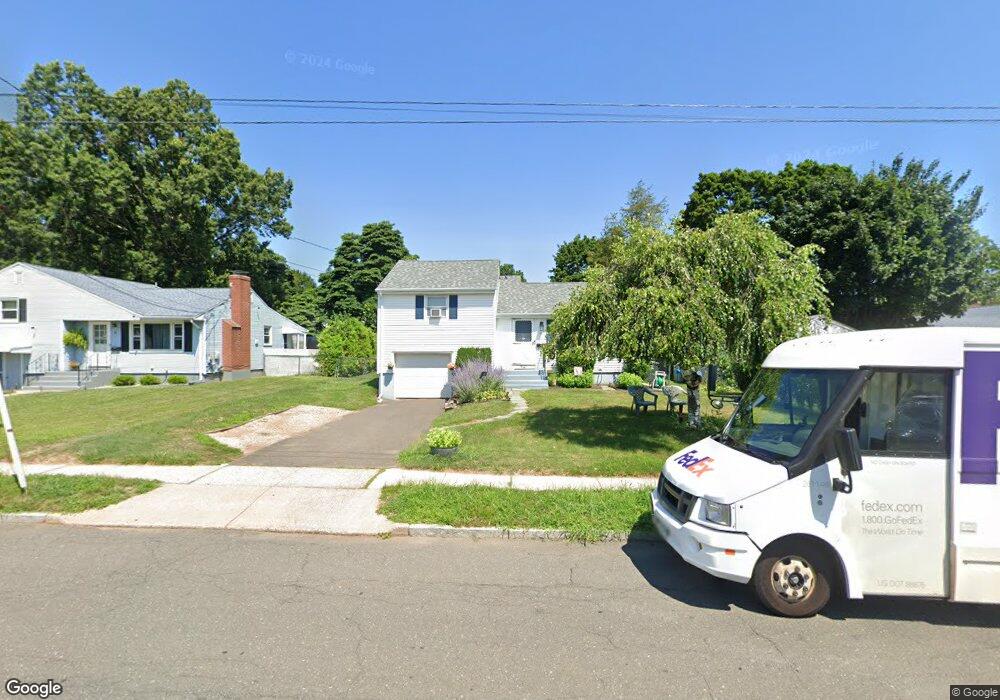

14 Crocker Ave West Hartford, CT 06110

Estimated Value: $294,000 - $325,000

2

Beds

1

Bath

896

Sq Ft

$344/Sq Ft

Est. Value

About This Home

This home is located at 14 Crocker Ave, West Hartford, CT 06110 and is currently estimated at $308,522, approximately $344 per square foot. 14 Crocker Ave is a home located in Hartford County with nearby schools including Charter Oak International Academy, Sedgwick Middle School, and Conard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2018

Sold by

Santana Linda E

Bought by

Miskin Paul and Santana Linda E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,655

Outstanding Balance

$151,125

Interest Rate

4.5%

Mortgage Type

VA

Estimated Equity

$157,397

Purchase Details

Closed on

Aug 9, 2018

Sold by

Santana Linda E

Bought by

Miskin Paul and Santana Linda E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,655

Outstanding Balance

$151,125

Interest Rate

4.5%

Mortgage Type

VA

Estimated Equity

$157,397

Purchase Details

Closed on

Apr 9, 2018

Sold by

Santana Linda E and Miskin Paul

Bought by

Santana Linda E

Purchase Details

Closed on

Aug 21, 2002

Sold by

Varghese Kurian and Varghese Mariamma

Bought by

Santana Linda E

Purchase Details

Closed on

Aug 17, 1987

Sold by

Denney Exec Allan

Bought by

Varghese Kurian

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miskin Paul | -- | -- | |

| Miskin Paul | -- | -- | |

| Santana Linda E | -- | -- | |

| Santana Linda E | $139,000 | -- | |

| Varghese Kurian | $137,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Miskin Paul | $173,655 | |

| Previous Owner | Varghese Kurian | $144,000 | |

| Previous Owner | Varghese Kurian | $137,500 | |

| Previous Owner | Varghese Kurian | $131,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,006 | $134,120 | $57,890 | $76,230 |

| 2024 | $5,680 | $134,120 | $57,890 | $76,230 |

| 2023 | $5,488 | $134,120 | $57,890 | $76,230 |

| 2022 | $5,456 | $134,120 | $57,890 | $76,230 |

| 2021 | $4,846 | $114,240 | $45,150 | $69,090 |

| 2020 | $4,348 | $104,020 | $42,280 | $61,740 |

| 2019 | $4,348 | $104,020 | $42,280 | $61,740 |

| 2018 | $4,265 | $104,020 | $42,280 | $61,740 |

| 2017 | $4,269 | $104,020 | $42,280 | $61,740 |

| 2016 | $4,536 | $114,800 | $50,330 | $64,470 |

| 2015 | $4,398 | $114,800 | $50,330 | $64,470 |

| 2014 | $4,290 | $114,800 | $50,330 | $64,470 |

Source: Public Records

Map

Nearby Homes

- 394 Trout Brook Dr

- 101 Englewood Ave

- 741 Quaker Ln S

- 17 Parkview Rd

- 61 Woodmere Rd

- 69 Saint Augustine St

- 204 Trout Brook Dr

- 26 Saint Augustine St

- 72 Saint Charles St

- 50 Acadia St

- 96 Bentwood Rd

- 99 Caya Ave

- 90 Park Place Cir Unit 90

- 49 Park Place Cir Unit 49

- 89 Price Blvd

- 100 Kane St Unit D10

- 395 Park Rd

- 39 Cortland St

- 136 Kane St Unit B10

- 1145 New Britain Ave

- 18 Crocker Ave

- 605 Quaker Ln S

- 599 Quaker Ln S

- 22 Crocker Ave

- 595 Quaker Ln S

- 25 Jackson Ave

- 21 Jackson Ave

- 29 Jackson Ave

- 26 Crocker Ave

- 17 Jackson Ave

- 33 Jackson Ave

- 30 Crocker Ave

- 37 Jackson Ave

- 23 Crocker Ave

- 41 Jackson Ave

- 612 Quaker Ln S

- 34 Crocker Ave

- 7 Jackson Ave

- 27 Crocker Ave

- 45 Jackson Ave