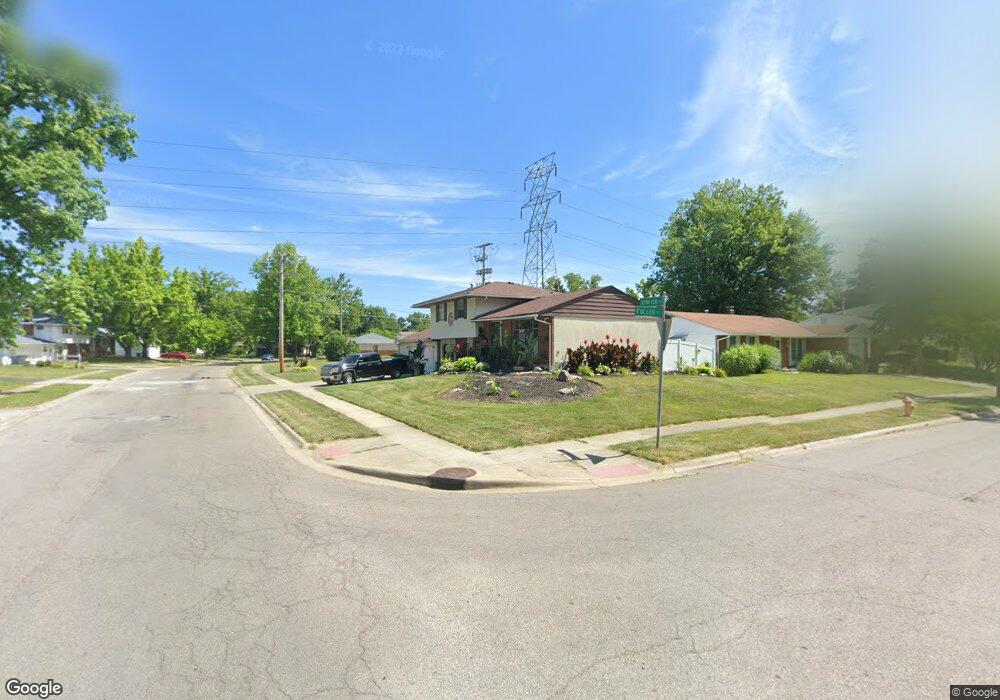

1360 Fullen Rd Columbus, OH 43229

Woodward Park NeighborhoodEstimated Value: $240,000 - $246,000

3

Beds

2

Baths

878

Sq Ft

$277/Sq Ft

Est. Value

About This Home

This home is located at 1360 Fullen Rd, Columbus, OH 43229 and is currently estimated at $243,386, approximately $277 per square foot. 1360 Fullen Rd is a home located in Franklin County with nearby schools including Valley Forge Elementary School, Woodward Park Middle School, and Northland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2003

Sold by

Frye William E and Frye Lori D

Bought by

Walton Marilu D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,097

Outstanding Balance

$46,847

Interest Rate

5.87%

Mortgage Type

FHA

Estimated Equity

$196,539

Purchase Details

Closed on

Sep 11, 1996

Sold by

Beckner Jeffrey G

Bought by

Frye William E and Frye Lori D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,963

Interest Rate

8.29%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 22, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Walton Marilu D | $109,000 | Chicago Title | |

| Frye William E | $89,000 | -- | |

| -- | $62,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Walton Marilu D | $108,097 | |

| Previous Owner | Frye William E | $86,963 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,385 | $65,420 | $22,330 | $43,090 |

| 2023 | $2,343 | $65,415 | $22,330 | $43,085 |

| 2022 | $1,900 | $38,930 | $9,000 | $29,930 |

| 2021 | $1,938 | $38,930 | $9,000 | $29,930 |

| 2020 | $1,927 | $38,930 | $9,000 | $29,930 |

| 2019 | $1,832 | $32,660 | $7,490 | $25,170 |

| 2018 | $1,889 | $32,660 | $7,490 | $25,170 |

| 2017 | $1,815 | $32,660 | $7,490 | $25,170 |

| 2016 | $1,955 | $32,310 | $6,690 | $25,620 |

| 2015 | $1,955 | $32,310 | $6,690 | $25,620 |

| 2014 | $1,957 | $32,310 | $6,690 | $25,620 |

| 2013 | $1,022 | $34,020 | $7,035 | $26,985 |

Source: Public Records

Map

Nearby Homes

- 1385 Thurell Rd

- 1485 Norma Rd

- 1414 Alvina Dr

- 4923 Karl Rd Unit 4925

- 4815 Bourke Rd

- 4852 Colonel Perry Dr

- 4816 Bourke Rd

- 4791 Bourke Rd

- 4800 Bourke Rd

- 4904 Almont Dr

- 4983 Almont Dr

- 4761 Colonel Perry Dr

- 4840 Almont Dr

- 5022 Sienna Ln

- 1493 Boxwood Dr

- 1125 Upland Dr

- 1116 Tulsa Dr

- 5231 Arrowood Ct

- 1704 Riverbirch Dr

- 5246 Eisenhower Rd