llc | |

| Winnebago County | -- | None Listed On Document | |

| Winnebago County | -- | None Listed On Document |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trammell Willie | $27,400 | |

| Closed | Trammell Willie | $27,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,604 | $16,927 | $4,397 | $12,530 |

| 2023 | $1,550 | $14,925 | $3,877 | $11,048 |

| 2022 | $1,524 | $13,340 | $3,465 | $9,875 |

| 2021 | $1,499 | $12,232 | $3,177 | $9,055 |

| 2020 | $1,487 | $11,563 | $3,003 | $8,560 |

| 2019 | $1,476 | $11,021 | $2,862 | $8,159 |

| 2018 | $1,301 | $10,386 | $2,697 | $7,689 |

| 2017 | $1,475 | $9,940 | $2,581 | $7,359 |

| 2016 | $1,652 | $10,933 | $2,533 | $8,400 |

| 2015 | $1,120 | $10,933 | $2,533 | $8,400 |

| 2014 | $1,025 | $12,375 | $3,162 | $9,213 |

Source: Public Records

Map

Nearby Homes