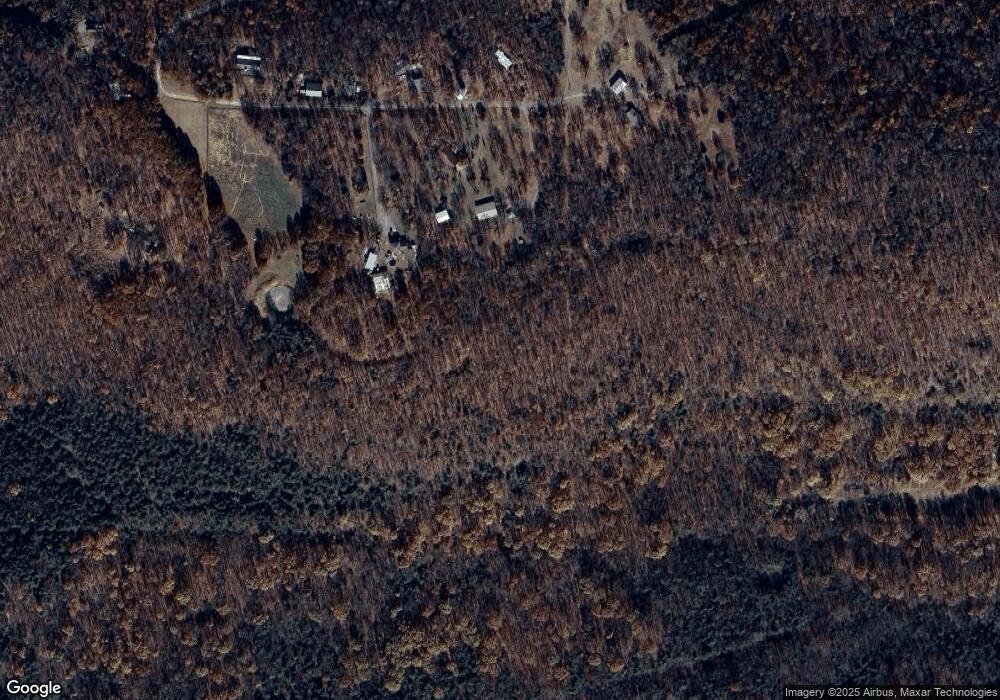

139 Leaning Tree Rd Fort Gibson, OK 74434

Estimated Value: $233,000 - $266,513

3

Beds

2

Baths

1,556

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 139 Leaning Tree Rd, Fort Gibson, OK 74434 and is currently estimated at $252,878, approximately $162 per square foot. 139 Leaning Tree Rd is a home located in Muskogee County with nearby schools including Fort Gibson Early Learning Center, Fort Gibson Intermediate Elementary School, and Fort Gibson Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 5, 2023

Sold by

Jewel Dean Stiglets Living Trust

Bought by

Fowler Frankie Lee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,668

Outstanding Balance

$201,222

Interest Rate

6.58%

Mortgage Type

FHA

Estimated Equity

$51,656

Purchase Details

Closed on

Jul 14, 2022

Sold by

Dean Stiglets Jewel

Bought by

Jewel Dean Stiglets Living Trust

Purchase Details

Closed on

Oct 9, 2017

Sold by

Stigels Jewel D and Stigels Jewel D

Bought by

Stigels Jewel D

Purchase Details

Closed on

Jan 10, 2000

Purchase Details

Closed on

Feb 24, 1994

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fowler Frankie Lee | $211,500 | Pioneer Abstract | |

| Fowler Frankie Lee | $211,500 | Pioneer Abstract | |

| Jewel Dean Stiglets Living Trust | $13,333 | None Listed On Document | |

| Stigels Jewel D | -- | None Available | |

| -- | -- | -- | |

| -- | $42,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fowler Frankie Lee | $207,668 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,007 | $23,266 | $4,836 | $18,430 |

| 2023 | $2,007 | $24,731 | $5,227 | $19,504 |

| 2022 | $1,228 | $15,926 | $5,227 | $10,699 |

| 2021 | $1,192 | $15,012 | $5,227 | $9,785 |

| 2020 | $1,162 | $14,575 | $5,227 | $9,348 |

| 2019 | $1,134 | $15,558 | $5,228 | $10,330 |

| 2018 | $1,098 | $15,558 | $5,228 | $10,330 |

| 2017 | $1,056 | $13,313 | $3,962 | $9,351 |

| 2016 | $1,022 | $12,925 | $3,574 | $9,351 |

| 2015 | $984 | $12,549 | $3,198 | $9,351 |

| 2014 | $952 | $12,183 | $2,832 | $9,351 |

Source: Public Records

Map

Nearby Homes

- 121 Quanah Rd

- 175 Reid Rd

- 1838 E Hwy 62

- 119 N 6 Mile Ln

- 1904 N County Line Rd E

- 11769 W 838 Rd

- 22695 N 6 Mile Rd

- 24481 S Manard Rd

- 1586 Joelle

- 24196 N 4 Mile Rd

- 1580 E Dawson Dr

- 12219 U S 62

- 23532 N 5 Mile Rd

- 1578 Kreider Rd

- 0 805 Rd

- 0 N 4 Mile Rd

- 1520 Highway 10 E

- 11396 W Joyce Ln

- 12890 W Southern Oaks St

- 170 N 2 Mile Rd

- 143 Leaning Tree Rd

- 120 Leaning Tree Rd

- 125 Leaning Tree Rd

- 132 Leaning Tree Rd

- 129 Leaning Tree Rd

- 135 Leaning Tree Rd

- 137 Leaning Tree Rd

- 119 Leaning Tree Rd

- 134 Leaning Tree Rd

- 143 Leaning Tree Rd

- 136 Leaning Tree Rd

- 118 Leaning Tree Rd

- 112 Leaning Tree Rd

- 109 Leaning Tree Rd

- 107 Leaning Tree Rd

- 105 Leaning Tree Rd

- 1887 Cotton Tail Ln

- 1880 Cotton Tail Ln

- 1884 Cotton Tail Ln

- 1886 Cotton Tail Ln