14 Adams St Jamestown, OH 45335

Estimated Value: $48,000 - $172,000

3

Beds

1

Bath

1,369

Sq Ft

$87/Sq Ft

Est. Value

About This Home

This home is located at 14 Adams St, Jamestown, OH 45335 and is currently estimated at $119,264, approximately $87 per square foot. 14 Adams St is a home located in Greene County with nearby schools including Greeneview Elementary School, Greeneview Middle School, and Greeneview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 6, 2009

Sold by

Webco Enterprise Llc

Bought by

Fisher Autumn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,100

Outstanding Balance

$35,596

Interest Rate

5.09%

Mortgage Type

Unknown

Estimated Equity

$83,668

Purchase Details

Closed on

Oct 8, 2008

Sold by

Fannie Mae

Bought by

Webco Enterprise Llc

Purchase Details

Closed on

Nov 8, 2007

Sold by

Workman Sarah M and Workman Richard L

Bought by

Federal National Mortgage Association

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fisher Autumn | $55,000 | Attorney | |

| Webco Enterprise Llc | $7,500 | Accutitle Agency Inc | |

| Federal National Mortgage Association | $30,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fisher Autumn | $56,100 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,228 | $25,200 | $4,350 | $20,850 |

| 2023 | $1,216 | $25,200 | $4,350 | $20,850 |

| 2022 | $1,084 | $19,140 | $4,350 | $14,790 |

| 2021 | $1,092 | $19,140 | $4,350 | $14,790 |

| 2020 | $1,012 | $19,140 | $4,350 | $14,790 |

| 2019 | $1,179 | $21,520 | $4,350 | $17,170 |

| 2018 | $1,184 | $21,520 | $4,350 | $17,170 |

| 2017 | $1,165 | $21,520 | $4,350 | $17,170 |

| 2016 | $1,165 | $21,610 | $4,350 | $17,260 |

| 2015 | $1,140 | $21,610 | $4,350 | $17,260 |

| 2014 | $1,080 | $21,610 | $4,350 | $17,260 |

Source: Public Records

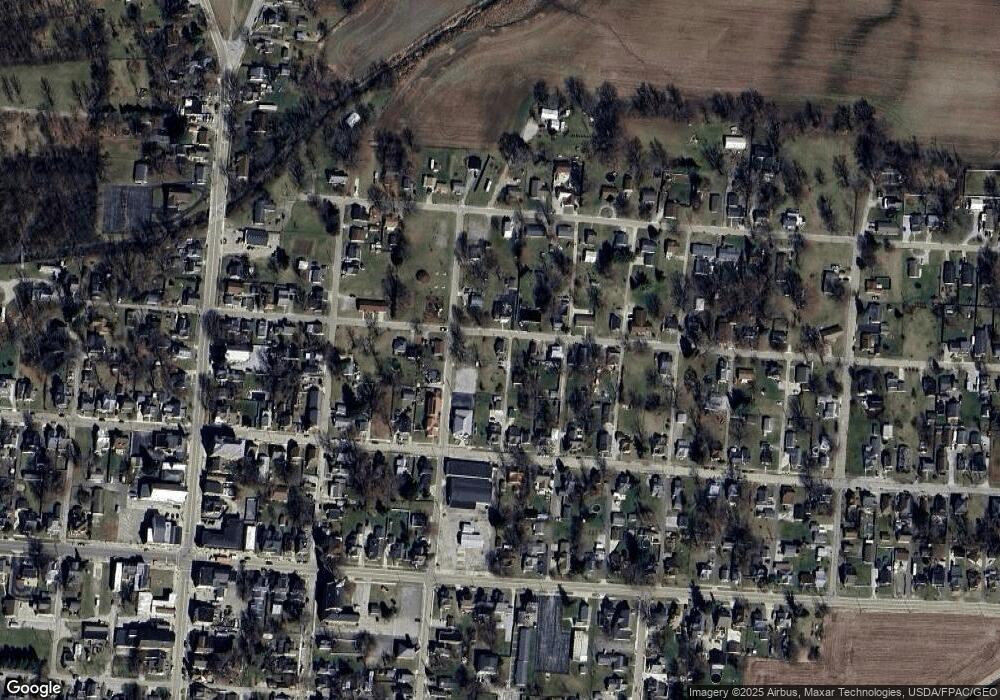

Map

Nearby Homes

- 21 E Xenia St

- 4620 82 1/2 x 161 Nelson St

- 77 E Xenia St

- 21 S Buckles Ave

- 30 W Xenia St

- 280 S Charleston Rd

- 48 W Xenia St

- 5 Maplewood Dr

- 43 Hidden Creek Dr

- 5852 Old Us Route 35 E

- 4533 Navajo Trail

- 643 Brickel Rd

- 4270 Shawnee Trail

- 4208 Shawnee Trail

- 4184 Shawnee Trail

- 4119 Beach Trail

- 4005 Cheyenne Trail

- 1861 Oh-72

- 815 Oneida Trail

- 978 State Route 72 N

Your Personal Tour Guide

Ask me questions while you tour the home.