1366 N Whispering Springs Cir Unit 123 Palatine, IL 60074

Capri Village NeighborhoodEstimated Value: $164,000 - $232,000

2

Beds

--

Bath

770

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 1366 N Whispering Springs Cir Unit 123, Palatine, IL 60074 and is currently estimated at $199,096, approximately $258 per square foot. 1366 N Whispering Springs Cir Unit 123 is a home located in Cook County with nearby schools including Palatine High School, Bright Horizons At Motorola-Arlington Hts, and NewHope Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2024

Sold by

Han Yixiang and Li Ge

Bought by

Yixiang Han And Ge Li Revocable Trust and Han

Current Estimated Value

Purchase Details

Closed on

Sep 26, 2016

Sold by

Dempsey Steven R and Dempsey Meghan

Bought by

Han Yixiang and Di Ge

Purchase Details

Closed on

May 7, 2009

Sold by

Tietjens Troy and Tietjens Karisa

Bought by

Dempsey Steven R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,500

Interest Rate

4.85%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 14, 2005

Sold by

Kraft Leo W

Bought by

Tietjens Troy and Tietjens Karisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,200

Interest Rate

5.98%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yixiang Han And Ge Li Revocable Trust | -- | None Listed On Document | |

| Han Yixiang | $110,000 | Attorney Title Guranty Fund | |

| Dempsey Steven R | $134,000 | Pntn | |

| Tietjens Troy | $160,000 | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dempsey Steven R | $100,500 | |

| Previous Owner | Tietjens Troy | $155,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,404 | $14,878 | $2,446 | $12,432 |

| 2023 | $4,261 | $14,878 | $2,446 | $12,432 |

| 2022 | $4,261 | $14,878 | $2,446 | $12,432 |

| 2021 | $3,906 | $12,026 | $2,069 | $9,957 |

| 2020 | $3,847 | $12,026 | $2,069 | $9,957 |

| 2019 | $3,865 | $13,477 | $2,069 | $11,408 |

| 2018 | $2,899 | $9,327 | $1,881 | $7,446 |

| 2017 | $2,844 | $9,327 | $1,881 | $7,446 |

| 2016 | $1,937 | $9,327 | $1,881 | $7,446 |

| 2015 | $2,315 | $10,159 | $1,693 | $8,466 |

| 2014 | $2,304 | $10,159 | $1,693 | $8,466 |

| 2013 | $2,227 | $10,159 | $1,693 | $8,466 |

Source: Public Records

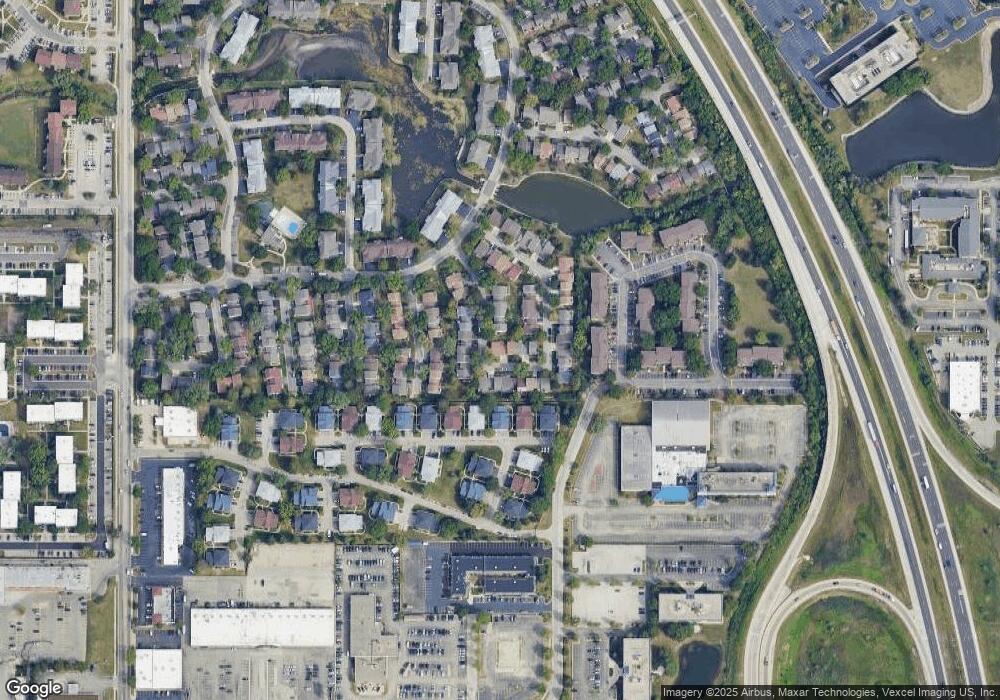

Map

Nearby Homes

- 1259 Inverrary Ln Unit 27D

- 2B E Dundee Quarter Dr Unit 101

- 6A E Dundee Quarter Dr Unit 207

- 5A E Dundee Quarter Dr Unit 206

- 10A E Dundee Quarter Dr Unit 306

- 10B E Dundee Quarter Dr Unit 301

- 2044 N Ginger Creek Dr Unit 30C

- 1275 E Baldwin Ln Unit 507

- 1275 E Baldwin Ln Unit 601

- 1275 E Baldwin Ln Unit 408

- 1275 E Baldwin Ln Unit 504

- 2500 Bayside Dr Unit 3

- 1144 Foxglove Ln Unit 4A

- 1005 E Lilac Dr

- 1325 N Baldwin Ct Unit VIID1

- 4000 Bayside Dr Unit 205

- 2245 Nichols Rd Unit C

- 1000 Bayside Dr Unit 212

- 175 E Lilly Ln

- 135 E Lilly Ln

- 1366 N Whispering Springs Cir

- 1378 N Whispering Springs Cir Unit 223

- 1368 N Whispering Springs Cir Unit 424

- 1365 N Whispering Springs Cir

- 1365 E Whispering Spgs Cir Unit 622

- 1380 N Whispering Springs Cir

- 1382 N Whispering Springs Cir Unit 423

- 1369 N Whispering Springs Cir

- 1369 E Whispering Spgs Cir Unit 422

- 1354 N Whispering Springs Cir Unit 321

- 1354 N Whispering Springs Cir Unit 3-21

- 1367 N Whispering Springs Cir Unit 522

- 1370 N Whispering Springs Cir Unit 324

- 1370 N Whispering Springs Cir Unit 1370

- 1352 N Whispering Springs Cir

- 1352 N Whispering Springs Cir Unit 221

- 1352 N Whispering Springs Cir

- 1356 N Whispering Springs Cir