1403 Old Briar Trail Unit 55 Auburn, IN 46706

Estimated Value: $312,000 - $318,000

3

Beds

2

Baths

1,687

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 1403 Old Briar Trail Unit 55, Auburn, IN 46706 and is currently estimated at $314,272, approximately $186 per square foot. 1403 Old Briar Trail Unit 55 is a home located in DeKalb County with nearby schools including DeKalb High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2025

Sold by

Wannemacher Ronald J and Wannemacher Elizabeth A

Bought by

Bry Thoma and Bry Shayne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$267,750

Outstanding Balance

$267,750

Interest Rate

6.63%

Mortgage Type

New Conventional

Estimated Equity

$46,522

Purchase Details

Closed on

Jul 2, 2020

Sold by

Baird Marc W and Baird Deana E

Bought by

Wannemacher Ronald J and Wannemacher Elizabeth A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,500

Interest Rate

3.1%

Mortgage Type

VA

Purchase Details

Closed on

May 23, 2014

Sold by

Baird Marc W

Bought by

Baird Marc W and Baird Deana E

Purchase Details

Closed on

Dec 19, 2013

Sold by

Homestead Acres Inc

Bought by

Baird Marc W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,428

Interest Rate

4.23%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bry Thoma | -- | None Listed On Document | |

| Wannemacher Ronald J | -- | None Available | |

| Baird Marc W | -- | -- | |

| Baird Marc W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bry Thoma | $267,750 | |

| Previous Owner | Wannemacher Ronald J | $212,500 | |

| Previous Owner | Baird Marc W | $166,428 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,995 | $284,800 | $52,000 | $232,800 |

| 2023 | $1,668 | $261,500 | $46,900 | $214,600 |

| 2022 | $1,941 | $258,700 | $45,100 | $213,600 |

| 2021 | $1,621 | $223,900 | $41,800 | $182,100 |

| 2020 | $1,374 | $204,800 | $32,000 | $172,800 |

| 2019 | $1,792 | $197,800 | $32,000 | $165,800 |

| 2018 | $1,597 | $175,400 | $32,000 | $143,400 |

| 2017 | $1,555 | $169,800 | $32,000 | $137,800 |

| 2016 | $1,482 | $162,100 | $32,000 | $130,100 |

| 2014 | $1,970 | $149,400 | $32,000 | $117,400 |

Source: Public Records

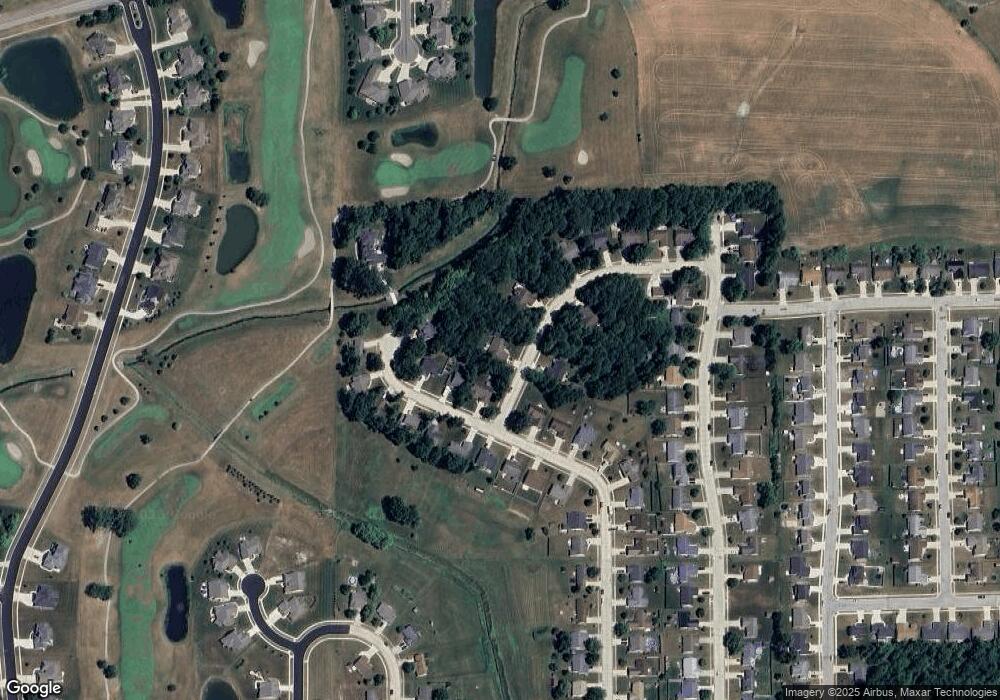

Map

Nearby Homes

- 1408 Katherine St

- 1815 Bent Tree Ct

- 1908 Bent Tree Ct

- TBD County Road 40

- 1208 Phaeton Way

- 2213 Golfview Dr

- 2002 Approach Dr

- 2002 Bogey Ct

- 2021 Approach Dr

- 2001 Bogey Ct

- 1102 Packard Place

- 3483 Indiana 8

- 106 Fox Trail Dr

- 816 E 1st St

- 303 Hunters Ridge

- 4562 County Road 35

- 812 E 9th St

- 218 Iwo St

- 271 N Mcclellan St Unit 105

- 1501 Foley Ct

- 1404 Timber Trace Unit 53

- 1404 Timber Trace

- 1402 Timber Trace

- 1406 Timber Trace Unit 52

- 1406 Timber Trace

- 1407 Old Briar Trail

- 1410 Timber Trace

- 1316 Timber Trace

- 1404 Old Briar Trail Unit 28

- 1404 Old Briar Trail

- 1406 Old Briar Trail Unit 27

- 1406 Old Briar Trail

- 1314 Timber Trace

- 1408 Old Briar Trail

- 1411 Old Briar Trail

- 1407 Timber Trace

- 1411 Timber Trace

- 1315 Timber Trace

- 1409 Timber Trace Unit 47

- 1409 Timber Trace