140 Freeman Rd Oxford, CT 06478

Estimated Value: $593,902 - $714,000

3

Beds

3

Baths

2,912

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 140 Freeman Rd, Oxford, CT 06478 and is currently estimated at $633,476, approximately $217 per square foot. 140 Freeman Rd is a home located in New Haven County with nearby schools including Quaker Farms School, Oxford Middle School, and Oxford High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2005

Sold by

Ferreone Lisa A

Bought by

Becker Donald H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,700

Outstanding Balance

$63,318

Interest Rate

5.78%

Estimated Equity

$570,158

Purchase Details

Closed on

May 12, 1994

Sold by

Lane Paul and Lane Kathleen

Bought by

Becker Donald and Ferrone Lisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,650

Interest Rate

7.93%

Mortgage Type

Unknown

Purchase Details

Closed on

Nov 12, 1992

Sold by

Wortham Ruth

Bought by

Slunner Robert and Slunner Deanna

Purchase Details

Closed on

Dec 19, 1989

Sold by

Hart James

Bought by

Wortham Ruth M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Becker Donald H | $70,000 | -- | |

| Becker Donald H | $70,000 | -- | |

| Becker Donald | $158,500 | -- | |

| Becker Donald | $158,500 | -- | |

| Slunner Robert | $130,000 | -- | |

| Wortham Ruth M | $170,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wortham Ruth M | $122,700 | |

| Closed | Wortham Ruth M | $122,700 | |

| Previous Owner | Wortham Ruth M | $142,650 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,933 | $296,520 | $76,090 | $220,430 |

| 2024 | $5,771 | $223,600 | $84,300 | $139,300 |

| 2023 | $5,480 | $223,600 | $84,300 | $139,300 |

| 2022 | $5,447 | $223,600 | $84,300 | $139,300 |

| 2021 | $5,143 | $223,600 | $84,300 | $139,300 |

| 2020 | $5,138 | $215,500 | $86,300 | $129,200 |

| 2019 | $5,138 | $215,500 | $86,300 | $129,200 |

| 2018 | $4,967 | $215,500 | $86,300 | $129,200 |

| 2017 | $4,786 | $215,500 | $86,300 | $129,200 |

| 2016 | $5,217 | $215,500 | $86,300 | $129,200 |

| 2015 | $5,569 | $223,100 | $86,300 | $136,800 |

| 2014 | $5,548 | $223,100 | $86,300 | $136,800 |

Source: Public Records

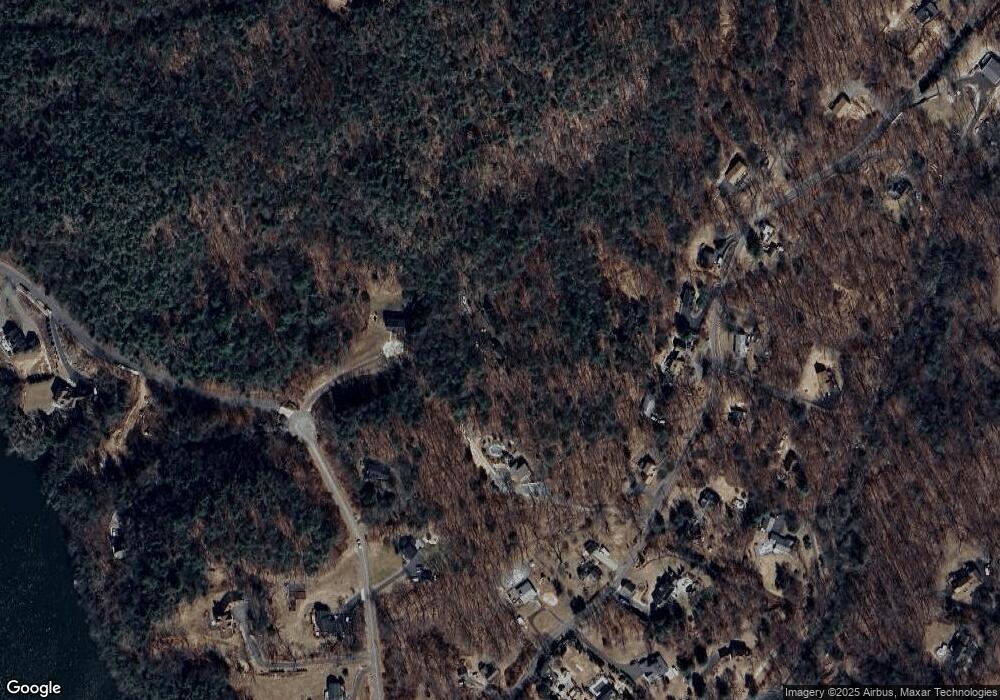

Map

Nearby Homes

- 159 Freeman Rd

- 56 Downs Rd

- 19 Good Hill Rd

- 44 Old Country Rd

- 124 Bagburn Rd

- 13 Jordan Hill Rd Unit Lot 4

- 567 Roosevelt Dr

- 8 Stone Bridge Trail

- 34 Bagburn Rd

- 238 Berkshire Rd

- 185 Quaker Farms Rd

- 81 Oneil Rd

- 3 Serenity Ln

- 141 Maple Tree Hill Rd

- 24 Legacy Ln

- 15 Legacy Ln

- 40 Osborne Hill Rd

- 134 Shelton Rd

- 39 Bradley Ln

- 59 Great Ring Rd

- 10 Fiddlehead Rd

- 142 Freeman Rd

- 126 Freeman Rd

- 6 Fiddlehead Rd

- 122 Freeman Rd

- 136 Freeman Rd

- 120 Freeman Rd

- 114 Freeman Rd

- 13 Fiddlehead Rd

- 146 Freeman Rd

- 150 Freeman Rd

- 4 Fiddlehead Rd

- 125 Freeman Rd

- 11 Fiddlehead Rd

- LOT 11 Fiddlehead Rd Estates Rd

- 119 Freeman Rd

- 139 Freeman Rd

- 2 Fiddlehead Rd

- 15 Fiddlehead Rd

- 112 Freeman Rd

Your Personal Tour Guide

Ask me questions while you tour the home.