1352 W 900 S Mapleton, UT 84664

5

Beds

4

Baths

8,126

Sq Ft

0.69

Acres

About This Home

This home is located at 1352 W 900 S, Mapleton, UT 84664. 1352 W 900 S is a home located in Utah County with nearby schools including Mapleton School, Mapleton Junior High School, and Maple Mountain High School.

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $473 | $734,030 | $0 | $0 |

| 2023 | $1,338 | $769,890 | $0 | $0 |

| 2022 | $1,740 | $788,920 | $0 | $0 |

| 2021 | $1,616 | $1,056,700 | $242,500 | $814,200 |

| 2020 | $6,053 | $876,200 | $214,600 | $661,600 |

| 2019 | $5,492 | $811,500 | $214,600 | $596,900 |

| 2018 | $5,151 | $724,500 | $183,300 | $541,200 |

| 2017 | $4,719 | $352,275 | $0 | $0 |

| 2016 | $4,127 | $306,240 | $0 | $0 |

| 2015 | $3,620 | $267,025 | $0 | $0 |

| 2014 | $3,437 | $248,930 | $0 | $0 |

Source: Public Records

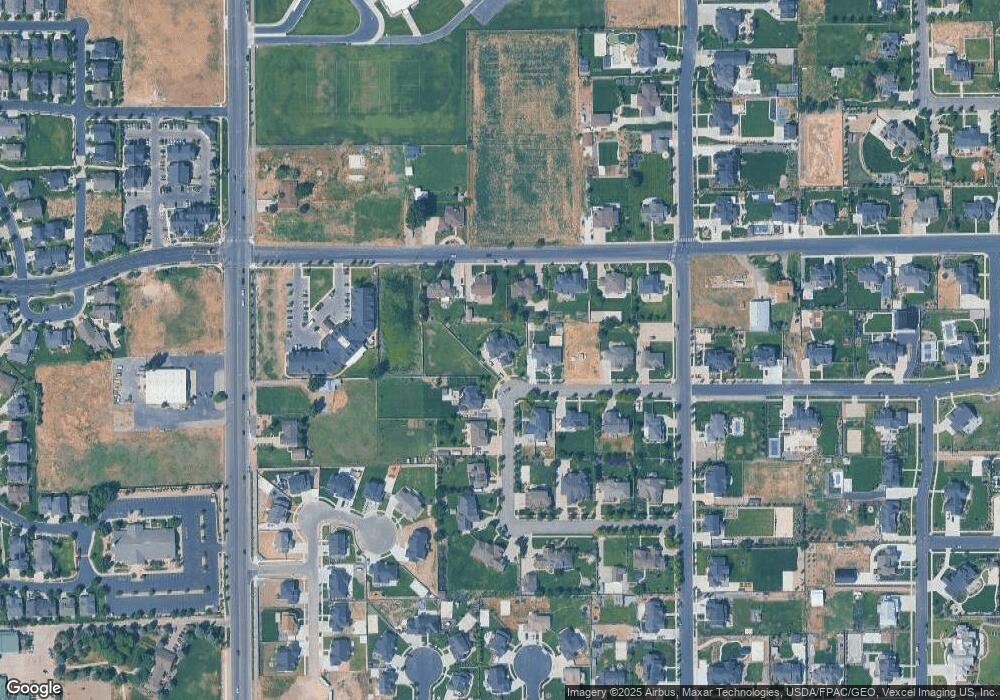

Map

Nearby Homes

- 715 W 4600 S Unit Lot I101

- 715 W 4600 S Unit Lot I102

- 715 W 4600 S Unit Lot I303

- 715 W 4600 S Unit Lot I304

- 1158 S 980 W

- 415 S 1200 W

- 896 W 675 S

- 161 W 250 S

- 213 W 250 S

- 473 W 350 S Unit 31

- 1810 W 300 S Unit A

- 2132 W River Birch Rd

- 2216 W Silver Leaf Dr Unit 35

- 1932 Charlotte Ct

- 4664 S 680 W Unit S101

- 4664 S 680 W Unit S303

- 4664 S 680 W Unit S301

- 4664 S 680 W Unit S302

- 4664 S 680 W Unit S204

- 4664 S 680 W Unit S202

- 1352 W 900 S Unit 11

- 1326 W 900 S

- 1326 W 900 S Unit 10

- 908 S 1350 W Unit 12

- 908 S 1350 W

- 1339 W 800 S

- 1415 W 800 S

- 1305 W 800 St S

- 1305 W 800 St S Unit 30D

- 1255 W 800 S

- 932 S 1350 W

- 927 S 1350 W

- 1301 W 800 S Unit 4

- 1301 W 800 S

- 1297 W 900 S Unit 24

- 1297 W 900 S

- 1258 W 900 S Unit 8

- 954 S 1350 W Unit 14

- 1420 W 800 S

- 1263 W 800 S