Estimated Value: $236,854 - $395,000

--

Bed

2

Baths

1,696

Sq Ft

$192/Sq Ft

Est. Value

About This Home

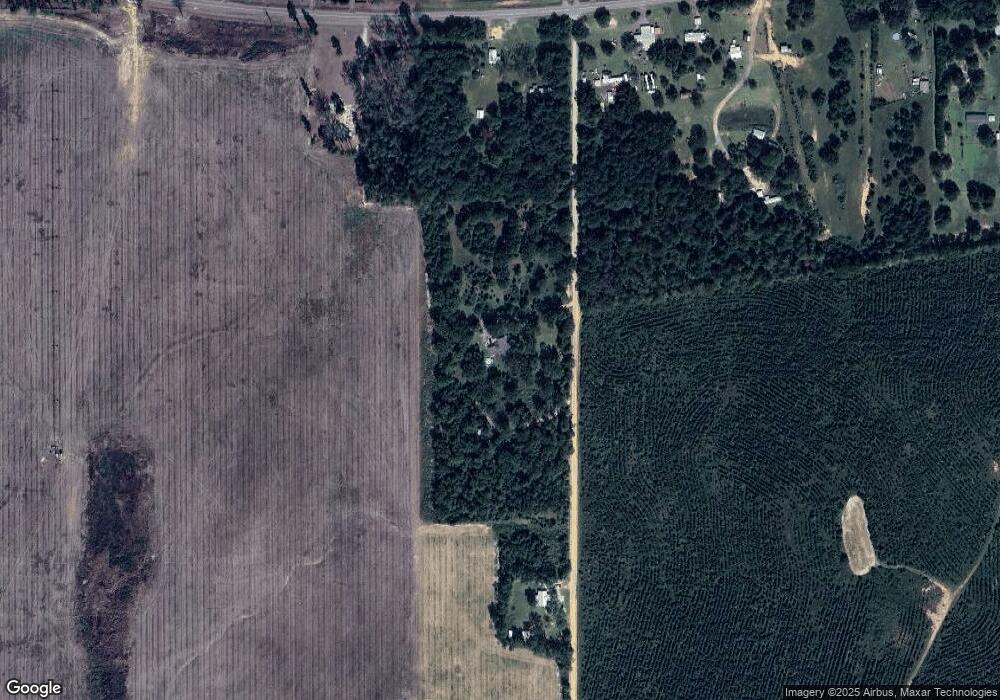

This home is located at 140 Richardson Rd, Elko, GA 31025 and is currently estimated at $325,714, approximately $192 per square foot. 140 Richardson Rd is a home located in Houston County with nearby schools including Kings Chapel Elementary School, Perry Middle School, and Perry High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2004

Sold by

Holder Deborah E

Bought by

Stephens Marion L

Current Estimated Value

Purchase Details

Closed on

Sep 18, 1997

Sold by

Holder Sean P

Bought by

Holder Deborah E

Purchase Details

Closed on

May 23, 1990

Sold by

Brantley Daniel L and Brantley Patricia C

Bought by

Holder Sean P

Purchase Details

Closed on

Mar 1, 1989

Sold by

Veterans Administration

Bought by

Brantley Daniel L and Brantley Patricia C

Purchase Details

Closed on

May 26, 1988

Sold by

Mortgage First Corp

Bought by

Veterans Administration

Purchase Details

Closed on

May 3, 1988

Sold by

Pike Bobby W and Pike Linda J

Bought by

Mortgage First Corp

Purchase Details

Closed on

May 13, 1986

Sold by

Smith Gary E and Smith Linda T

Bought by

Pike Bobby W and Pike Linda J

Purchase Details

Closed on

Dec 14, 1984

Sold by

Burtt Robert K and Burtt Audrey R

Bought by

Smith Gary E and Smith Linda T

Purchase Details

Closed on

May 8, 1981

Sold by

Burtt Robert K

Bought by

Burtt Robert K and Burtt Audrey R

Purchase Details

Closed on

Mar 27, 1978

Bought by

Burtt Robert K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stephens Marion L | $110,000 | -- | |

| Holder Deborah E | -- | -- | |

| Holder Sean P | -- | -- | |

| Brantley Daniel L | -- | -- | |

| Veterans Administration | -- | -- | |

| Mortgage First Corp | -- | -- | |

| Pike Bobby W | -- | -- | |

| Smith Gary E | -- | -- | |

| Burtt Robert K | -- | -- | |

| Burtt Robert K | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $76,040 | $25,400 | $50,640 |

| 2023 | $0 | $57,360 | $16,840 | $40,520 |

| 2022 | $1,287 | $53,240 | $16,840 | $36,400 |

| 2021 | $1,212 | $49,520 | $14,560 | $34,960 |

| 2020 | $981 | $40,080 | $11,000 | $29,080 |

| 2019 | $981 | $40,080 | $11,000 | $29,080 |

| 2018 | $0 | $40,080 | $11,000 | $29,080 |

| 2017 | $0 | $40,080 | $11,000 | $29,080 |

| 2016 | $269 | $40,080 | $11,000 | $29,080 |

| 2015 | -- | $40,080 | $11,000 | $29,080 |

| 2014 | -- | $40,080 | $11,000 | $29,080 |

| 2013 | -- | $40,080 | $11,000 | $29,080 |

Source: Public Records

Map

Nearby Homes

- 865 Ga Highway 26 E

- 792 Ellis Rd

- 0 Georgia 26 Unit 10418617

- 335 Georgia 26

- Lot 15 Georgia 26

- 406 Third St

- Lot C-17 Elko Rd

- LOT 14 Elko Rd

- 3371 Sugar Hill Rd

- 3371 Sugar Hill Rd Unit County Line Rd

- 2540 Sugar Hill Rd

- 104 Oak St

- Ga-26

- Lot# 26 2587 SE (18 64 Acres) Elko Rd

- 0 Flournoy Rd Unit 10620581

- 0 Flournoy Rd Unit 256441

- 0 Flournoy Rd Unit 250816

- 0 Flournoy Rd Unit 250814

- 2581 Elko Rd

- Lot# 24 SE (55+ - Acres) Elko Rd

- 170 Richardson Rd

- 776 Ga Highway 26 E

- 770 Ga Highway 26 E

- 800 Georgia 26

- 800 Ga Highway 26 E

- 131 Brown Hill Rd

- 119 Brown Hill Rd

- 135 Brown Hill Rd

- 806 Ga Highway 26 E

- 806 Georgia 26

- 0 Richardson Rd Unit off Hwy 26 92589

- 0 Richardson Rd

- 759 Ga Highway 26 E

- 808 Ga Highway 26 E

- 808 Georgia 26

- 0 Richardson Rd Unit 98713

- 824 Ga Highway 26 E

- 767 Ga Highway 26 E

- 747 Ga Highway 26 E

- 0 Hwy 26 (12 Acres)