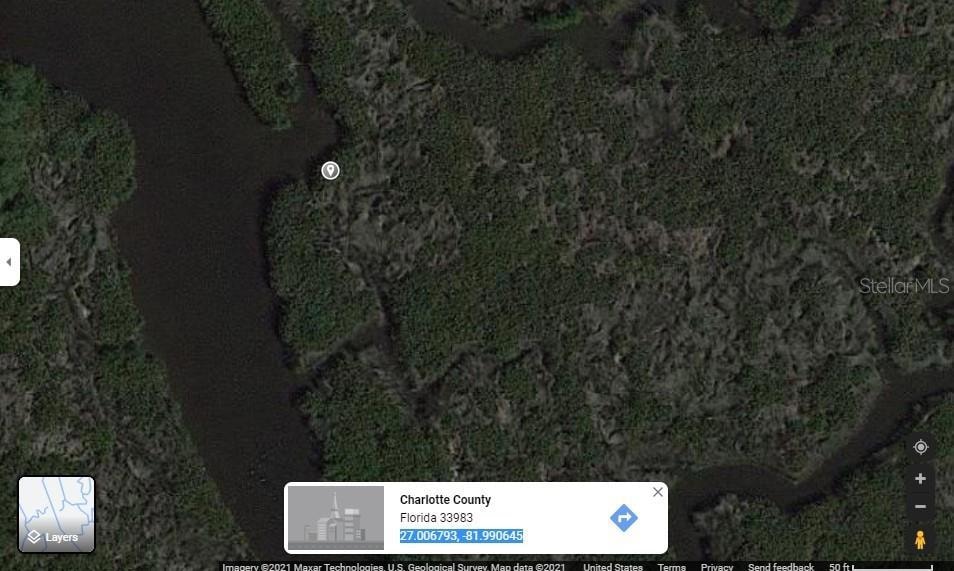

1371 Biscayne Ct Punta Gorda, FL 33983

Estimated payment $168/month

Total Views

2,757

0.28

Acre

$107,139

Price per Acre

12,197

Sq Ft Lot

About This Lot

boaters are welcome, waterfront lot direct, many exposures, build your dream house on it, a quit claim closing only

Listing Agent

STARLINK REALTY Brokerage Phone: 239-693-7263 License #3134808 Listed on: 08/24/2021

Property Details

Property Type

- Land

Lot Details

- 0.28 Acre Lot

- Lot Dimensions are 80x150

- The property's road front is unimproved

- Property is zoned ES

Community Details

- Harbour Heights Community

- Hrbr Heights Subdivision

Listing and Financial Details

- Legal Lot and Block 91 / 210

- Assessor Parcel Number 402311303009

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $139 | $10,200 | $10,200 | -- |

| 2023 | $128 | $4,675 | $0 | $0 |

| 2022 | $96 | $4,250 | $4,250 | $0 |

| 2021 | $50 | $1,360 | $1,360 | $0 |

| 2020 | $47 | $1,190 | $1,190 | $0 |

| 2019 | $46 | $1,063 | $1,063 | $0 |

| 2018 | $45 | $1,063 | $1,063 | $0 |

| 2017 | $45 | $1,063 | $1,063 | $0 |

| 2016 | $68 | $2,334 | $0 | $0 |

| 2015 | $73 | $2,122 | $0 | $0 |

| 2014 | $71 | $1,929 | $0 | $0 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 11/02/2025 11/02/25 | For Sale | $29,999 | 0.0% | -- |

| 10/31/2025 10/31/25 | Off Market | $29,999 | -- | -- |

| 11/01/2024 11/01/24 | For Sale | $29,999 | 0.0% | -- |

| 10/31/2024 10/31/24 | Off Market | $29,999 | -- | -- |

| 10/01/2023 10/01/23 | For Sale | $29,999 | 0.0% | -- |

| 09/30/2023 09/30/23 | Off Market | $29,999 | -- | -- |

| 08/23/2021 08/23/21 | For Sale | $29,999 | -- | -- |

Source: Stellar MLS

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Public Action Common In Florida Clerks Tax Deed Or Tax Deeds Or Property Sold For Taxes | $4,200 | None Available | |

| Interfamily Deed Transfer | -- | Attorney | |

| Deed | $22,500 | -- |

Source: Public Records

Source: Stellar MLS

MLS Number: A4510293

APN: 402311303009

Nearby Homes

- 1372 Monterey Ct

- 1510 Sorrento Ct

- 1357 Beauregard Ct

- 27494 Harbour Point Dr

- 27512 San Carlos Dr

- 1353 Wallaroo Ct

- 1284 Malaluka Ct

- 1457 Beerbohm Terrace

- 1259 Harbour Hawk Ct

- 27441 Neaptide Dr

- 27406 San Carlos Dr

- TBD Ct

- 1198 Malabo Ct

- 28150 Harbour Sunrise Dr

- 1456 Tahoe Terrace

- 27430 San Marco Dr

- 27438 San Marco Dr

- 27450 San Marco Dr

- 27354 San Carlos Dr

- 27399 Solomon Dr

- 27221 Partin Dr

- 28434 Silver Palm Dr

- 2300 Harbour Dr

- 27289 Porto Nacional Dr

- 27217 Washington St

- 390 Posadas Cir

- 26528 Oran Way

- 27063 Washington St

- 1174 Navigator Rd

- 26485 Rampart Blvd Unit E23

- 27178 Adams St Unit A

- 311 Goiana St

- 26485 Rampart Blvd Unit E2

- 27139 Monroe St

- 1416 San Cristobal Ave Unit 3

- 27385 Voyageur Dr

- 27401 Voyageur Dr

- 26397 Nadir Rd Unit 204

- 1222 San Cristobal Ave

- 26333 Nadir Rd Unit 105