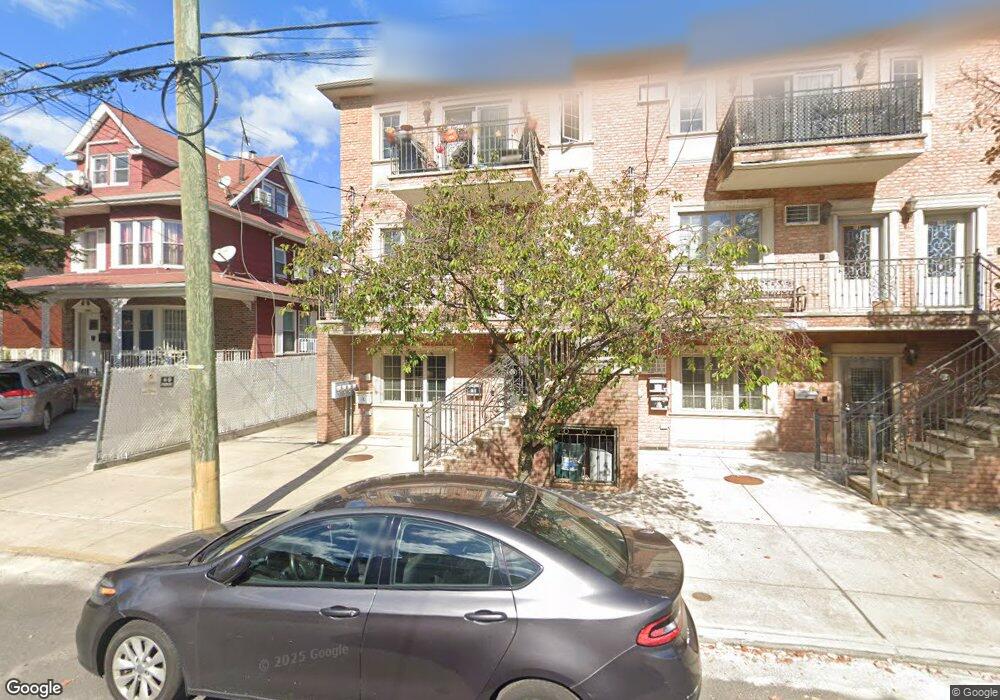

1375 70th St Unit P5 Brooklyn, NY 11228

Dyker Heights Neighborhood

--

Bed

--

Bath

153

Sq Ft

6,011

Sq Ft Lot

About This Home

This home is located at 1375 70th St Unit P5, Brooklyn, NY 11228. 1375 70th St Unit P5 is a home located in Kings County with nearby schools including P.S. 176 Ovington, Junior High School 227 Edward B Shallow, and New Utrecht High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 6, 2018

Sold by

Yee Chun Leung and Zhen Tianquan

Bought by

Tong Pei Qiong

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$254,073

Interest Rate

3.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 10, 2016

Sold by

Lin Wu and Zheng Xiu Tan

Bought by

Yee Chun Leung and Zhen Tianquan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$282,000

Interest Rate

3.57%

Mortgage Type

Commercial

Purchase Details

Closed on

Jan 22, 2007

Sold by

Dyker Gardens Llc

Bought by

Lin Wu and Zheng Xiu Tan

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tong Pei Qiong | $755,000 | -- | |

| Tong Pei Qiong | $755,000 | -- | |

| Yee Chun Leung | $543,000 | -- | |

| Yee Chun Leung | $543,000 | -- | |

| Lin Wu | $461,370 | -- | |

| Lin Wu | $461,370 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tong Pei Qiong | $300,000 | |

| Closed | Tong Pei Qiong | $300,000 | |

| Previous Owner | Yee Chun Leung | $282,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $603 | $6,421 | $145 | $6,276 |

| 2024 | $603 | $6,039 | $145 | $5,894 |

| 2023 | $491 | $5,740 | $145 | $5,595 |

| 2022 | $373 | $5,524 | $145 | $5,379 |

| 2021 | $248 | $5,221 | $145 | $5,076 |

| 2020 | $81 | $5,886 | $145 | $5,741 |

| 2019 | $40 | $5,886 | $145 | $5,741 |

| 2018 | $40 | $5,886 | $146 | $5,740 |

| 2017 | $40 | $5,901 | $145 | $5,756 |

| 2016 | $40 | $5,901 | $145 | $5,756 |

| 2015 | $29 | $5,901 | $145 | $5,756 |

| 2014 | $29 | $5,465 | $146 | $5,319 |

Source: Public Records

Map

Nearby Homes

- 1375 70th St Unit 2C

- 1375 70th St Unit 1C

- 1379 70th St Unit 2B

- 1379 70th St Unit 1B

- 1375 70th St Unit P6

- 1379 70th St

- 6914 14th Ave

- 1369 70th St

- 1381 70th St Unit 3A

- 1381 70th St Unit 2A

- 1381 70th St Unit 1A

- 1381 70th St Unit P3

- 1381 70th St Unit P1

- 1381 70th St Unit P4

- 1381 70th St Unit P2

- 6910 14th Ave

- 1363 70th St

- 7006 14th Ave

- 1376 70 St

- 1376 70th St